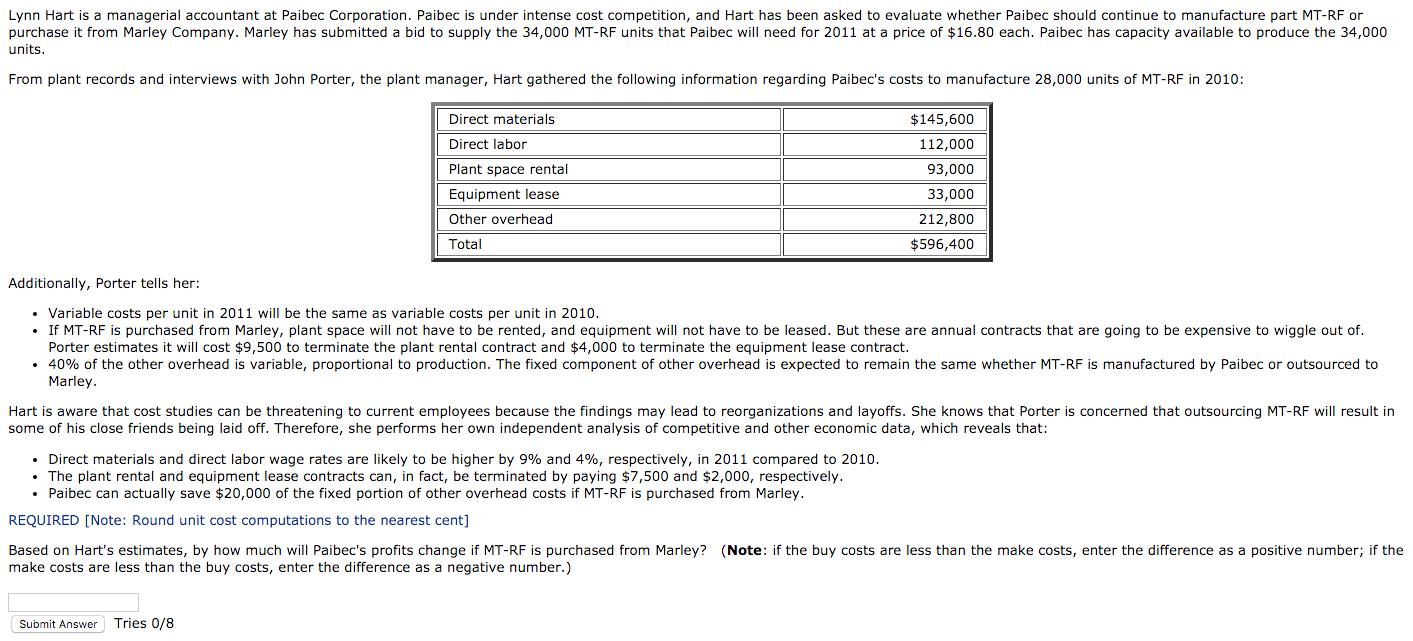

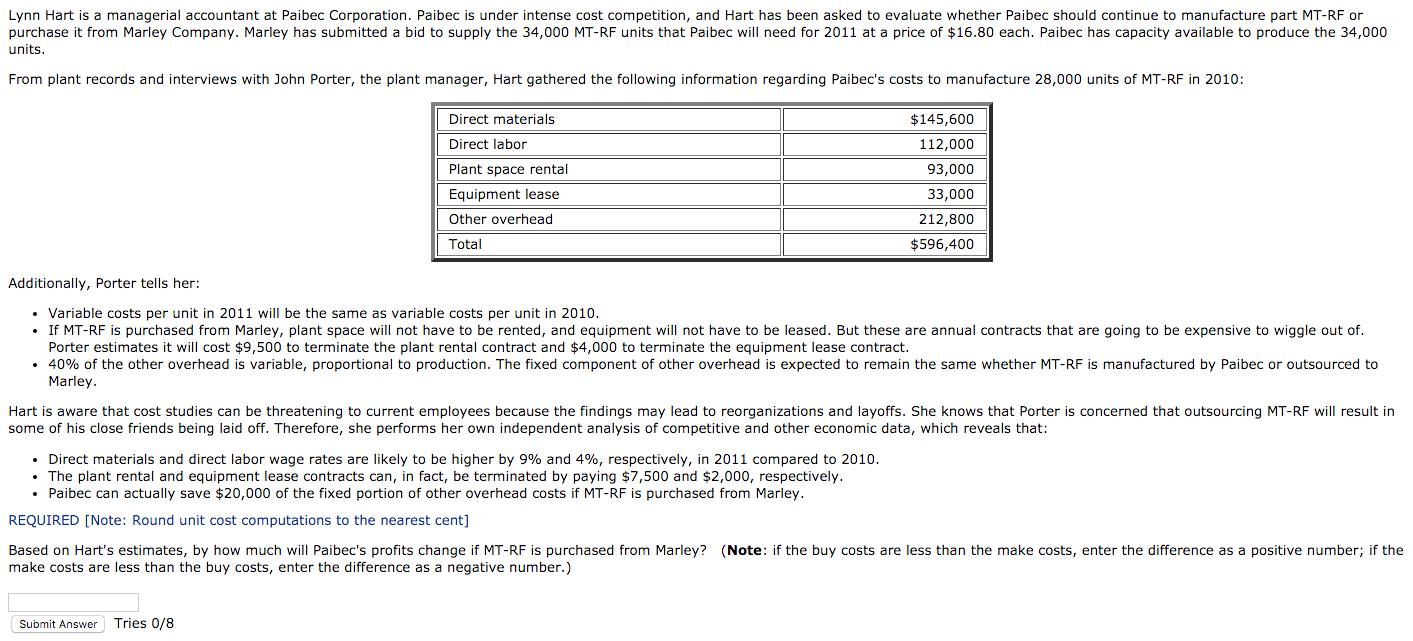

Lynn Hart is a managerial accountant at Paibec Corporation. Paibec is under intense cost competition, and Hart has been asked to evaluate whether Paibec should continue to manufacture part MT-RF or purchase it from Marley Company. Marley has submitted a bid to supply the 34,000 MT-RF units that Paibec will need for 2011 at a price of $16.80 each. Paibec has capacity available to produce the 34,000 units. From plant records and interviews with John Porter, the plant manager, Hart gathered the following information regarding Paibec's costs to manufacture 28,000 units of MT-RF in 2010: Additionally, Porter tells her: Variable costs per unit in 2011 will be the same as variable costs per unit in 2010. If MT-RF is purchased from Marley, plant space will not have to be rented, and equipment will not have to be leased. But these are annual contracts that are going to be expensive to wiggle out of. Porter estimates it will cost $9,500 to terminate the plant rental contract and $4,000 to terminate the equipment lease contract. 40% of the other overhead is variable, proportional to production. The fixed component of other overhead is expected to remain the same whether MT-RF is manufactured by Paibec or outsourced to Marley. Hart is aware that cost studies can be threatening to current employees because the findings may lead to reorganizations and layoffs. She knows that Porter is concerned that outsourcing MT-RF will result in some of his close friends being laid off. Therefore, she performs her own independent analysis of competitive and other economic data, which reveals that: Direct materials and direct labor wage rates are likely to be higher by 9% and 4%, respectively, in 2011 compared to 2010. The plant rental and equipment lease contracts can, in fact, be terminated by paying S7,500 and S2,000, respectively. Paibec can actually save $20,000 of the fixed portion of other overhead costs if MT-RF is purchased from Marley. Based on Hart's estimates, by how much will Paibec's profits change if MT-RF is purchased from Marley? (Note: if the buy costs are less than the make costs, enter the difference as a positive number; if the make costs are less than the buy costs, enter the difference as a negative number.)