Answered step by step

Verified Expert Solution

Question

1 Approved Answer

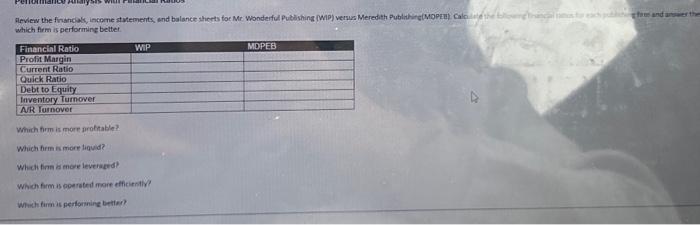

manco Analysis will Pa Review the financials, income statements, and balance sheets for Mr. Wonderful Publishing (WIP) versus Meredith Publishing(MOPEE) Cale which firm is

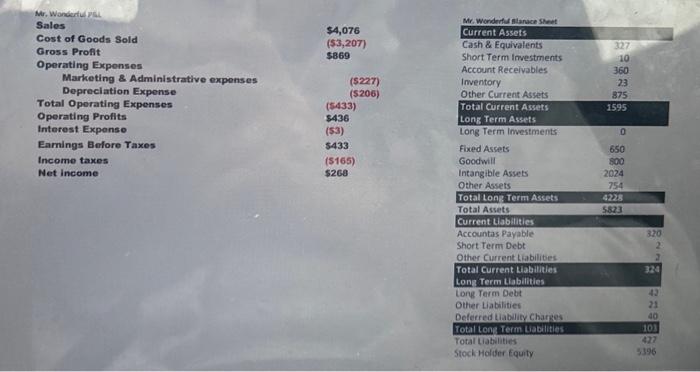

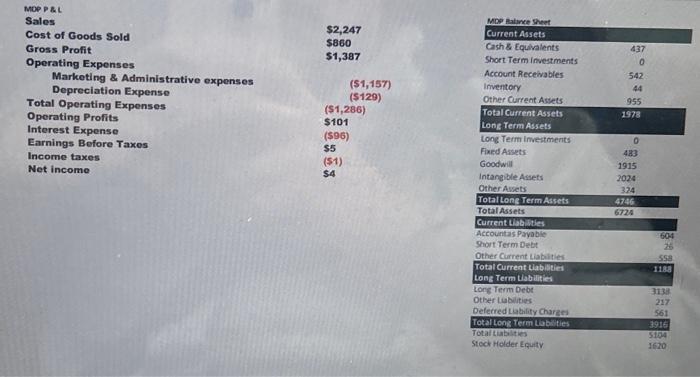

manco Analysis will Pa Review the financials, income statements, and balance sheets for Mr. Wonderful Publishing (WIP) versus Meredith Publishing(MOPEE) Cale which firm is performing better. Financial Ratio Profit Margin Current Ratio Quick Ratio Debt to Equity Inventory Turnover A/R Turnover WIP Which firm is more profitable? Which firm is more liquid? Which firm is more leveraged? Which firm is operated more efficiently? Which firm is performing better? MDPEB chpuf and answer the Mr. Wonderful PAL Sales Cost of Goods Sold Gross Profit Operating Expenses Marketing & Administrative expenses Depreciation Expense Total Operating Expenses Operating Profits Interest Expense Earnings Before Taxes Income taxes Net income $4,076 ($3,207) $869 ($227) (5206) (5433) $436 (53) $433 ($165) $268 Mr. Wonderful Blanace Sheet Current Assets Cash & Equivalents Short Term Investments Account Receivables Inventory Other Current Assets Total Current Assets Long Term Assets Long Term Investments Fixed Assets Goodwill Intangible Assets Other Assets Total Long Term Assets Total Assets Current Liabilities Accountas Payable Short Term Debt Other Current Liabilities Total Current Liabilities Long Term Liabilities Long Term Debt Other Liabilities Deferred Liability Charges Total Long Term Liabilities Total Liabilities Stock Holder Equity 327 10 360 2.3 875 1595 0 650 800 2024 754 4228 5823 320 2 2 324 43 21 40 103 427 5396 MOP P&L Sales Cost of Goods Sold Gross Profit Operating Expenses Marketing & Administrative expenses Depreciation Expense Total Operating Expenses Operating Profits Interest Expense Earnings Before Taxes Income taxes Net income $2,247 $860 $1,387 ($1,157) ($129) ($1,286) $101 (596) $5 ($1) $4 MDP Balance Sheet Current Assets Cash & Equivalents Short Term Investments Account Receivables Inventory Other Current Assets Total Current Assets Long Term Assets Long Term Investments Fixed Assets Goodwill Intangible Assets Other Assets Total Long Term Assets Total Assets Current Liabilities Accountas Payable Short Term Debt Other Current Liabilities Total Current Liabilities Long Term Liabilities Long Term Debt Other Liabilities Deferred Liability Charges Total Long Term Liabilities Total Liabilities Stock Holder Equity 437 542 44 955 1978 0 0 483 1915 2024 324 4746 6724 604 26 558 1188 3138 217 561 3916 5104 1620

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Youve provided images of the income statement and balance sheet for two companies WIP and MOPFB and a table where youre supposed to calculate and comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started