Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mr Smith has been very successful in expanding the Caf T outlets and he is now planning an IPO to make Caf T a

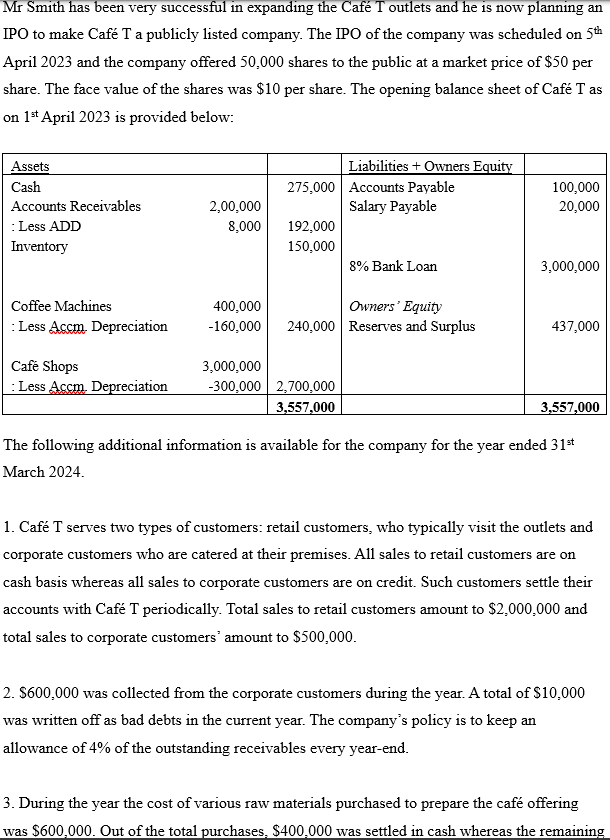

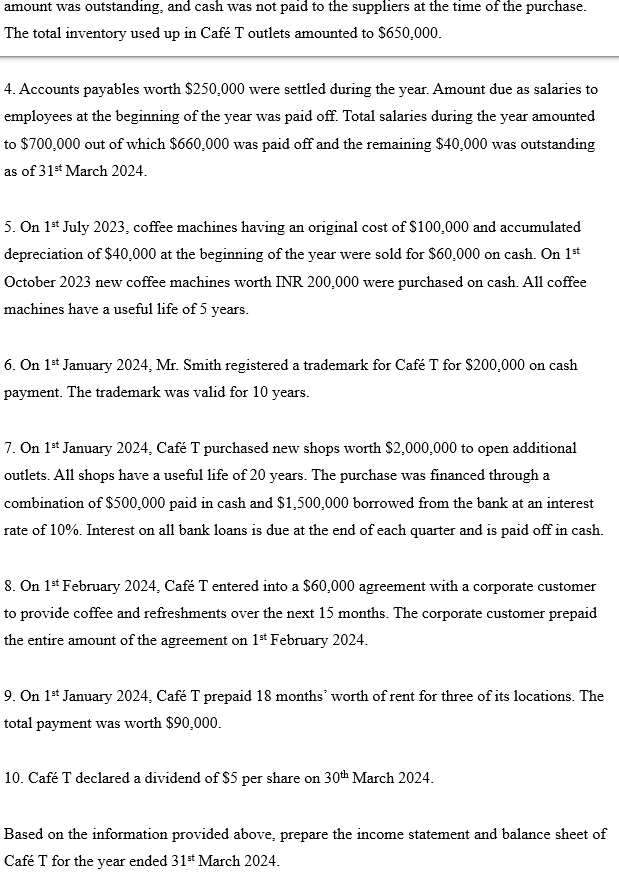

Mr Smith has been very successful in expanding the Caf T outlets and he is now planning an IPO to make Caf T a publicly listed company. The IPO of the company was scheduled on 5th April 2023 and the company offered 50,000 shares to the public at a market price of $50 per share. The face value of the shares was $10 per share. The opening balance sheet of Caf T as on 1st April 2023 is provided below: Assets Cash Accounts Receivables : Less ADD Inventory Coffee Machines : Less Accm. Depreciation Cafe Shops : Less Accm. Depreciation 2,00,000 8,000 400,000 -160,000 275,000 Accounts Payable Salary Payable 192,000 150,000 Liabilities + Owners Equity 3,000,000 -300,000 2,700,000 3,557,000 8% Bank Loan Owners' Equity 240,000 Reserves and Surplus 100,000 20,000 3,000,000 437,000 3,557,000 The following additional information is available for the company for the year ended 31st March 2024. 1. Caf T serves two types of customers: retail customers, who typically visit the outlets and corporate customers who are catered at their premises. All sales to retail customers are on cash basis whereas all sales to corporate customers are on credit. Such customers settle their accounts with Caf T periodically. Total sales to retail customers amount to $2,000,000 and total sales to corporate customers' amount to $500,000. 2. $600,000 was collected from the corporate customers during the year. A total of $10,000 was written off as bad debts in the current year. The company's policy is to keep an allowance of 4% of the outstanding receivables every year-end. 3. During the year the cost of various raw materials purchased to prepare the caf offering was $600,000. Out of the total purchases, $400,000 was settled in cash whereas the remaining amount was outstanding, and cash was not paid to the suppliers at the time of the purchase. The total inventory used up in Caf T outlets amounted to $650,000. 4. Accounts payables worth $250,000 were settled during the year. Amount due as salaries to employees at the beginning of the year was paid off. Total salaries during the year amounted to $700,000 out of which $660,000 was paid off and the remaining $40,000 was outstanding as of 31st March 2024. 5. On 1st July 2023, coffee machines having an original cost of $100,000 and accumulated depreciation of $40,000 at the beginning of the year were sold for $60,000 on cash. On 1st October 2023 new coffee machines worth INR 200,000 were purchased on cash. All coffee machines have a useful life of 5 years. 6. On 1st January 2024, Mr. Smith registered a trademark for Caf T for $200,000 on cash payment. The trademark was valid for 10 years. 7. On 1st January 2024, Caf T purchased new shops worth $2,000,000 to open additional outlets. All shops have a useful life of 20 years. The purchase was financed through a combination of $500,000 paid in cash and $1,500,000 borrowed from the bank at an interest rate of 10%. Interest on all bank loans is due at the end of each quarter and is paid off in cash. 8. On 1st February 2024, Caf T entered into a $60,000 agreement with a corporate customer to provide coffee and refreshments over the next 15 months. The corporate customer prepaid the entire amount of the agreement on 1st February 2024. 9. On 1st January 2024, Caf T prepaid 18 months' worth of rent for three of its locations. The total payment was worth $90,000. 10. Caf T declared a dividend of $5 per share on 30th March 2024. Based on the information provided above, prepare the income statement and balance sheet of Caf T for the year ended 31st March 2024.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Calculations for Income Statement for the Year Ended March 31 2024 Sales Revenue Retail Customers 2000000 Corporate Customers 500000 Total Sales Reven...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started