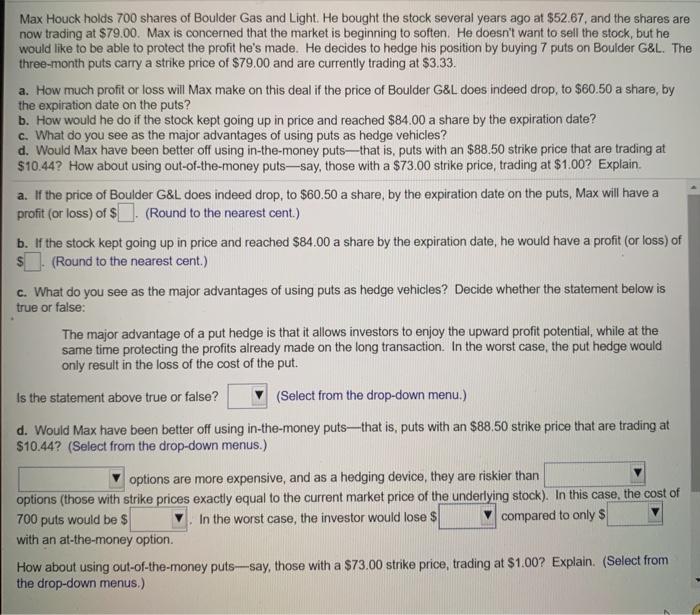

Max Houck holds 700 shares of Boulder Gas and Light. He bought the stock several years ago at $52.67, and the shares are now trading at $79.00. Max is concerned that the market is beginning to soften. He doesn't want to sell the stock, but he would like to be able to protect the profit he's made. He decides to hedge his position by buying 7 puts on Boulder G&L. The three-month puts carry a strike price of $79.00 and are currently trading at $3.33. a. How much profit or loss will Max make on this deal if the price of Boulder G&L does indeed drop, to $60.50 a share, by the expiration date on the puts? b. How would he do if the stock kept going up in price and reached $84.00 a share by the expiration date? c. What do you see as the major advantages of using puts as hedge vehicles? d. Would Max have been better off using in-the-money putsthat is, puts with an $88.50 strike price that are trading at $10.44? How about using out-of-the-money puts-say, those with a $73.00 strike price, trading at $1.00? Explain. a. If the price of Boulder G&L does indeed drop, to $60.50 a share, by the expiration date on the puts, Max will have a profit (or loss) of $ . (Round to the nearest cent.) b. If the stock kept going up in price and reached $84.00 a share by the expiration date, he would have a profit (or loss) of (Round to the nearest cent.) c. What do you see as the major advantages of using puts as hedge vehicles? Decide whether the statement below is true or false; The major advantage of a put hedge is that it allows investors to enjoy the upward profit potential, while at the same time protecting the profits already made on the long transaction. In the worst case, the put hedge would only result in the loss of the cost of the put. Is the statement above true or false? (Select from the drop-down menu.) d. Would Max have been better off using in-the-money putsthat is, puts with an $88.50 strike price that are trading at $10.44? (Select from the drop-down menus.) options are more expensive, and as a hedging device, they are riskier than options (those with strike prices exactly equal to the current market price of the underlying stock). In this case, the cost of 700 puts would be $ In the worst case, the investor would lose $ compared to only s with an at-the-money option. How about using out-of-the-money puts-say, those with a $73.00 strike price, trading at $1.00? Explain. (Select from the drop-down menus.)