MAXWELL LTD Maxwell ltd produces and sells a single product. The results for year one are given as follows: The selling price is K50

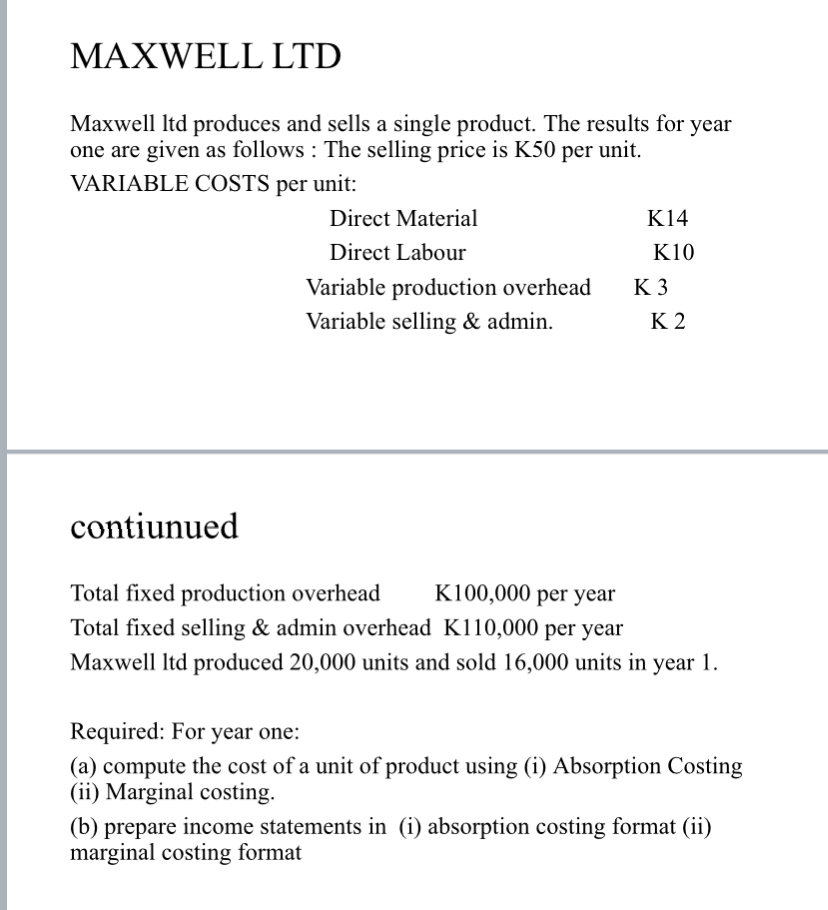

MAXWELL LTD Maxwell ltd produces and sells a single product. The results for year one are given as follows: The selling price is K50 per unit. VARIABLE COSTS per unit: Direct Material Direct Labour K14 K10 Variable production overhead K 3 Variable selling & admin. K2 contiunued Total fixed production overhead K100,000 per year Total fixed selling & admin overhead K110,000 per year Maxwell ltd produced 20,000 units and sold 16,000 units in year 1. Required: For year one: (a) compute the cost of a unit of product using (i) Absorption Costing (ii) Marginal costing. (b) prepare income statements in (i) absorption costing format (ii) marginal costing format

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started