Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary Ellis owns a small manufacturing company and would like to develop more accurate estimates for overhead expenses when making planning decisions. She is

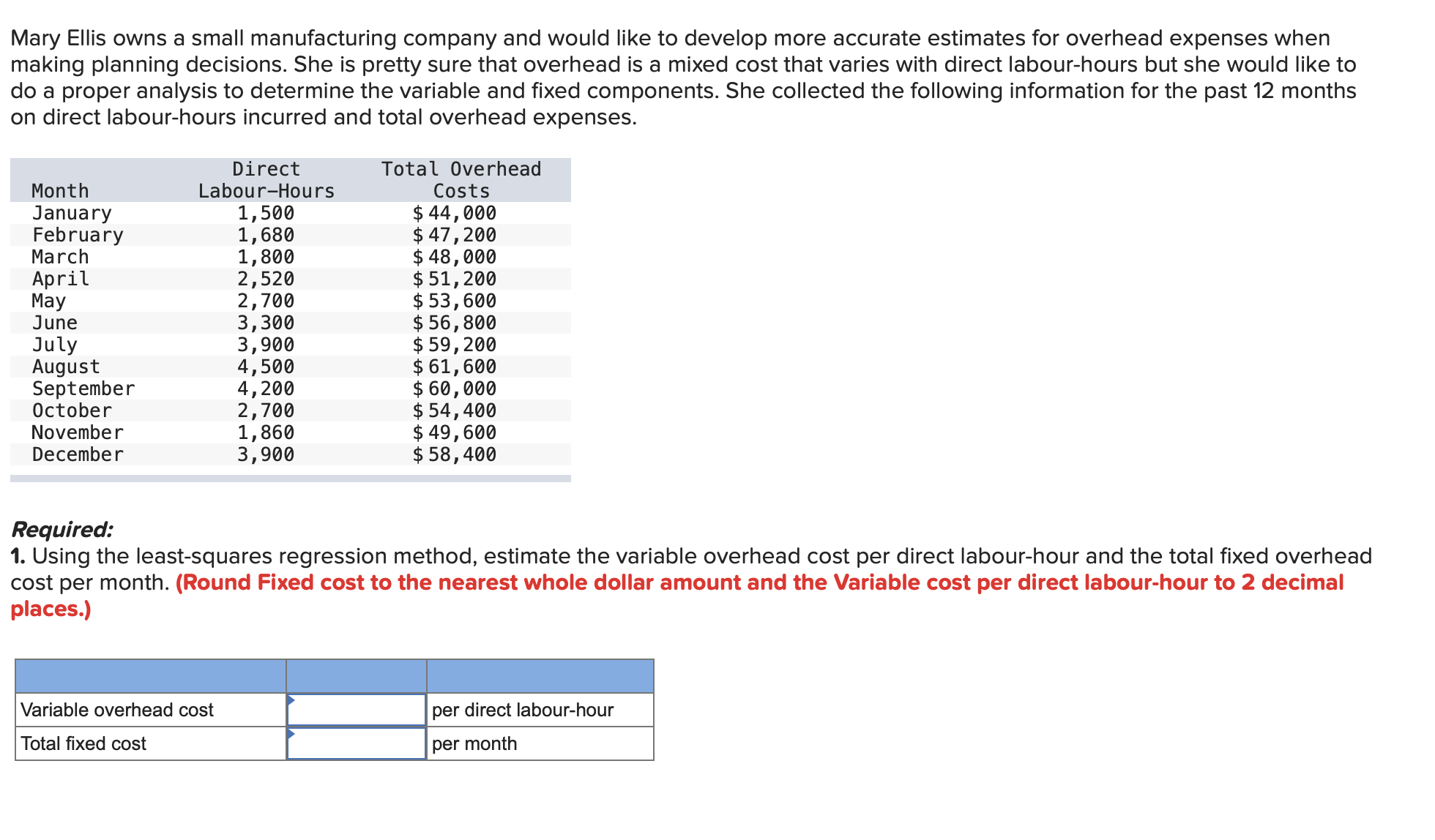

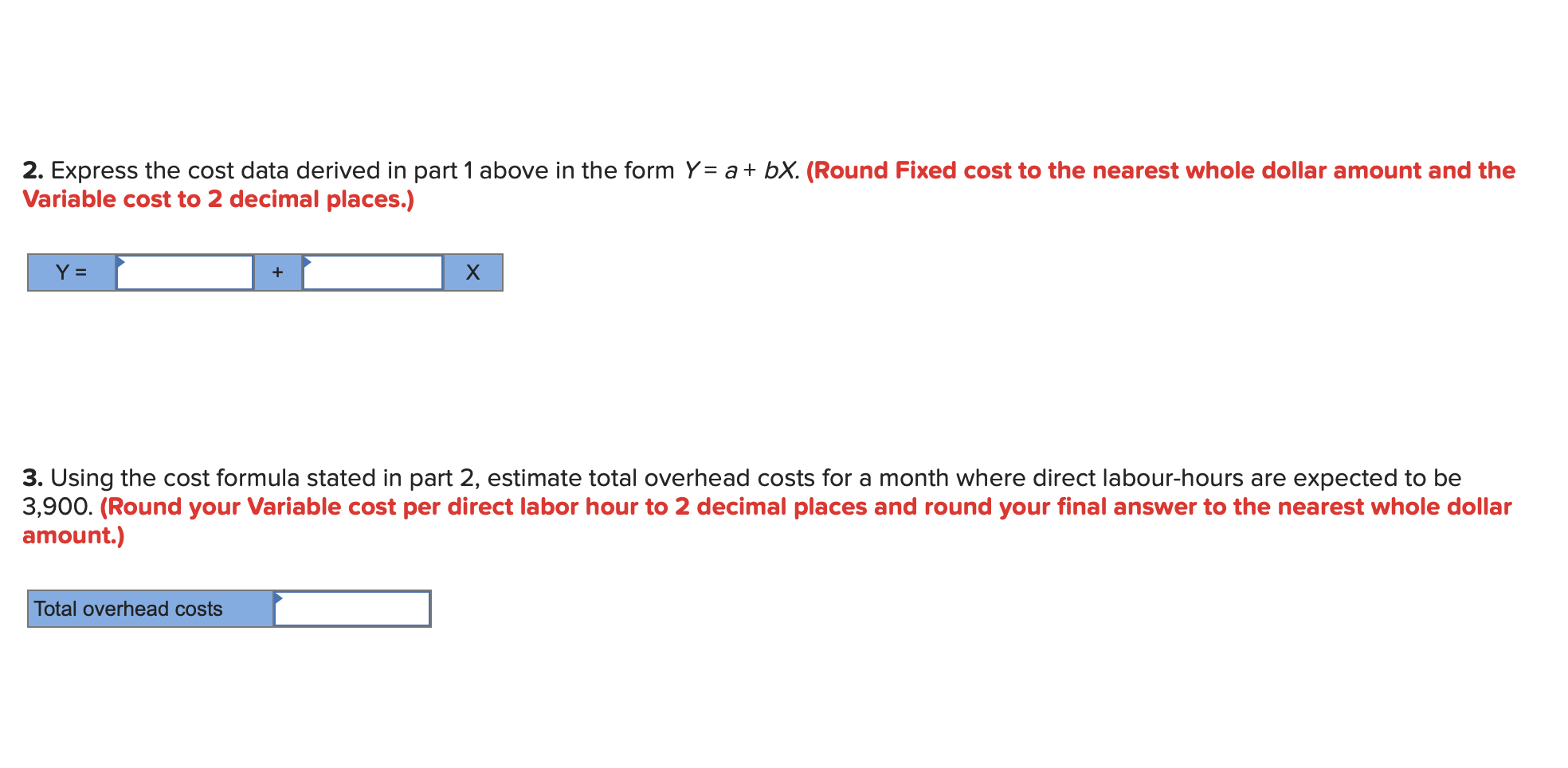

Mary Ellis owns a small manufacturing company and would like to develop more accurate estimates for overhead expenses when making planning decisions. She is pretty sure that overhead is a mixed cost that varies with direct labour-hours but she would like to do a proper analysis to determine the variable and fixed components. She collected the following information for the past 12 months on direct labour-hours incurred and total overhead expenses. Direct Labour-Hours Month January 1,500 Total Overhead Costs $44,000 February 1,680 $47,200 March 1,800 $ 48,000 April 2,520 $ 51,200 May 2,700 $53,600 June 3,300 $ 56,800 July 3,900 $ 59,200 August 4,500 $ 61,600 September 4,200 $ 60,000 October 2,700 $ 54,400 November 1,860 $ 49,600 December 3,900 $ 58,400 Required: 1. Using the least-squares regression method, estimate the variable overhead cost per direct labour-hour and the total fixed overhead cost per month. (Round Fixed cost to the nearest whole dollar amount and the Variable cost per direct labour-hour to 2 decimal places.) Variable overhead cost per direct labour-hour Total fixed cost per month 2. Express the cost data derived in part 1 above in the form Y= a + bX. (Round Fixed cost to the nearest whole dollar amount and the Variable cost to 2 decimal places.) Y = + 3. Using the cost formula stated in part 2, estimate total overhead costs for a month where direct labour-hours are expected to be 3,900. (Round your Variable cost per direct labor hour to 2 decimal places and round your final answer to the nearest whole dollar amount.) Total overhead costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started