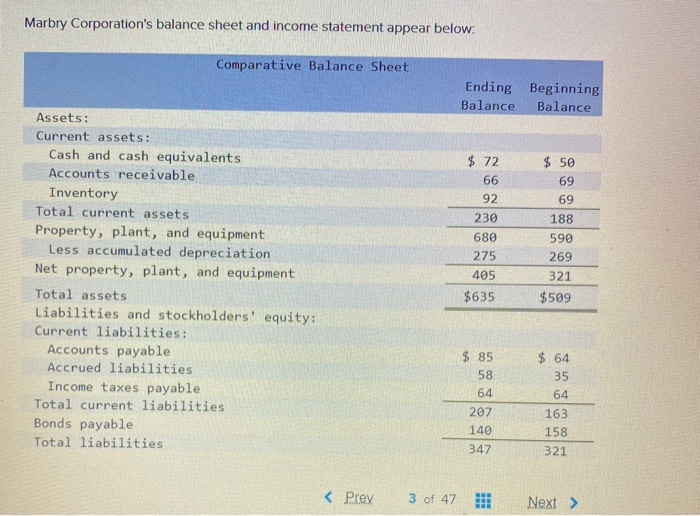

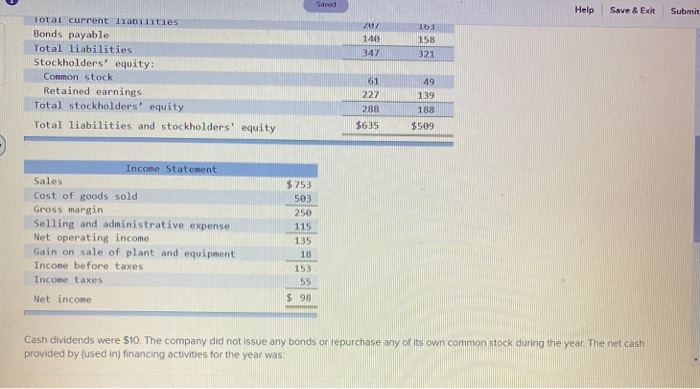

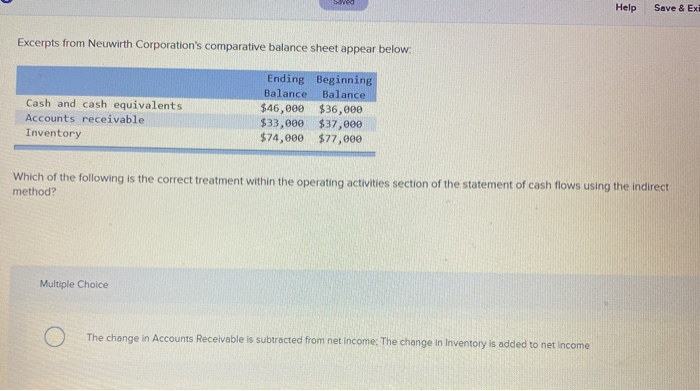

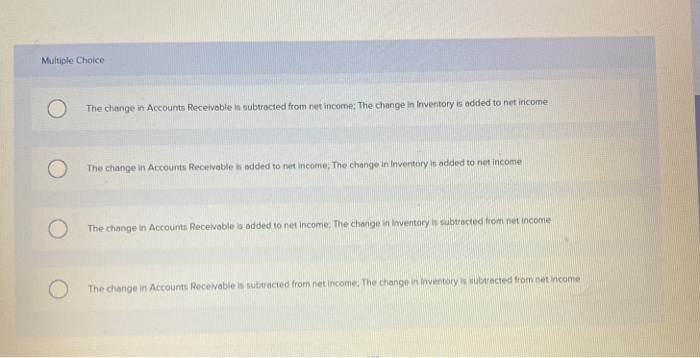

Marbry Corporation's balance sheet and income statement appear below: Comparative Balance Sheet Ending Beginning Balance Balance $ 72 66 $ 50 69 69 92 230 680 275 Assets: Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Property, plant, and equipment Less accumulated depreciation Net property, plant, and equipment Total assets Liabilities and stockholders' equity: Current liabilities: Accounts payable Accrued liabilities Income taxes payable Total current liabilities Bonds payable Total liabilities 188 590 269 321 $509 405 $635 $ 85 58 64 $ 64 35 64 163 207 140 347 158 321 Served Help Save & Exit Submit 2017 Tbs 140 347 158 321 Total current abilities Bonds payable Total liabilities Stockholders' equity: Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 61 227 288 49 139 188 $509 $635 Income Statement Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Gain on sale of plant and equipment Incone before taxes Income taxes $ 753 503 250 115 135 18 153 55 Net income $ 98 Cash dividends were $10. The company did not issue any bonds or repurchase any of its own common stock during the year. The net cash provided by used in) financing activities for the year was ved Help Save & EXE Excerpts from Neuwirth Corporation's comparative balance sheet appear below: Cash and cash equivalents Accounts receivable Inventory Ending Beginning Balance Balance $46,000 $36,000 $33,000 $37,000 $74,000 $77,000 Which of the following is the correct treatment within the operating activities section of the statement of cash flows using the indirect method? Multiple Choice O The change in Accounts Receivable is subtracted from net income: The change in Inventory is added to net income Multiple Choice The change in Accounts Receivable is subtracted from net income: The change in Inventory is added to net income The change in Accounts Receivable is added to net income: The change in Inventory is added to net income The change in Accounts Receivable is added to net income: The change in Inventory is subtracted from net income The change in Accounts Receivable is subtracted from net income. The change in Inventory is subtracted from net income