Answered step by step

Verified Expert Solution

Question

1 Approved Answer

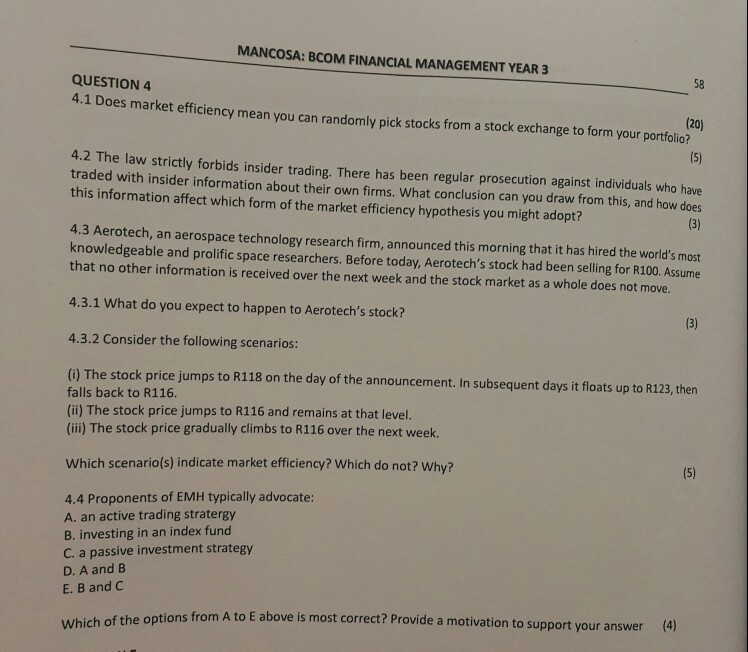

MANCOSA: BCOM FINANCIAL MANAGEMENT YEAR 3 58 QUESTION 4 4.1 Doe s market efficiency mean you can randomly pick stocks from a stock exchange to

MANCOSA: BCOM FINANCIAL MANAGEMENT YEAR 3 58 QUESTION 4 4.1 Doe s market efficiency mean you can randomly pick stocks from a stock exchange to form your portfolio? (20) 4.2 The law strictly forbids insider trading. There has been regular prosecution against individuals who have traded with insider information about their own firms. What conclusion can you draw from this, and how does this information affect which form of the market efficiency hypothesis you might adopt? 4.3 Aerotech, an aerospace technology research firm, announced this morning that it has hired the world's most knowledgeable and prolific space researchers. Before today, Aerotech's stock had been selling for R100. Assume that no other information is received over the next week and the stock market as a whole does not move. 4.3.1 What do you expect to happen to Aerotech's stock? 4.3.2 Consider the following scenarios: (i) The stock price jumps to R118 on the day of the announcement. In subsequent days it floats up to R123,then falls back to R116. (i) The stock price jumps to R116 and remains at that level. (ii) The stock price gradually climbs to R116 over the next week. Which scenario(s) indicate market efficiency? Which do not? Why? 4.4 Proponents of EMH typically advocate: A. an active trading stratergy B. investing in an index fund C. a passive investment strategy D. A and B E. B and C ns from A to E above is most correct? Provide a motivation to support your answer (4) Which of the optio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started