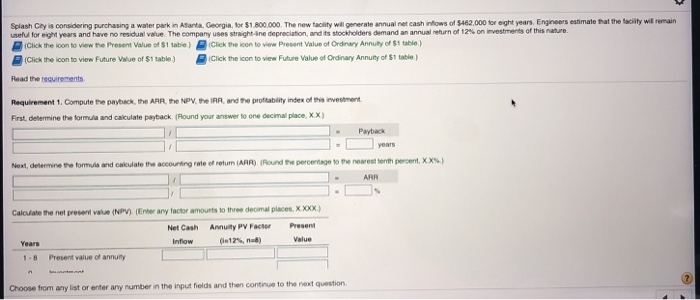

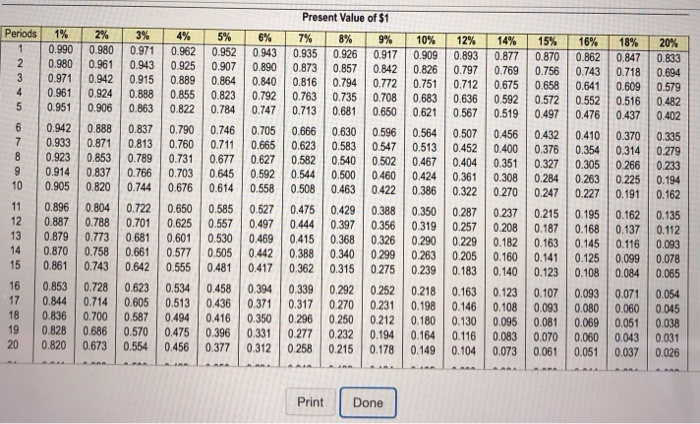

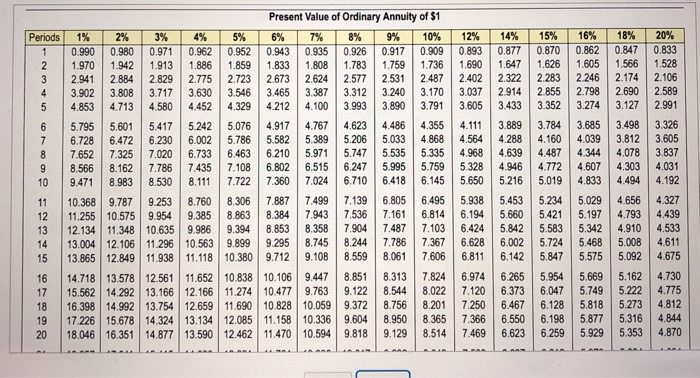

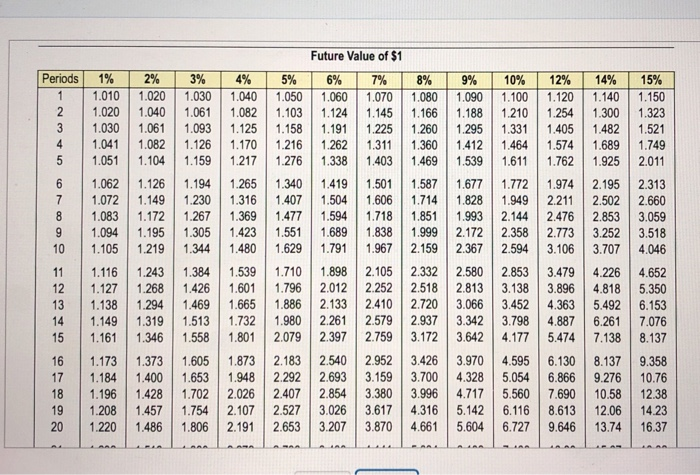

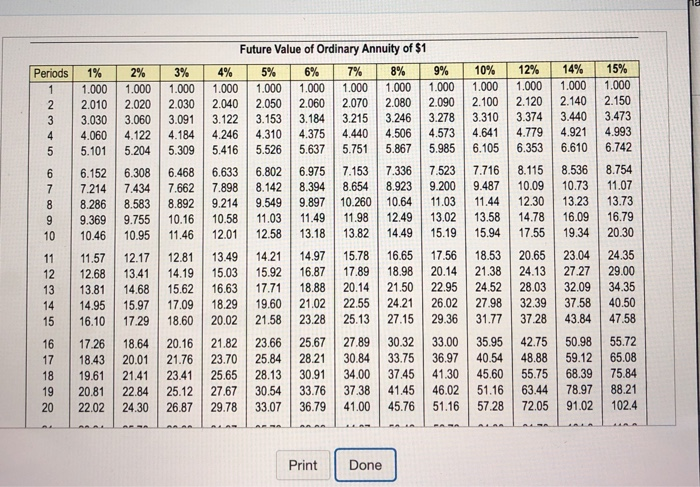

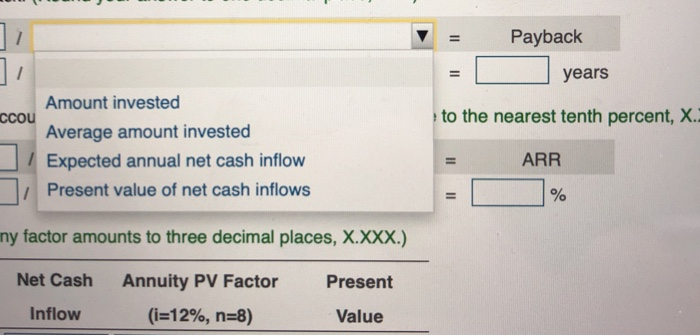

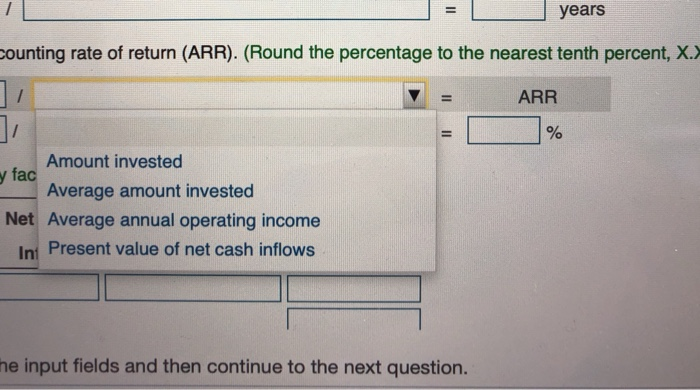

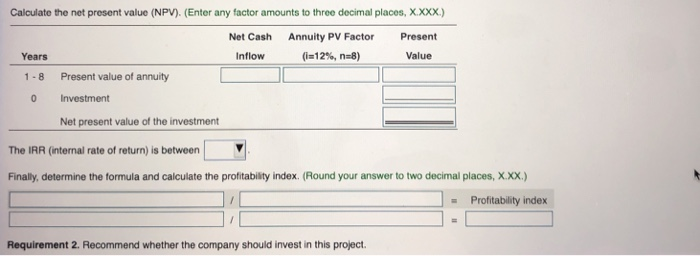

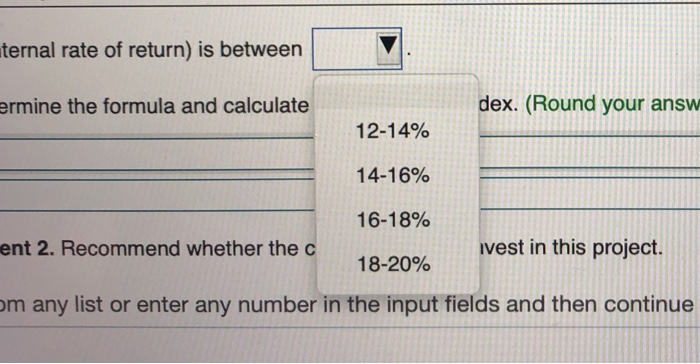

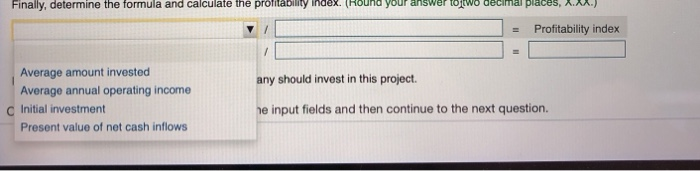

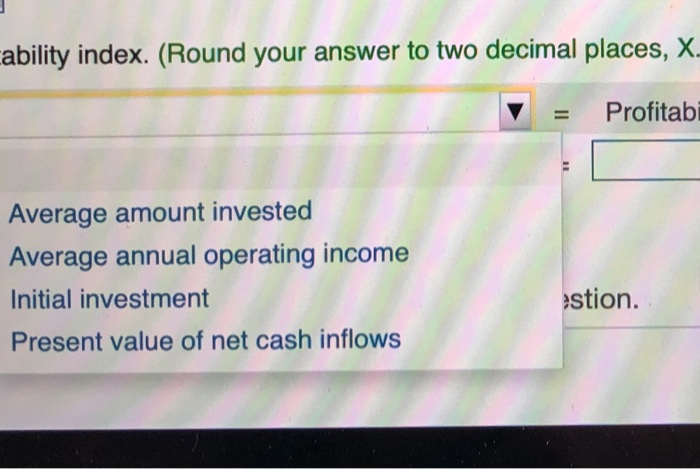

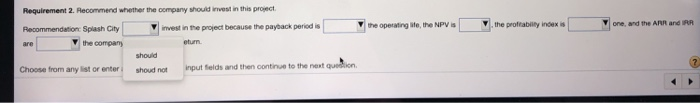

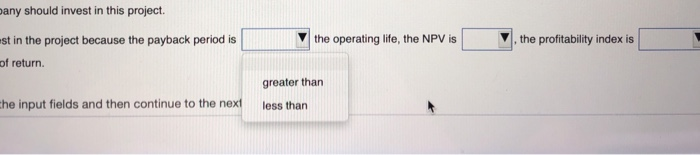

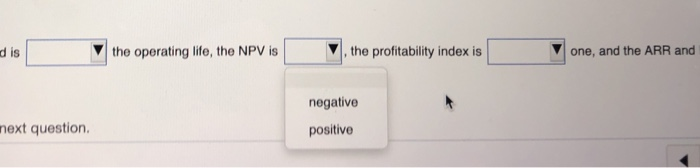

mate hat the tacity w E -s of S462 O treght years. En n ers e main Splash y is consi ng purchas a wa er park n Ata ta. org or S1 000 The new tacity wil geerate a nual nee cas use d or e t years and have no res ual vai e The comp any uses strag tar e depreciato, and its stockholders demand an annual murn of 12% on nestreres of this nat Click the loon to view the Present Value of $1 table)Click the icon to view Present Value of Ordinary Annuity of $t table.) Click the loon to vilew Future Value of $t table) (Click the icon to view Future Value of Ordinary Annuity of $1 table) Read the requirements Requirement 1. Compute the payback, the ARR, the NPV, the IRR, and the profitability index ofis invesment formula and calculate payback (Round your answer to one decimal place. .) Frst, determine Payback years Next, determine the formuls and cakulate the accouning rate of retum (ARR(Round Pe percertage to the nearest tenth percent, xx.) ARR Calou/ate the net present value (NPV) (Enter any factor amounts to three decimal places, X.xXxx) Present Value Annuity PV Factor (i-12% nd) Net Cash Inflow 1 8 Present value of annutyL Choose from any list or enter any number in the input fields and then continue to the next question Present Value of $1 Pods l 1% -- 2% | 3% | 4% 5% | 6% | 7% | 8% | 9% | 10% | 12% | 14% | 15% | 16% -18% 20%! 1 0.990 0.980 0.971 0.962 0.52 0943 0.935 0926 0917 0.909 0893 0.877 0800862 0.847 0.833 2 0.980 0.961 0.943 0.9250.900890 0.873 0857 0842 0826 0797 0769 0756 0743 0.718 0.694 3 0971 0942 0915 0889 0864 0840 0816 0.794 0.772 0.751 0712 0675 0658 06410609 0579 40961 0924 0.888 0.855 0823 07920.763 0735 0708 0,683 0636 0.592 0.572 0.552 0516 0482 0951 0906 0863 082 0,784 0747 0713 0681 065062167 0519 0,497 0.476 0437 0402 60942 0884600036 0564 0507 0456 0432 0410.35 70.933 0.871 0813 0.760 0.711 0.665 0623 0583 0547 0.513 0452 0.400 0.376 0.354 0314 0279 8 0.923 0.853 0.789 0731 0677 627 0.582 0.540 0502 0467 0404 0.351 0.327 0.305 0266 0233 9 0914 0.837 0.766 0703 0645 052 05440500 0460 0424 0.361 0.3080.284 0.263 0.225 0.194 10 0.905 0820 0.744 0.676 0614 0.55808 463 0422 0.386 0.322 0270 027 0227 0.191 0.162 11 0.896 0804 0.722 06508 0475 0429 38387 0237 02150195.62 0.135 12 0887 0.788 0.701 0,625 0.557 0.497 0.444 0397 0356 0.319 0.257208 0.187 0.168 0.137 0.112 13 0879 0.773 0681 6 0530 0,469 0415 0.368 0326 0290 0.229 0.82 0.163 0.145 0116 0.093 14 0.870 0.758 0661 0.577505 0442 0.88 0.340 0299 0.263 .205 0.160 0.141 0.125 0.099 0.078 15 0861 0743 0642 0.55 0481 0417 0362 0315 0275 0,239 0,183 0140 0123 0108 0084 0065 16 0.853 0.728 0,623 0534 0458 034 0.339 0292 0252 0218 0.163 0123 0.107 003 0071 0054 17 0844 0.714 0.605 0513 0436 0371 0.317 0.270 0231 0.98 046 0.108 0.093 0.800.060 0.045 18 0.836 0.700 0587 0494 0416 0.300.296 0250 0212 0.180 0.130 0.095 0.081 0.069 0.01 0.03 19 0.828 0.686 0.570 0.475 0.96 0330.277 0.232 094 0.164 0.116 0083 0.070 0.060 0.043 0,03 20 0.820 0673 0.554 046 0377 0312 025815 178 0.149 0104 0,073 0.061 .051 007 0,02 Print Done Present Value of Ordinary Annuity of $1 Periods l 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 12% | 14% | 15% | 16% | 18% | 20% 10.9900.980 0.971 0.962 0.952 0.943 0935 0.926 0.917 0.909 0893 0.877 0.870 0.862 0.847 0.833 2 1970 1942 913 1.886 1859 1833 1808 1.783 759 .736 .690 1.647 1.626 1.605 1.566 1.528 3 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.402 2.322 2.283 2.246 2.174 2.106 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2.914 2.855 2.798 2.690 2.589 5 4.853 4.713 4.580 4452 4.329 4212 4.100 3.993 3.890 3791 3.605 3.433 3.352 3.274 3.127 2.991 6 5.795 5601 5417 5242 5.076 4917 4767 4.623 4.486 4.355 4.11 3889 3.784 3.685 3.498 3.326 7 6.728 6472 6.230 6002 5.786 5.582 5.389 5206 5033 4868 4564 4.288 4.160 4.039 3.812 3.605 8 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5747 5.535 5.335 4.968 4.639 4.487 4.344 4.078 3.837 9 8.566 8.162 7.786 7435 7.108 6802 65156247 5.995 5759 5328 4.946 4.772 4.607 4.303 4.031 10 9471 8.983 8.530 8.11 7.722 7.360 7.024 6710 6418 6145 650 5216 5019 4833 4494 4.192 11 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6495 5.938 5.453 5.234 5.029 4.656 4.327 12 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.8146.194 5.660 54215.197 4.793 4.439 13 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.9047.487 7.103 6.424 5842 5.583 5.342 4.910 4533 14 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.628 6.002 5.724 5.468 5.008 4.611 15 13.865 12 849 11.938 11.118 10.380 9712 9108 8559 8.061 7.606 68116.142 5.847 5575 5.092 4675 16 14.718 13578 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7824 6.974 6265 5.954 5669 5.162 4.730 17 15.562 14.292 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 7.120 6373 6.047 5.749 5.222 4.775 18 16.398 14.992 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.250 6.467 6.128 5818 5.273 4.812 19 17.226 15.678 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 7.366 6.550 6.198 5.877 5.316 4844 20 18.046 16.351 14.877 13.590 12462 11470 0.594 9.818 9.129 8.514 7469 6623 6259 5929 5353 4870 0 Future Value of $1 0246 11.0101.020 1.030 1.040 050 .060 1.070 1080 1.090 1.100 1.120 1.140 1.150 2 1.020 1.040 061 .082 1.103 1.124 1.145 1.166 .188 1210 1.254 1.300 1.323 3 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.2601.295 1.331 1.405 1.482 1.521 4 1.041 1.082 1.126 1.170 1.216 .262 1.311 1360 1.412 1.464 1.574 1.689 1.749 5 1051 1.1041.159 1.217 1.276 1338 1.403 1.469 1.539 611 1.762 1925 2.011 6 1.062 1.126 1.194 1265 1.340 1.419 1501 1.587 1677 1.772 19742.195 2.313 7 1.072 1.149 1.230 1.316 1.407 1.504 1606 1714 1.828 1949 2. 2.502 2.660 8 1.083 1.172 1.267 1.369 1.477 1.594 1.718 85 1993 2.144 2.476 2.853 3.059 9 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.773 3.252 3.518 10 1.105 1.219 1.3441.480 1.629 1.791 1.967 2.159367 2.594 3.106 3.707 4.046 8421 12023 1 1.116 1.243 1.384 1.539 1.710 1.8982.105 2.332 2.580 2.8533.479 4226 4.652 2 1.127 1.268 1.426 1.601 1.796 2.0122.252 2.518 2.813 3.138 3.896 4.818 5.350 13 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 4.363 5.492 6.153 4 1.149 1.319 1.513 1732 1.980 2.261 2.579 2.937 3.342 3.798 4.887 6.261 7.076 15 1.161 1.346 1.558 1.801 2.079 2.3972.759 3.172 3.642 4.1775.474 7.138 8.137 16 1.173 1.373 1.605 1873 2.183 2.540 2952 3.426 3.970 4.595 6.130 8.137 9.358 7 1.184 1.400 1.6531948 2.292 2.693 3.159 3.700 4.328 5.054 6.866 9.276 10.76 18 1.196 1.428 1.702 2.026 2.407 2854 3.380 3.996 4.717 5.560 7.690 10.58 12.38 19 1.208 1.457 1.7542.107 2.527 3.026 3.617 4.3165.142 6.116 8.613 12.06 14.23 20 1.220 1.486 1.8062.191 2.653 3.207 3.870 4.6615.604 6.727 9.646 13.74 16.37 42 4163 %00141 2943 3622 0872 06009 74199 28072 05513 16887 52099 04128 9 7 569 8671 12345 67891 12345 67890 Future Value of Ordinary Annuity of $1 5580 Periods 1% | 2% | 3% | 4% | 5% | 6% | 7% | 8% | 9% | 10% | 12% | 14% | 15% 1 1.00 1.000 1.000 1.00 1.00 1.000 1.000 1.000 1.000 1.000| 1.000 1.000 1.000 2 2.010 2.020 2.030 2.040 2.050 2.060 2070 2080 2.090 2.100 2120 2.140 2150 3 3.030 3.060 3091 3.122 3.153 3.84 3215 3246 3.278 3.310 3.374 3.440 3473 4 4.060 4.122 4.184 4246 4.310 4.375 4440 4.506 4573 4.641 4.779 421 4993 5 5.101 5,204 5.309 54166 5,751 5867 5.985 6.105 633 6610 6742 66.152 6308 6.468 6.633 6802 6975 7.153 7.336 7.523 7.716 8.115 8.536 8.754 7 7214 7434 7.662 7.898 8.142 8394 8654 8923 9200 9.487 10.09 10.73 11.07 8 8286 8.583 8892 9.214 9.549 98970260 064 103 1144 12.30 1323 1373 9 9.369 9.755 10.16 058103 149 118 249 1302 1358 1478 16.09 16.79 10 10.46 10.95 11.46 1201 258 13.18 1382 1449 15.19 15.94 17.55 1934 20.30 8297 11 1157 12.17 12.81 1349 14.21 14.97 1578 665 756 18.53 20.65 23.04 24.35 12 12.68 1341 14.19 503 15.92 687 789 898 20.14 21.38 24.13 27.27 29.00 13 13.81 14.68 15.62 16.63 17.71 18.88 20.14 21.50 22.9524.52 28.03 32.09 34.35 14 14.95 15.97 7.09 18.29 19.60 21.02 22.55 24.21 26.02 27.98 3239 375840.50 103 15 6.10 1729 1860 20.02 21.58 2328 25.13 27.15 29 36 31.77 3728 43.84 47.58 16 1726 1864 20.16 21.82 2366 2567 27.89 30.32 33.00 35.95 4275 50.98 55.72 17 1843 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 4054 48.88 59.1265.08 18 19.61 2141 23.41 25.65 28.13 30.91 34.003745 41.30 45.60 5575 68.39 75.84 19 2081 22.84 25.12 276730.54 33.76 3738 4145 4602 51.16 63.44 78.97 88.21 20 22.02 24.30 2687 2978 3307 36.79 100 45.76 51.16 5728 72.05 91.02 1024 04827 28532 Print Done ^^ 16 12345 79111 1 9521 37447 344 82 89453 79 1 2 013 5722 00266 38481 9 82266 19290 66127 2345 66811 21178 22222 1000 01 12230 12346 7890 12345 67891 12345 67890 Amount invested Average amount invested Expected annual net cash inflovw Present value of net cash inflows counting rate of return (ARR). (Round the Calculate the net present value (NPV). (Enter any factor amounts to three decimal places, - Payback years Amount invested Average amount invested Expected annual net cash inflow to the nearest tenth percent, Xi ccoU ARR Present value of net cash inflows ny factor amounts to three decimal places, X.xxx.) Net Cash Annuity PV Factor Present (i=12%, n=8) Inflow Value Amount invested Average amount investe Average annual operating income Present value of net cash inflows factor amounts to Net Cash Ann (i Inflow years ounting rate of return (ARR). (Round the percentage to the nearest tenth percent, X.X ARR Amount invested y fac Average amount invested Net Average annual operating income Int Present value of net cash inflows he input fields and then continue to the next question. Calculate the net present value (NPV). (Enter any factor amounts to three decimal places, X.XXX Net Cash Annuity PV Factor Present (i=12%, n28) Inflow Value Years 1-8 Present value of annuity L 0 Investment Net present value of the investment The IRR (internal rate of return) is between Finally, determine the formula and calculate the profitability index. (Round your answer to two decimal places, XXX) - Profitability index Requirement 2. Recommend whether the company should invest in this project ternal rate of return) is between dex. (Round your answ ermine the formula and calculate 12-14% 14-16% 16-18% 18-20% ent 2. Recommend whether the vest in this project. m any list or enter any number in the input fields and then continue Finally, determine the formula and calculate the profitability index. (round your answer topo decima paces, .) Profitability index Average amount invested Average annual operating income any should invest in this project C Initial investment e input fields and then continue to the next question. Present value of net cash inflows ability index. (Round your answer to two decimal places, X. Profitabi Average amount invested Average annual operating income Initial investment Present value of net cash inflows estion. Requirement 2. Rlecommend whether the oompany should innvest in this project one, a nd the Ann and the proftability index is the operating lite, the NPV is invest in the project because the payback period is Recommendation Splash City the company etun should felds and then continue to the next queion Choose from any list or enter shoud not any should invest in this project. st in the project because the payback period is of return. | the operating life, the NPV is V, the profitability index is greater than the input fields and then continue to the next less than the operating life, the NPV is one, and the ARR and Vthe profitability index is d is negative next question. positive one, and the ARR and IRR ability index is greater than less than inv Recommendation: Splash City the company's required rate are hoc o greater thannter any number in less tharn