Question

Mack S corporation is owned 50/50 by Mackenzie and Craig. At the beginning of the year Mack's stock basis was $40,000 and Craig's stock

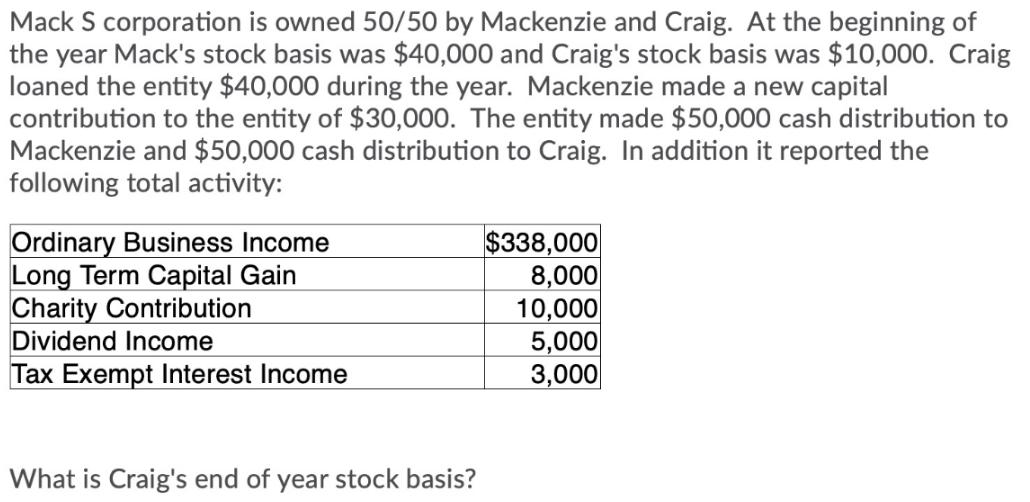

Mack S corporation is owned 50/50 by Mackenzie and Craig. At the beginning of the year Mack's stock basis was $40,000 and Craig's stock basis was $10,000. Craig loaned the entity $40,000 during the year. Mackenzie made a new capital contribution to the entity of $30,000. The entity made $50,000 cash distribution to Mackenzie and $50,000 cash distribution to Craig. In addition it reported the following total activity: Ordinary Business Income Long Term Capital Gain Charity Contribution Dividend Income Tax Exempt Interest Income $338,000 8,000 10,000 5,000 3,000 What is Craig's end of year stock basis?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

2100000 179 Deduction 1000000 Bonus Depreciation 1100000 So tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Personal Finance Turning Money into Wealth

Authors: Arthur J. Keown

7th edition

978-0133856507, 013385650X, 133856437, 978-0133856439

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App