-

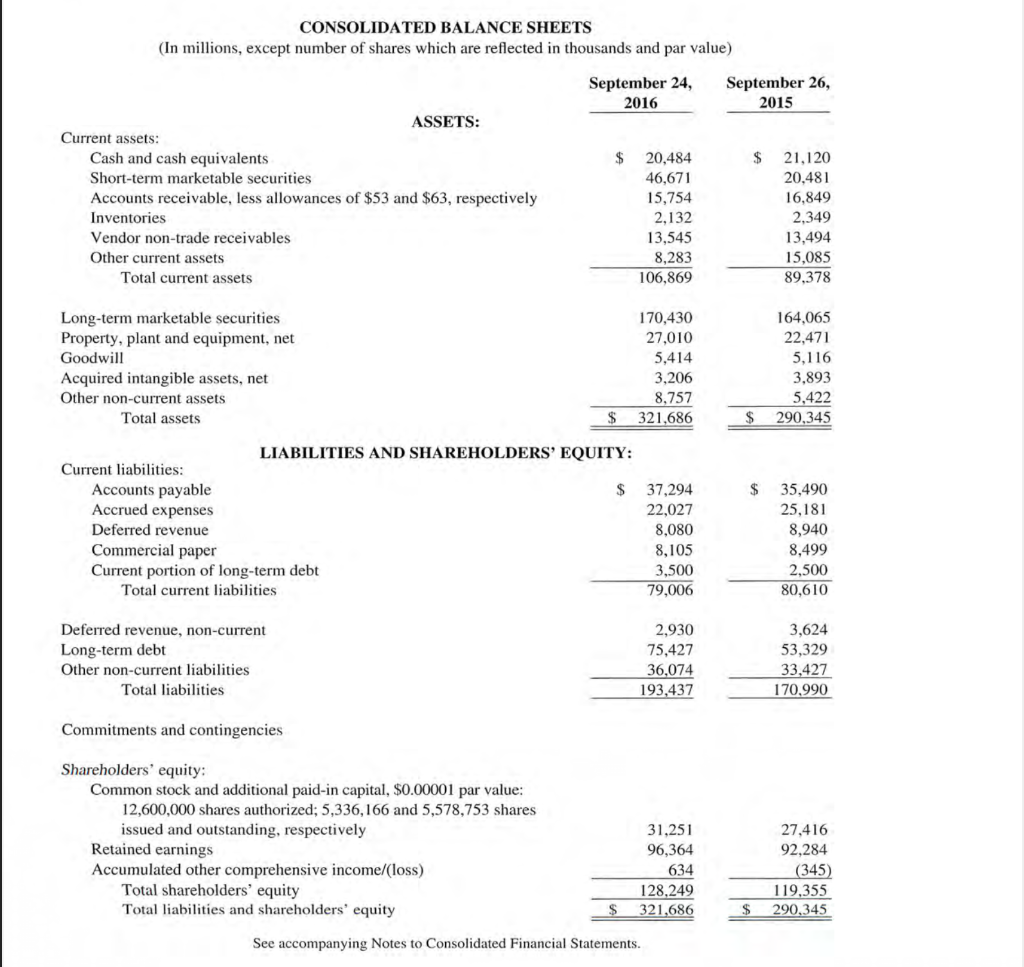

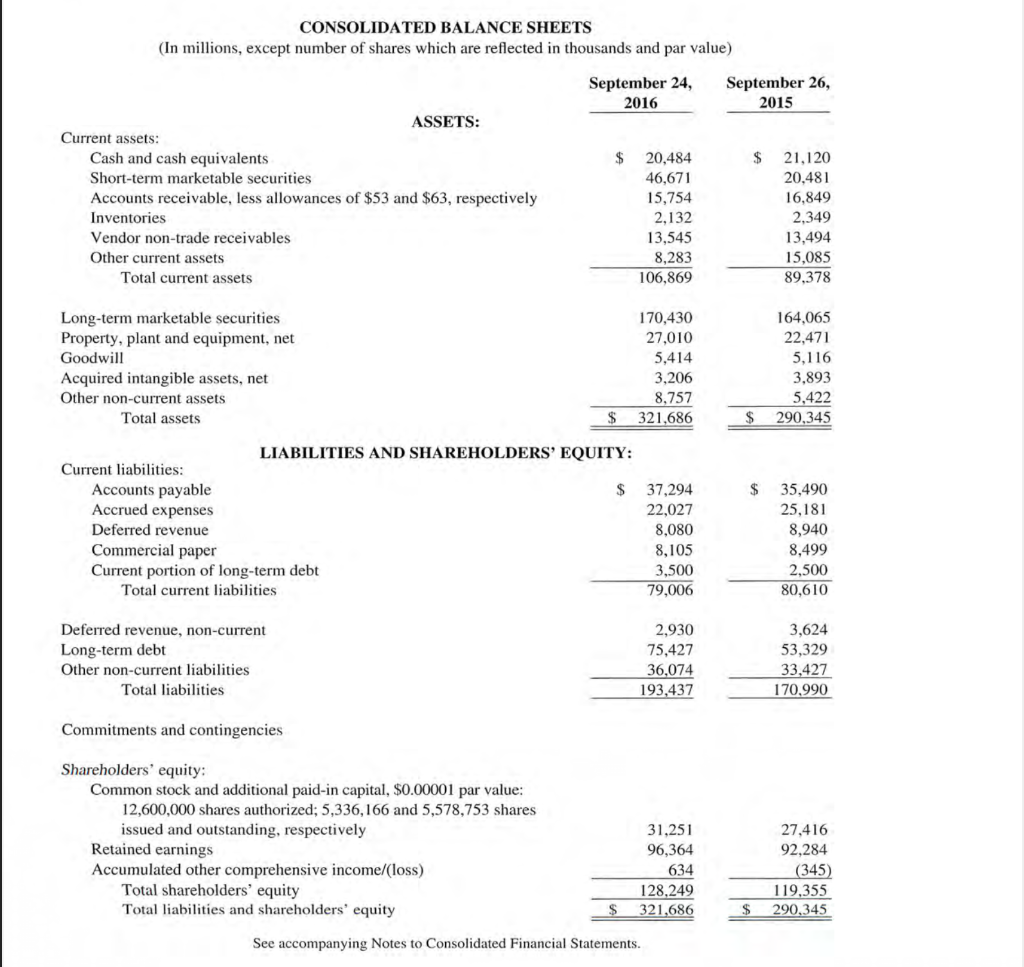

Make an analysis of the Consolidated Balance Sheets. What do you see? The Long-term Debt has increased considerably...does that concern you? How is that explained in the notes to the financial statements?

CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 26, 2015 $ $ ASSETS: Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $53 and $63, respectively Inventories Vendor non-trade receivables Other current assets Total current assets 20,484 46,671 15,754 2,132 13,545 8,283 106,869 21,120 20,481 16,849 2,349 13,494 15,085 89,378 Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other non-current assets Total assets 170,430 27,010 5,414 3,206 8,757 321,686 164,065 22,471 5,116 3,893 5,422 290,345 $ $ $ LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable $ Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities 37,294 22,027 8.080 8,105 3,500 79,006 35,490 25,181 8,940 8,499 2,500 80,610 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2,930 75,427 36,074 193,437 3,624 53,329 33,427 170,990 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,336,166 and 5,578,753 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 31,251 96,364 634 128,249 321,686 27.416 92,284 (345) 119,355 290,345 $ See accompanying Notes to Consolidated Financial Statements. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 24, 2016 September 26, 2015 $ $ ASSETS: Current assets: Cash and cash equivalents Short-term marketable securities Accounts receivable, less allowances of $53 and $63, respectively Inventories Vendor non-trade receivables Other current assets Total current assets 20,484 46,671 15,754 2,132 13,545 8,283 106,869 21,120 20,481 16,849 2,349 13,494 15,085 89,378 Long-term marketable securities Property, plant and equipment, net Goodwill Acquired intangible assets, net Other non-current assets Total assets 170,430 27,010 5,414 3,206 8,757 321,686 164,065 22,471 5,116 3,893 5,422 290,345 $ $ $ LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable $ Accrued expenses Deferred revenue Commercial paper Current portion of long-term debt Total current liabilities 37,294 22,027 8.080 8,105 3,500 79,006 35,490 25,181 8,940 8,499 2,500 80,610 Deferred revenue, non-current Long-term debt Other non-current liabilities Total liabilities 2,930 75,427 36,074 193,437 3,624 53,329 33,427 170,990 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares authorized; 5,336,166 and 5,578,753 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/(loss) Total shareholders' equity Total liabilities and shareholders' equity 31,251 96,364 634 128,249 321,686 27.416 92,284 (345) 119,355 290,345 $ See accompanying Notes to Consolidated Financial Statements