Answered step by step

Verified Expert Solution

Question

1 Approved Answer

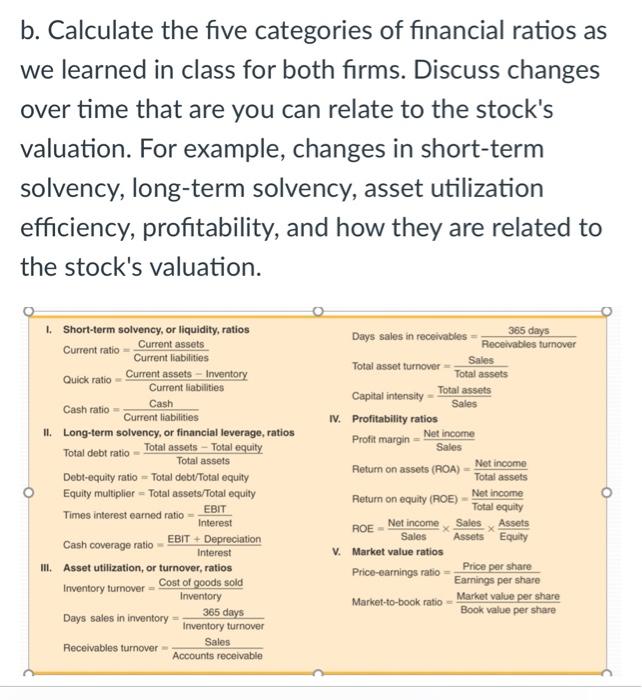

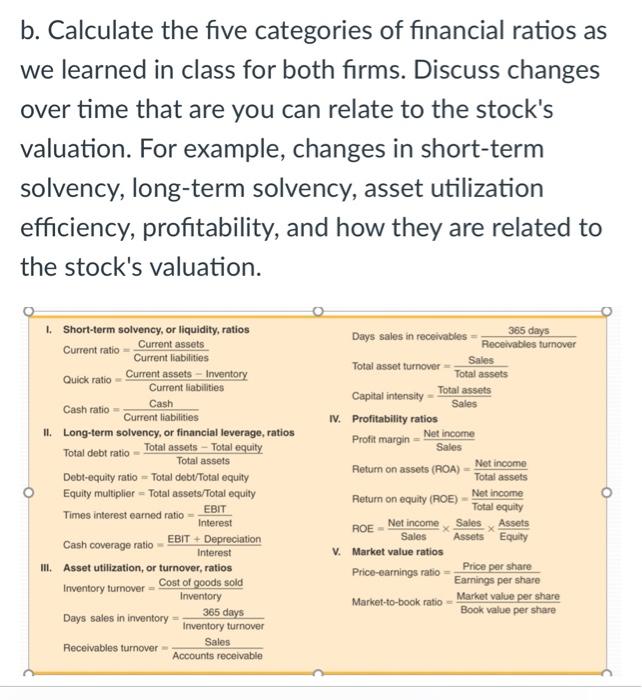

macys and nordstroms b. Calculate the five categories of financial ratios as we learned in class for both firms. Discuss changes over time that are

macys and nordstroms

b. Calculate the five categories of financial ratios as we learned in class for both firms. Discuss changes over time that are you can relate to the stock's valuation. For example, changes in short-term solvency, long-term solvency, asset utilization efficiency, profitability, and how they are related to the stock's valuation. Current ratio - Current assets Days sales in receivables 365 days Receivables turnover Sales Total asset turnover - Total assets Capital intensity - Total assets Net income Short-term solvency, or liquidity, ratios Current liabilities Quick ratio Current assets Inventory Current liabilities Cash ratio Cash Current liabilities I. Long-term solvency, or financial leverage ratios Total debt ratio Total assets - Total equity Total assets Debt-equity ratio = Total debt/Total equity Equity multiplier - Total assets/Total equity Times interest earned ratio- EBIT Interest Cash coverage ratio EBIT + Depreciation Interest II. Asset utilization, or turnover, ratios Inventory turnover Cost of goods sold Inventory Days sales in inventory 365 days Inventory turnover Sales Accounts receivable Sales IV. Profitability ratios Profit margin Net income Sales Return on assets (ROA) Total assets Return on equity (ROE) Net income Total equity ROE - Net income Sales Assets Sales Assets Equity V. Market value ratios Price-earnings ratio Price per share Earnings per share Market-to-book ratio Market value per share Book value per share Receivables turnover b. Calculate the five categories of financial ratios as we learned in class for both firms. Discuss changes over time that are you can relate to the stock's valuation. For example, changes in short-term solvency, long-term solvency, asset utilization efficiency, profitability, and how they are related to the stock's valuation. Current ratio - Current assets Days sales in receivables 365 days Receivables turnover Sales Total asset turnover - Total assets Capital intensity - Total assets Net income Short-term solvency, or liquidity, ratios Current liabilities Quick ratio Current assets Inventory Current liabilities Cash ratio Cash Current liabilities I. Long-term solvency, or financial leverage ratios Total debt ratio Total assets - Total equity Total assets Debt-equity ratio = Total debt/Total equity Equity multiplier - Total assets/Total equity Times interest earned ratio- EBIT Interest Cash coverage ratio EBIT + Depreciation Interest II. Asset utilization, or turnover, ratios Inventory turnover Cost of goods sold Inventory Days sales in inventory 365 days Inventory turnover Sales Accounts receivable Sales IV. Profitability ratios Profit margin Net income Sales Return on assets (ROA) Total assets Return on equity (ROE) Net income Total equity ROE - Net income Sales Assets Sales Assets Equity V. Market value ratios Price-earnings ratio Price per share Earnings per share Market-to-book ratio Market value per share Book value per share Receivables turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started