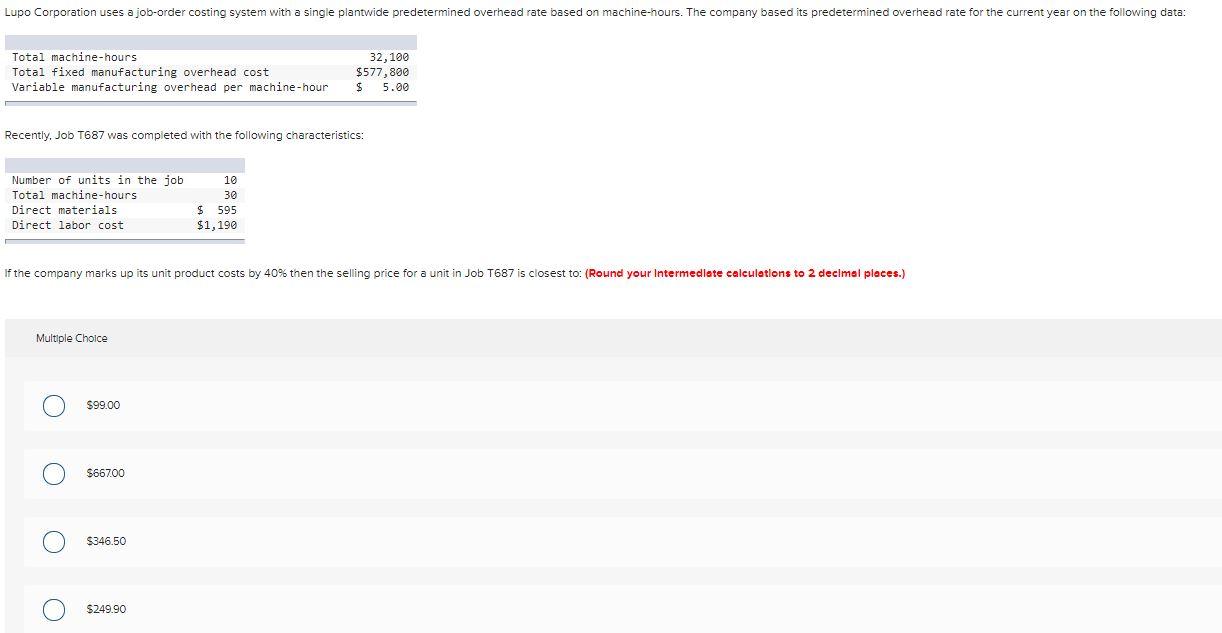

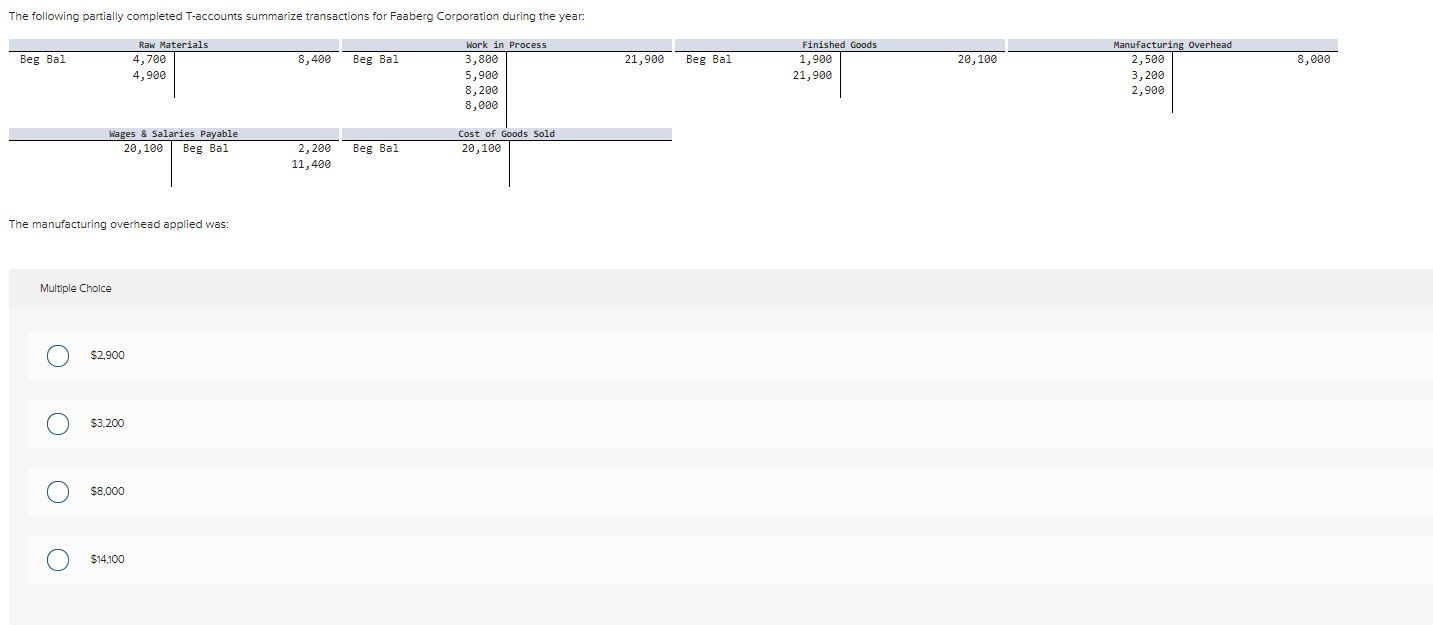

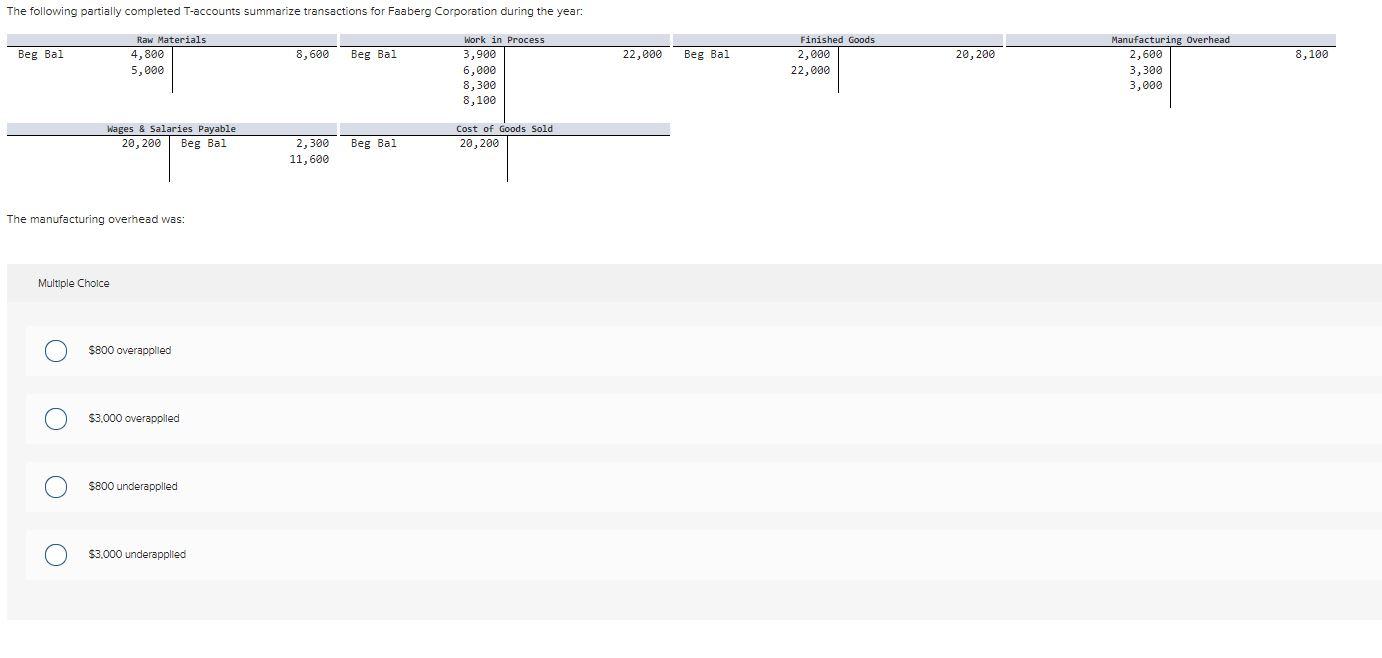

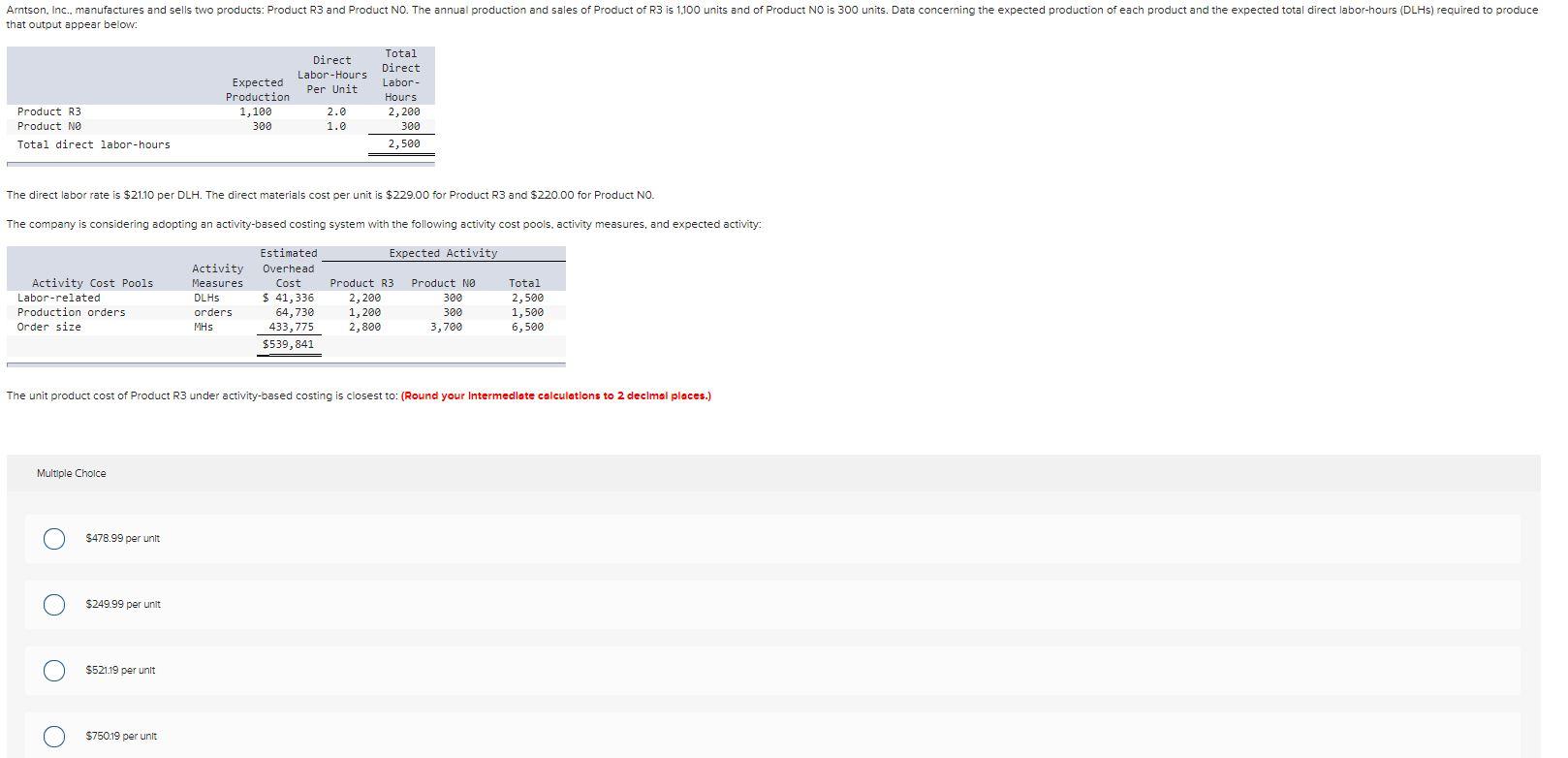

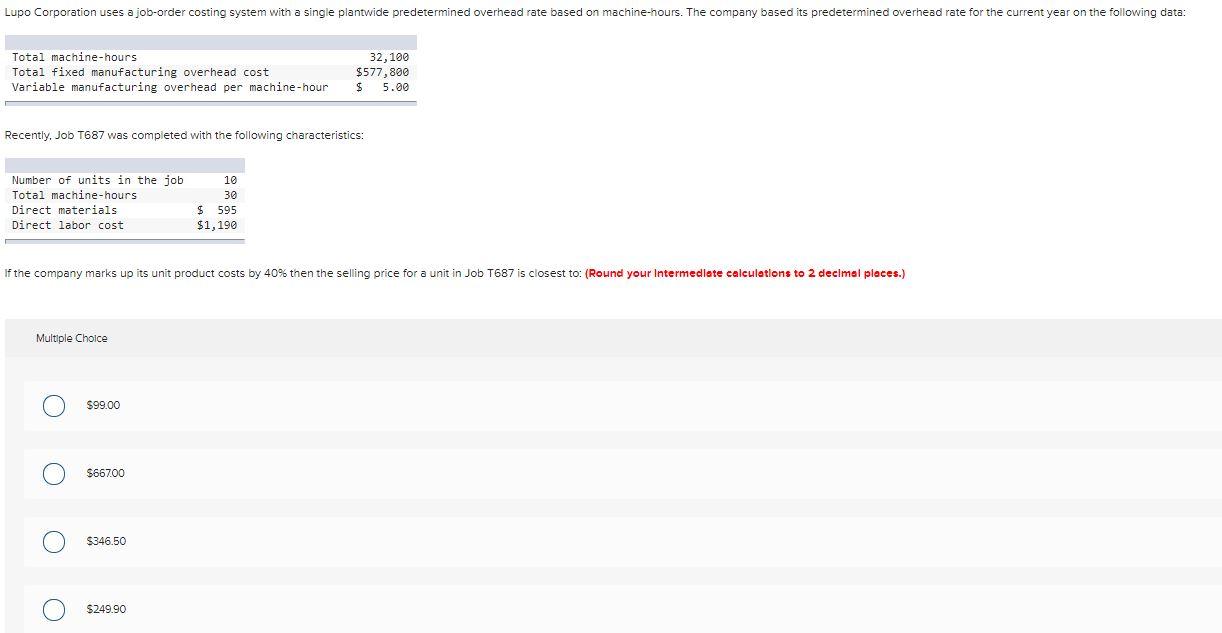

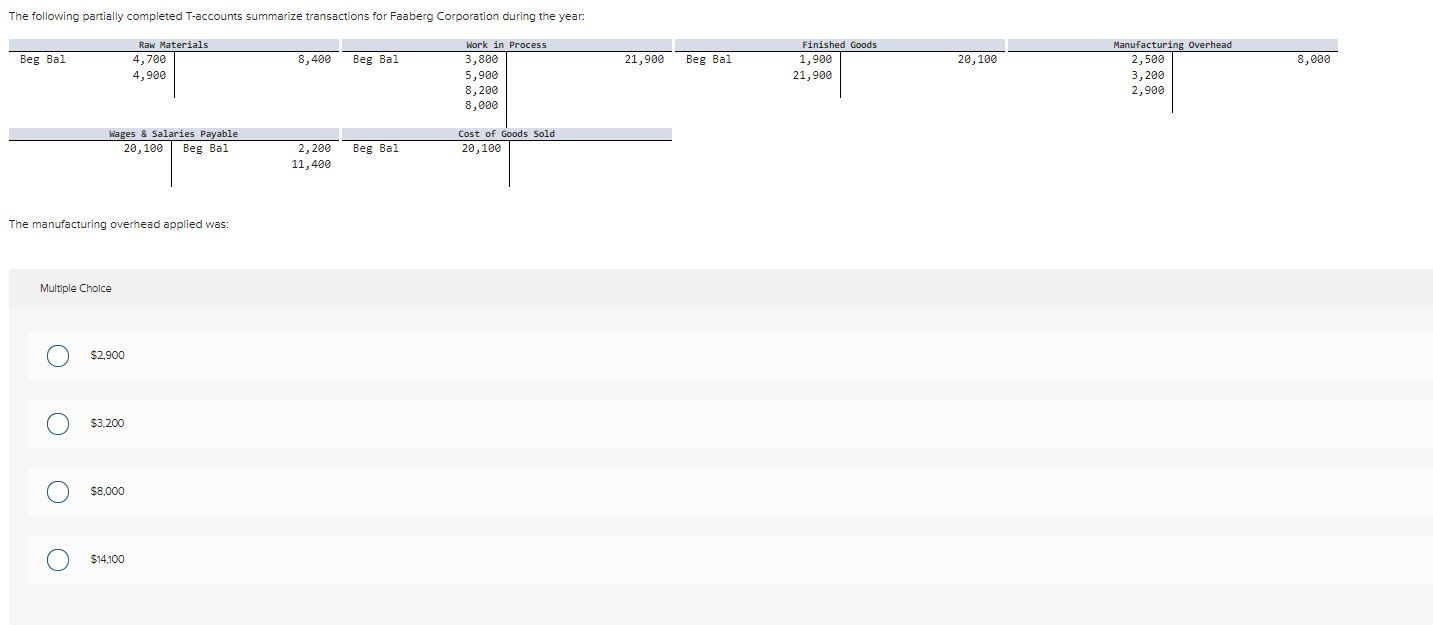

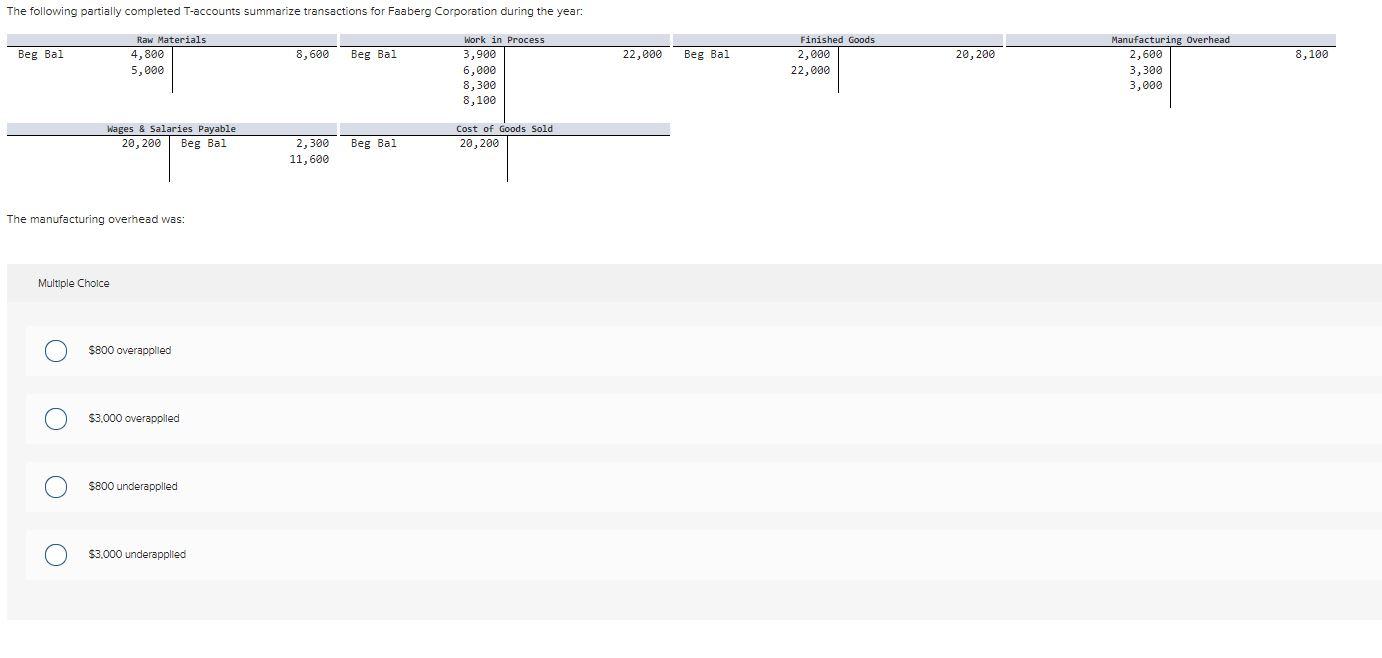

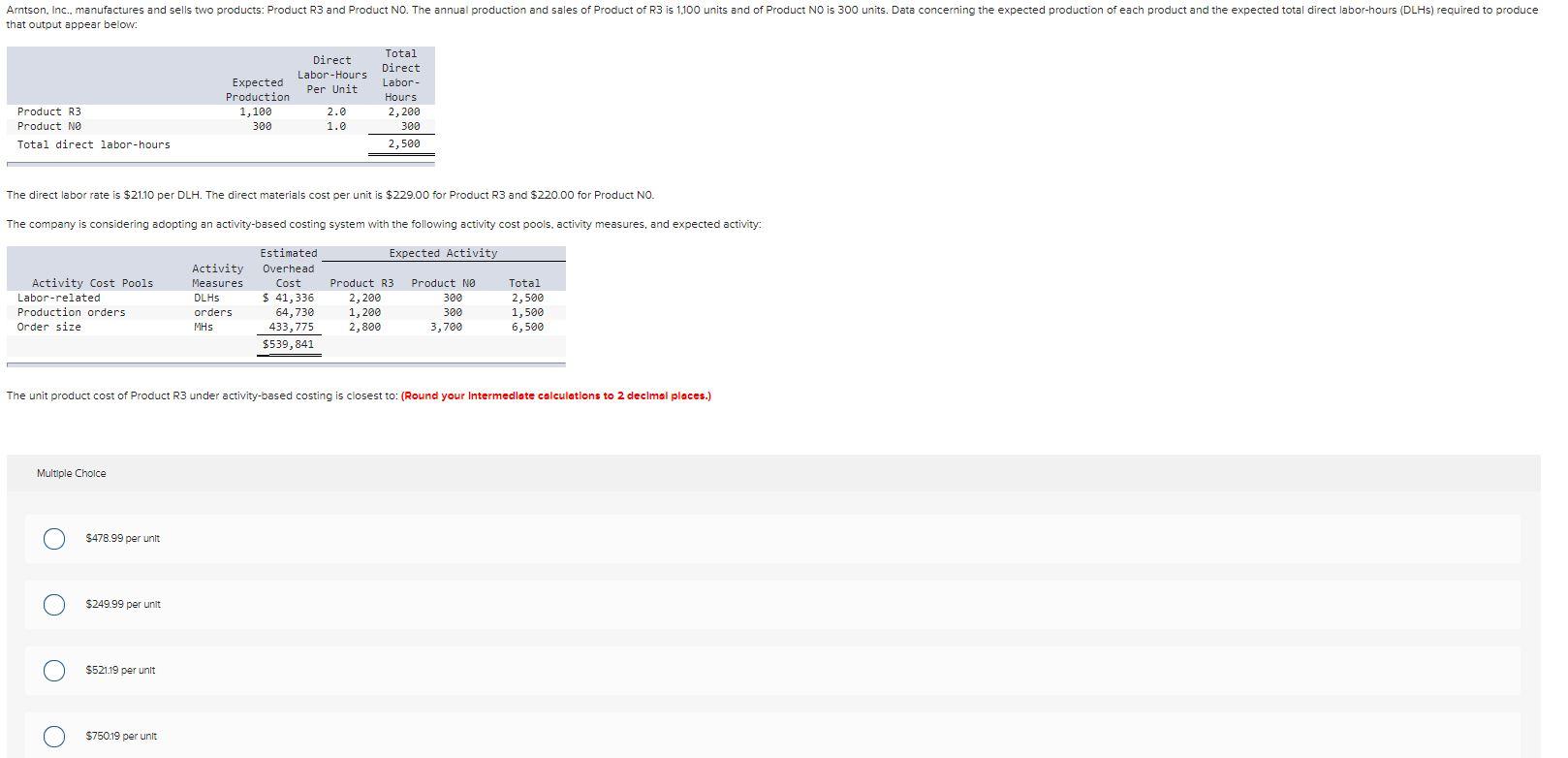

Lupo Corporation uses a job-order costing system with a single plantwide predetermined overhead rate based on machine-hours. The company based its predetermined overhead rate for the current year on the following data: Total machine-hours Total fixed manufacturing overhead cost Variable manufacturing overhead per machine-hour 32,100 $577,800 $ 5.00 Recently, Job T687 was completed with the following characteristics: Number of units in the job Total machine-hours Direct materials Direct labor cost 10 30 $ 595 $1,190 If the company marks up its unit product costs by 40% then the selling price for a unit in Job T687 is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice $99.00 $66700 $346.50 o $249.90 The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year: Beg Bal Raw Materials 4,700 4,900 8,400 Beg Bal 21,900 Beg Bal Finished Goods 1,900 21,900 20,100 Work in Process 3,800 5,900 8,200 8,000 8,000 Manufacturing Overhead 2,500 3,200 2,900 Wages & Salaries Payable 20,100 Beg Bal Cost of Goods sold 20,100 Beg Bal 2,200 11,400 The manufacturing overhead applied was: Multiple Choice $2,900 $3,200 O $8,000 O O $14.100 The following partially completed T-accounts summarize transactions for Faaberg Corporation during the year: Beg Bal Raw Materials 4,800 5,000 8,600 Beg Bal 22,000 Beg Bal Finished Goods 2,000 22,000 20,200 Work in Process 3,900 6,000 8,300 8,100 8,100 Manufacturing Overhead 2,600 3,300 3,000 Wages & Salaries Payable 20, 200 Beg Bal Cost of Goods Sold 20,200 Beg Bal 2,300 11,600 The manufacturing overhead was: Multiple Choice O $800 overapplied $3.000 overappiled $800 underapplied O $3.000 underapplied O Arntson, Inc., manufactures and sells two products: Product R3 and Product NO. The annual production and sales of Product of R3 is 1,100 units and of Product NO is 300 units. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Direct Labor-Hours Per Unit Expected Production 1,100 300 Total Direct Labor- Hours 2,200 300 2,500 Product R3 Product NO Total direct labor-hours 2.0 1.0 The direct labor rate is $21.10 per DLH. The direct materials cost per unit is $229.00 for Product R3 and $220.00 for Product NO. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Expected Activity Activity Cost Pools Labor-related Production orders Order size Activity Measures DLHS orders MHS Estimated Overhead Cost $ 41,336 64,730 433,775 $539, 841 Product R3 2,200 1,200 2,800 Product NO 300 300 3,700 Total 2,500 1,500 6,500 The unit product cost of Product R3 under activity-based costing is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice $478.99 per unit $249.99 per unit $521.19 per unit $750.19 per unit