Answered step by step

Verified Expert Solution

Question

1 Approved Answer

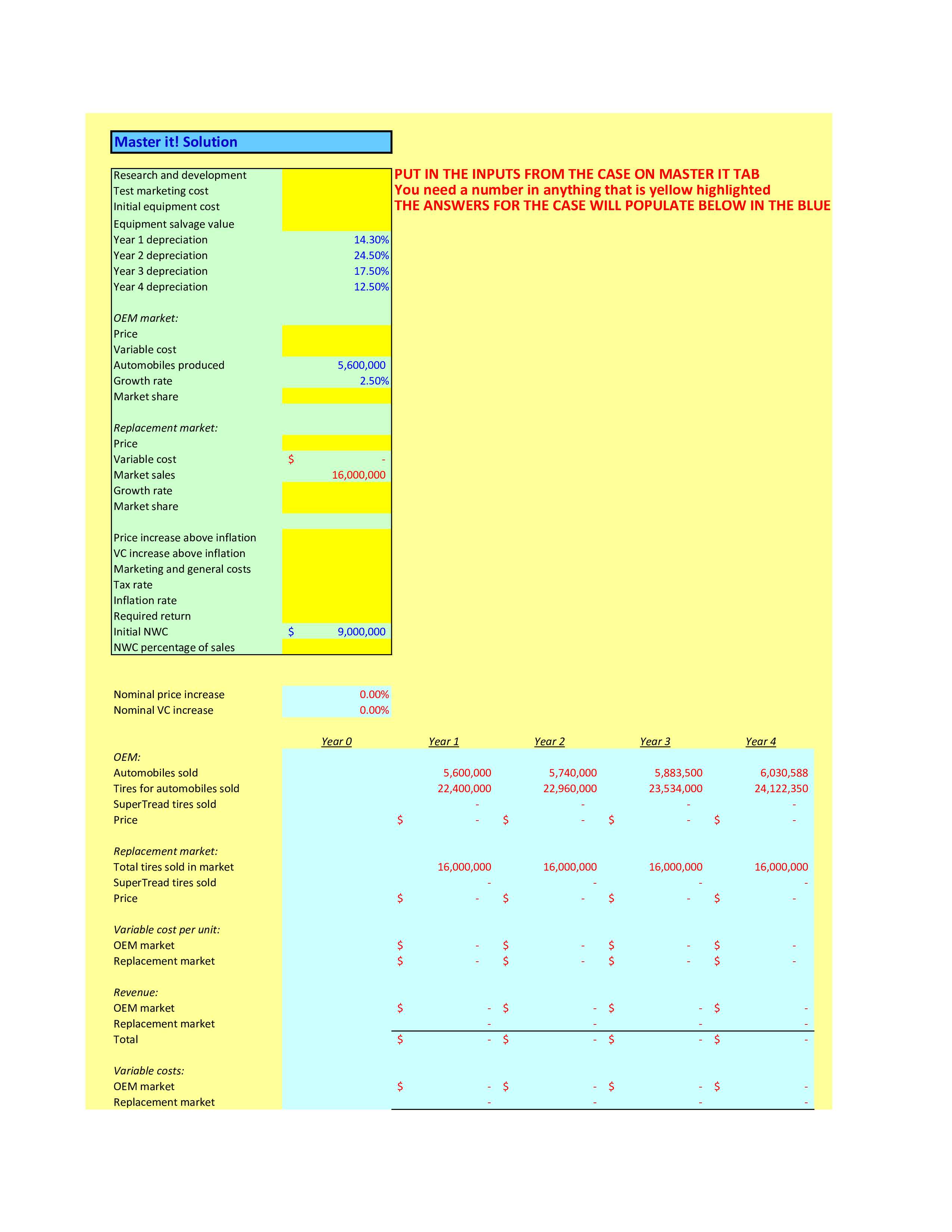

Master it! Solution Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation 14.30% Year 2 depreciation 24.50% Year

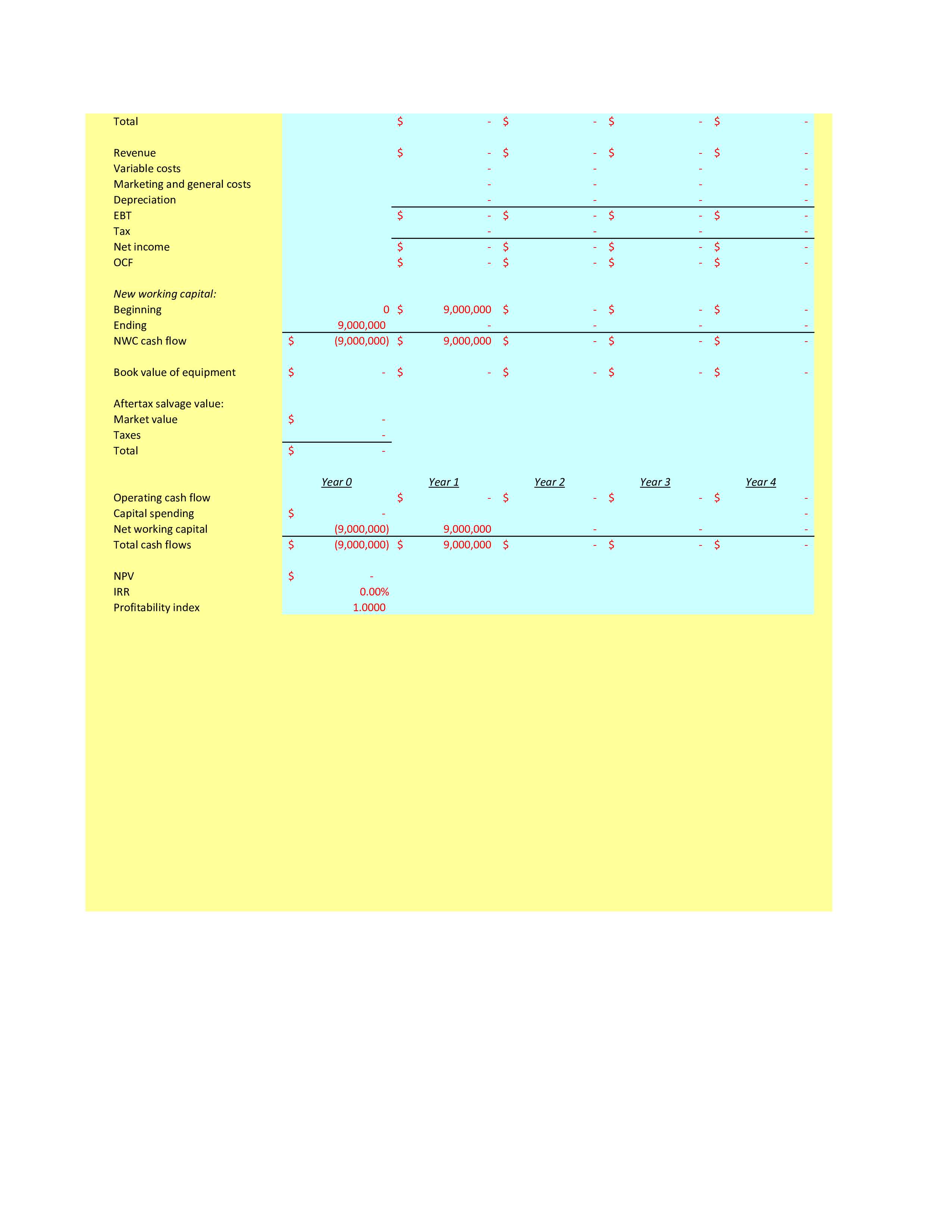

Master it! Solution Research and development Test marketing cost Initial equipment cost Equipment salvage value Year 1 depreciation 14.30% Year 2 depreciation 24.50% Year 3 depreciation Year 4 depreciation 17.50% 12.50% OEM market: Price Variable cost Automobiles produced 5,600,000 Growth rate 2.50% Market share Replacement market: Price Variable cost $ Market sales 16,000,000 Growth rate Market share Price increase above inflation VC increase above inflation Marketing and general costs Tax rate Inflation rate Required return Initial NWC $ 9,000,000 NWC percentage of sales Nominal price increase Nominal VC increase OEM: Automobiles sold Tires for automobiles sold Super Tread tires sold Price Replacement market: Total tires sold in market Super Tread tires sold Price Variable cost per unit: Year O 0.00% 0.00% $ PUT IN THE INPUTS FROM THE CASE ON MASTER IT TAB You need a number in anything that is yellow highlighted THE ANSWERS FOR THE CASE WILL POPULATE BELOW IN THE BLUE Year 1 Year 2 Year 3 Year 4 5,600,000 22,400,000 5,740,000 22,960,000 5,883,500 23,534,000 16,000,000 16,000,000 16,000,000 $ $ $ OEM market Replacement market SS $ $ Revenue: OEM market $ Replacement market Total $ Variable costs: OEM market Replacement market $ SS S S St St $ SS $ $ $ $ 6,030,588 24,122,350 16,000,000 Total Revenue Variable costs Marketing and general costs Depreciation EBT Tax Net income OCF New working capital: $ $ $ $ 1 $ $ $ St St $ St St 1 1 1 I 1 $ $ St St ST 1 S Beginning 0 $ 9,000,000 $ Ending NWC cash flow $ 9,000,000 (9,000,000) $ 9,000,000 $ S Book value of equipment $ $ $ $ Aftertax salvage value: Market value $ Taxes Total $ Year O Year 1 Year 2 Year 3 Operating cash flow Capital spending $ Net working capital (9,000,000) Total cash flows $ (9,000,000) $ 9,000,000 9,000,000 $ NPV $ IRR 0.00% Profitability index 1.0000 1 1 $ $ S Year 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started