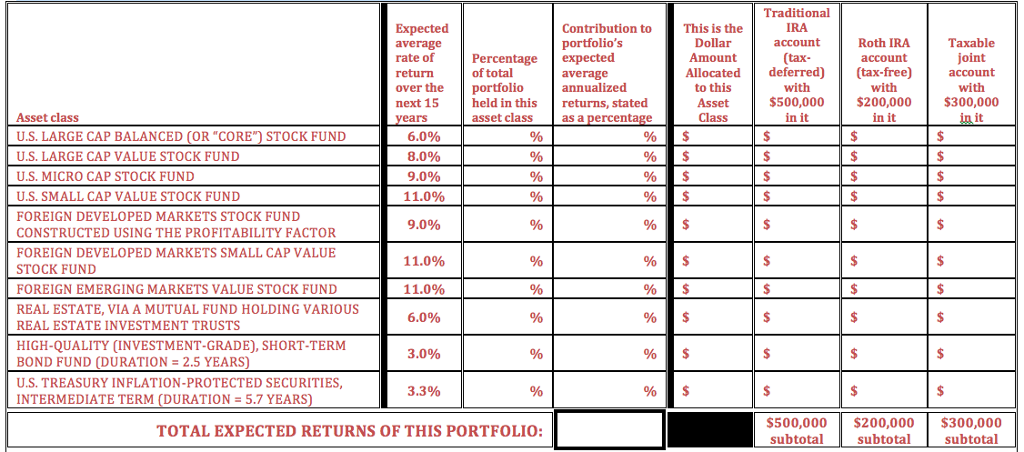

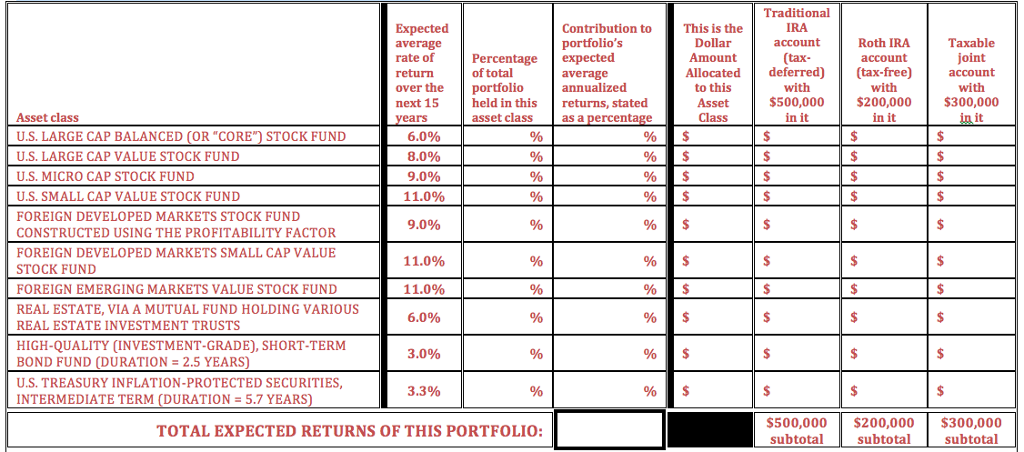

Matt and Joerge, ages 67 and 64, who are both now retired and who require $35,000 a year from their investment portfolio (the first year, with increases thereafter for inflation), have the following $1,000,000 investment portfolio. They own a $300,000 home. They have a separate $50,000 cash reserve account. They possess no debt. Their other source of income is social security. Please complete all of the blank squares. Suggest an age-appropriate portfolio for them. Then allocate their investment assets among the different types of investment accounts. Then, explain your portfolio construction

Traditional Contribution to This is the IRA. Expected portfolio's Dollar account Roth IRA Taxable average Percentage expected rate of Amount (tax oint account Allocated deferred) (tax-free) of total account return average over the portfolio annualized next 15 held in this returns, stated to this with with $500,000 $200,000 $300,000 Asset Asset class asset class Class n it as a percentage n it ears 6.0% IS IS IS IS U.S. LARGE CAP BALANCED (OR "CORE") STOCK FUND 13.0% U.S. LARGE CAP VALUE STOCK FUND U.S. MICRO CAP STOCK FUND 9.0% S IS IS II S 11.0% l U.S. SMALL CAP VALUE STOCK FUND FOREIGN DEVELOPED MARKETS STOCK FUND CONSTRUCTED USING THE PROFITABILITY FACTOR 11.0 %S S S FOREIGN DEVELOPED MARKETS SMALL CAP VALUE STOCK FUND 11.0% IES S FOREIGN EMERGING MARKETS VALUE STOCK FUND REAL ESTATE, VIA A MUTUAL FUND HOLDING VARIOUS REAL ESTATE INVESTMENT TRUSTS S HIGH-QUALITY (INVESTMENT-GRADE), SHORT-TERM 3.0% BOND FUND (DURATION 2.5 YEARS) U.S. TREASURY INFLATION-PROTECTED SECURITIES 3.3% INTERMEDIATE TERM (DURATION 5.7 YEARSO $500,000 $200,000 $300,000 TOTAL EXPECTED RETURNS OF THIS PORTFOLIO: subtotal subtotal subtotal Traditional Contribution to This is the IRA. Expected portfolio's Dollar account Roth IRA Taxable average Percentage expected rate of Amount (tax oint account Allocated deferred) (tax-free) of total account return average over the portfolio annualized next 15 held in this returns, stated to this with with $500,000 $200,000 $300,000 Asset Asset class asset class Class n it as a percentage n it ears 6.0% IS IS IS IS U.S. LARGE CAP BALANCED (OR "CORE") STOCK FUND 13.0% U.S. LARGE CAP VALUE STOCK FUND U.S. MICRO CAP STOCK FUND 9.0% S IS IS II S 11.0% l U.S. SMALL CAP VALUE STOCK FUND FOREIGN DEVELOPED MARKETS STOCK FUND CONSTRUCTED USING THE PROFITABILITY FACTOR 11.0 %S S S FOREIGN DEVELOPED MARKETS SMALL CAP VALUE STOCK FUND 11.0% IES S FOREIGN EMERGING MARKETS VALUE STOCK FUND REAL ESTATE, VIA A MUTUAL FUND HOLDING VARIOUS REAL ESTATE INVESTMENT TRUSTS S HIGH-QUALITY (INVESTMENT-GRADE), SHORT-TERM 3.0% BOND FUND (DURATION 2.5 YEARS) U.S. TREASURY INFLATION-PROTECTED SECURITIES 3.3% INTERMEDIATE TERM (DURATION 5.7 YEARSO $500,000 $200,000 $300,000 TOTAL EXPECTED RETURNS OF THIS PORTFOLIO: subtotal subtotal subtotal