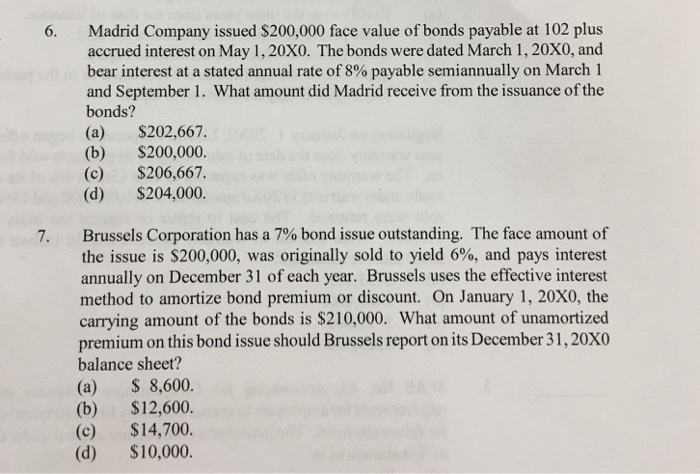

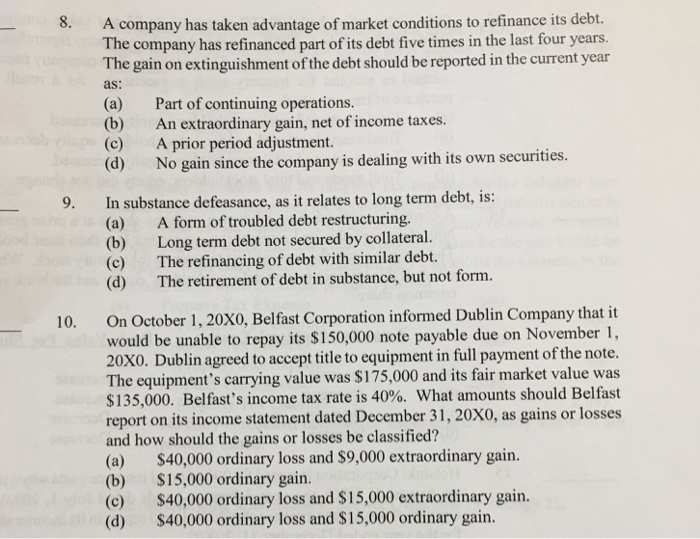

Madrid Company issued $200,000 face value of bonds payable at 102 plus accrued interest on May 1,20X0. The bonds were dated March 1, 20X0, and bear interest at a stated annual rate of 8% payable semiannually on March 1 and September 1. What amount did Madrid receive from the issuance of the bonds? (a) $202,667 (b) $200,000. (c) $206,667. (d) $204,000. 6. Brussels Corporation has a 7% bond issue outstanding. The face amount of the issue is $200,000, was originally sold to yield 6%, and pays interest annually on December 31 of each year. Brussels uses the effective interest method to amortize bond premium or discount. On January 1, 20X0, the carrying amount of the bonds is $210,000. What amount of unamortized premium on this bond issue should Brussels report on its December 31,20XO balance sheet? (a) 8,600. (b) $12,600. (c) $14,700. (d) $10,000. 7, 8. A company has taken advantage of market conditions to refinance its debt. The company has refinanced part of its debt five times in the last four years. The gain on extinguishment of the debt should be reported in the current year as: (a) Part of continuing operations. (b) An extraordinary gain, net of income taxes. (c) A prior period adjustment (d) No gain since the company is dealing with its own securities In substance defeasance, as it relates to long term debt, is: (a) (b) (c) (d) 9. A form of troubled debt restructuring. Long term debt not secured by collateral. The refinancing of debt with similar debt. The retirement of debt in substance, but not form. 10. On October 1, 20X0, Belfast Corporation informed Dublin Company that it would be unable to repay its $150,000 note payable due on November 1, 20X0. Dublin agreed to accept title to equipment in full payment of the note. The equipment's carrying value was $175,000 and its fair market value was $135,000, Belfast's income tax rate is 40%. What amounts should Belfast report on its income statement dated December 31, 20X0, as gains or losses and how should the gains or losses be classified? (a) $40,000 ordinary loss and $9,000 extraordinary gain. (b) $15,000 ordinary gain. (c) $40,000 ordinary loss and $15,000 extraordinary gain. (d) $40,000 ordinary loss and $15,000 ordinary gain