Answered step by step

Verified Expert Solution

Question

1 Approved Answer

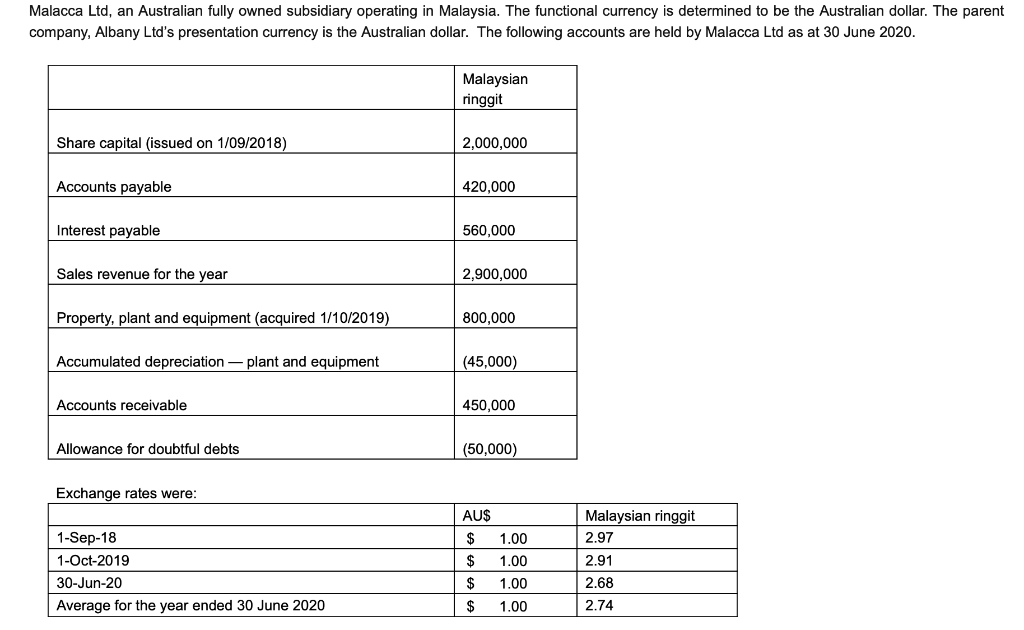

Malacca Ltd, an Australian fully owned subsidiary operating in Malaysia. The functional currency is determined to be the Australian dollar. The parent company, Albany Ltd's

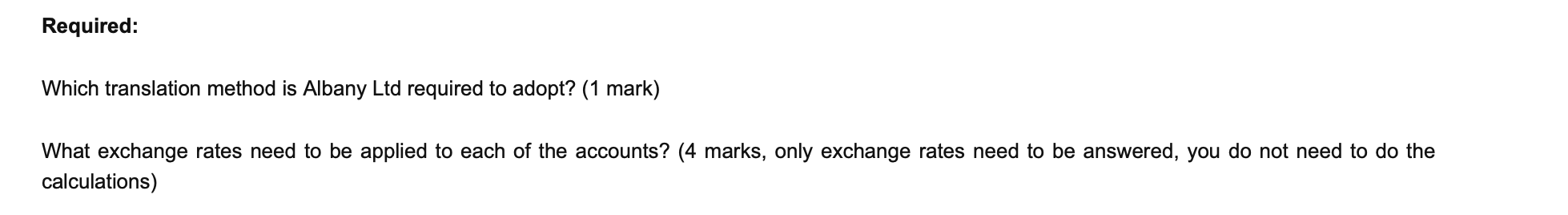

Malacca Ltd, an Australian fully owned subsidiary operating in Malaysia. The functional currency is determined to be the Australian dollar. The parent company, Albany Ltd's presentation currency is the Australian dollar. The following accounts are held by Malacca Ltd as at 30 June 2020. Malaysian ringgit Share capital (issued on 1/09/2018) 2,000,000 Accounts payable 420,000 Interest payable 560,000 Sales revenue for the year 2,900,000 Property, plant and equipment (acquired 1/10/2019) 800,000 Accumulated depreciation - plant and equipment (45,000) Accounts receivable 450,000 Allowance for doubtful debts (50,000) Exchange rates were: 1.00 AU$ $ $ $ 1-Sep-18 1-Oct-2019 30-Jun-20 Average for the year ended 30 June 2020 1.00 Malaysian ringgit 2.97 2.91 2.68 2.74 1.00 1.00 $ Required: Which translation method is Albany Ltd required to adopt? (1 mark) What exchange rates need to be applied to each of the accounts? (4 marks, only exchange rates need to be answered, you do not need to do the calculations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started