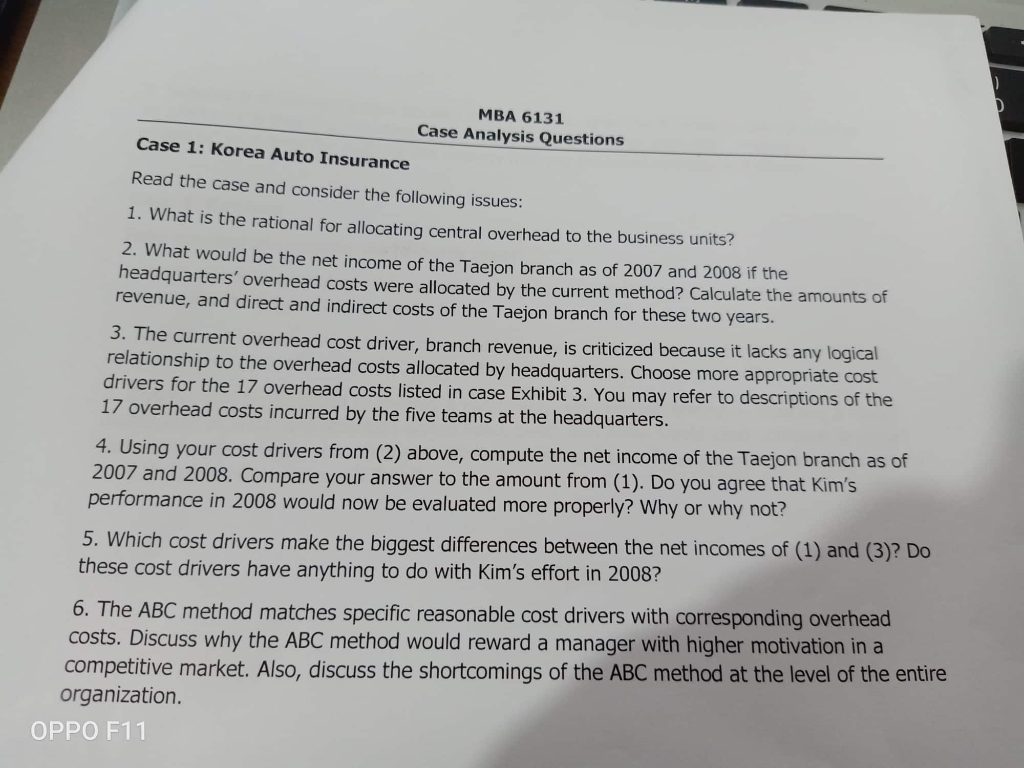

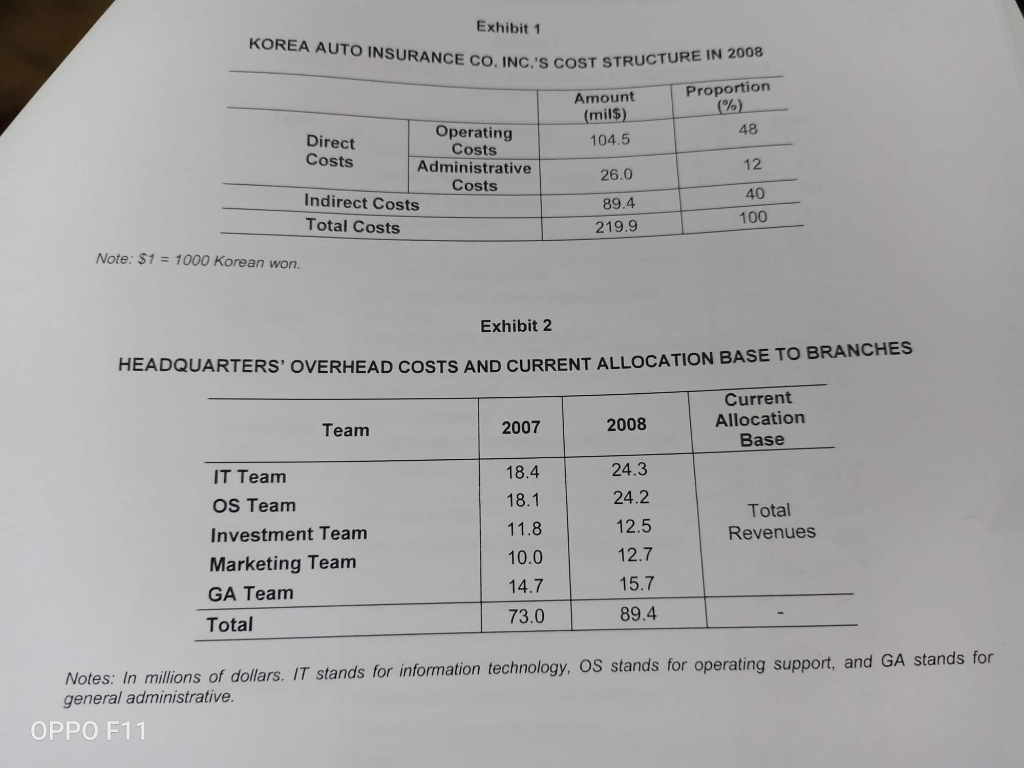

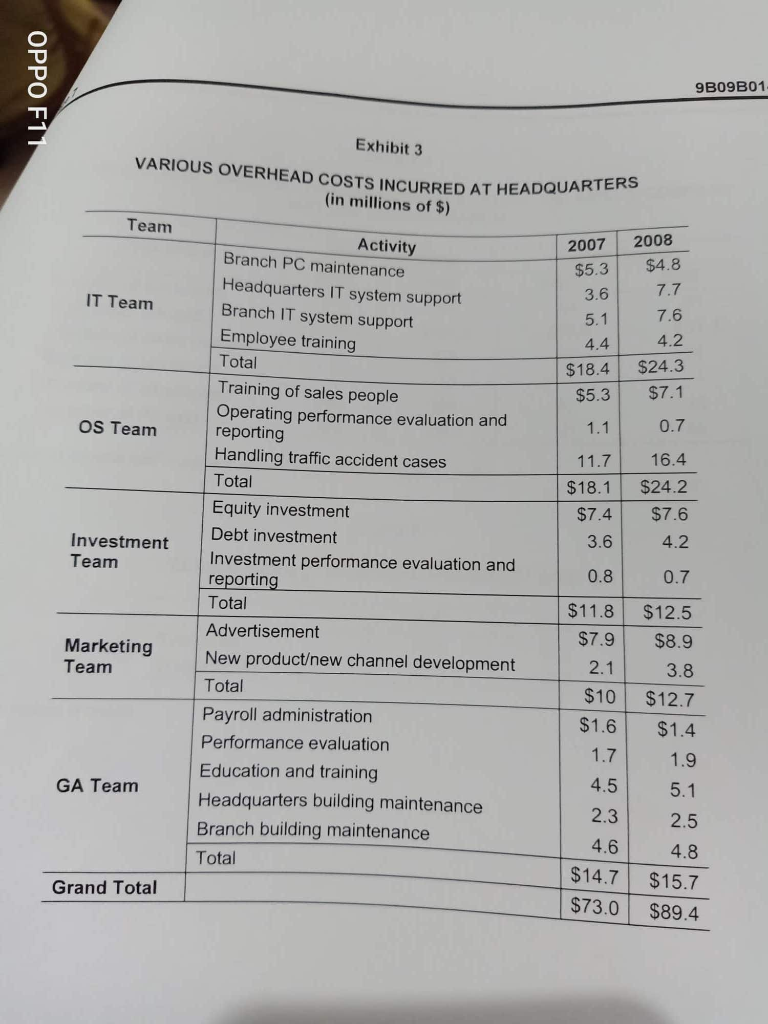

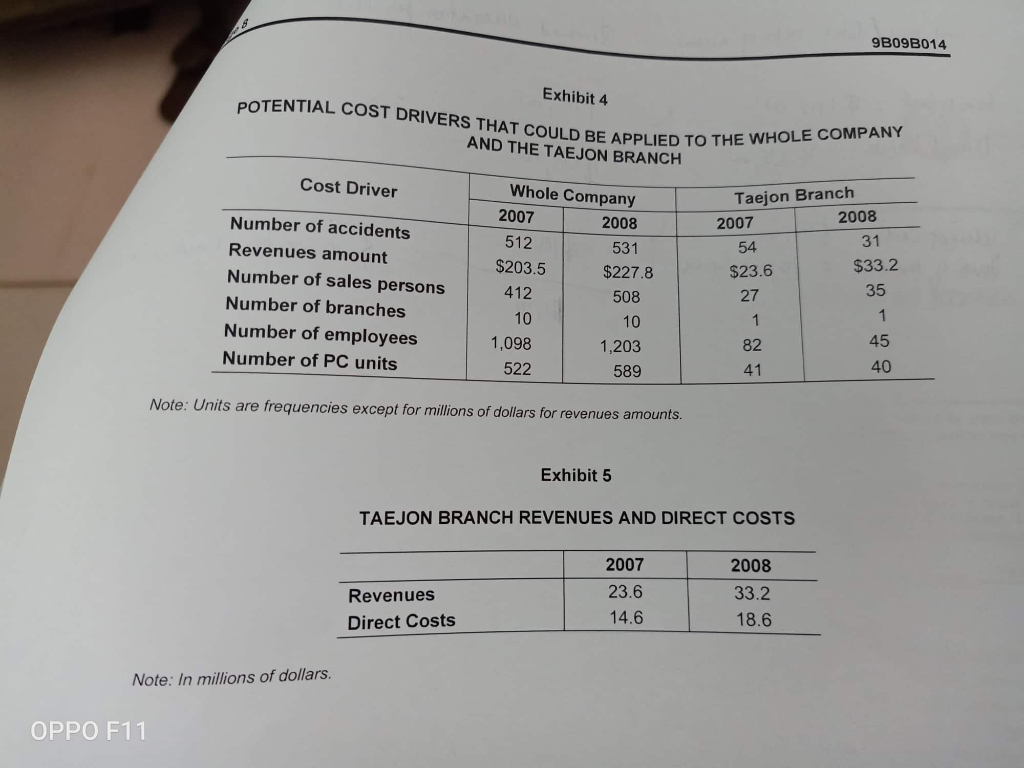

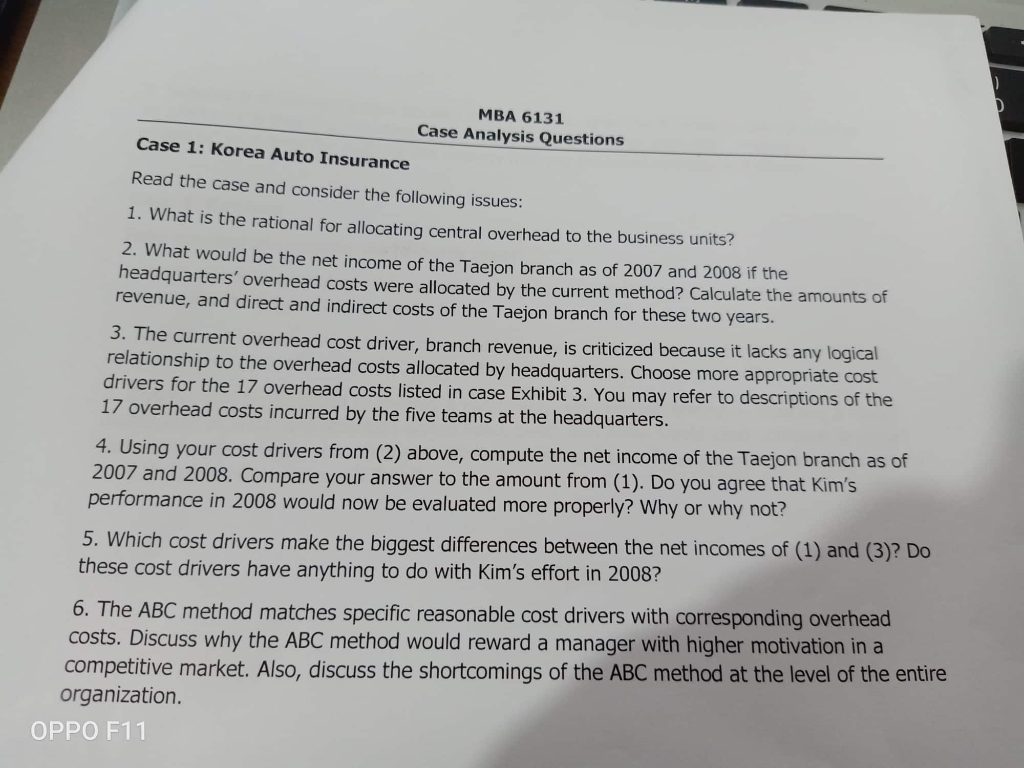

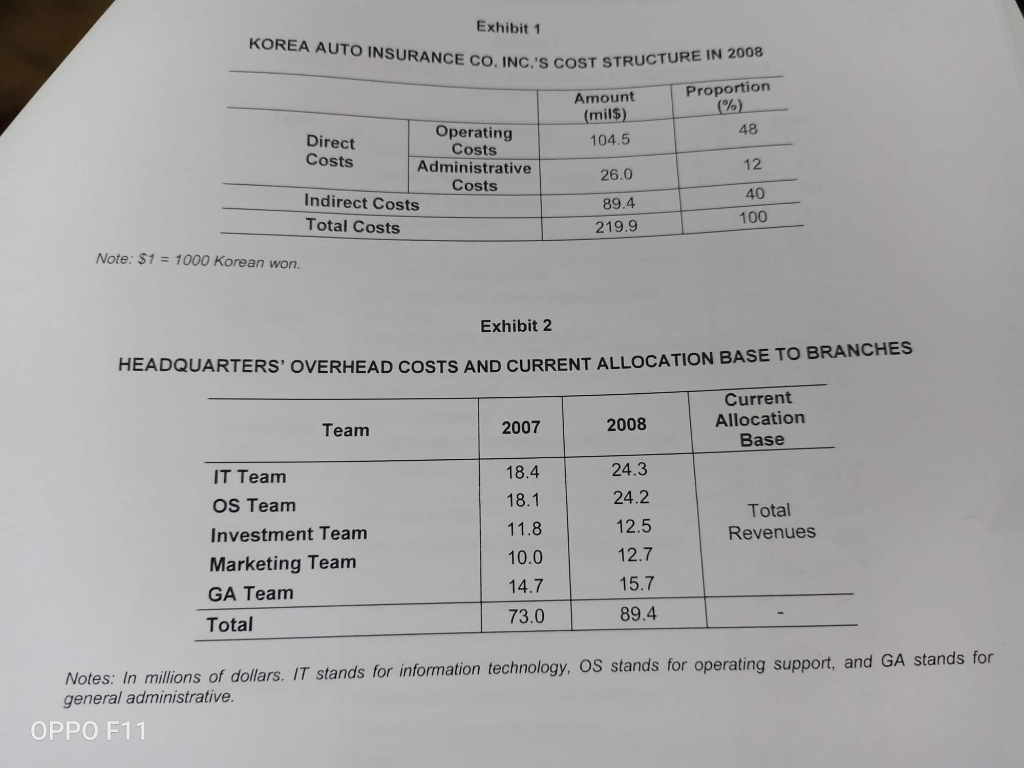

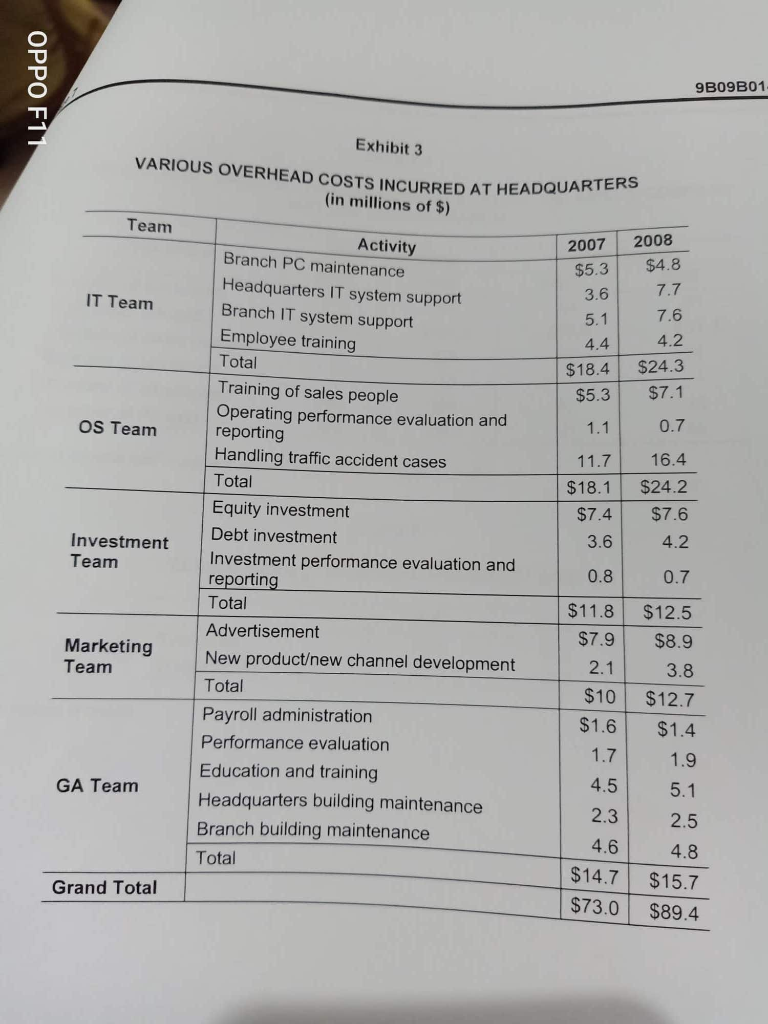

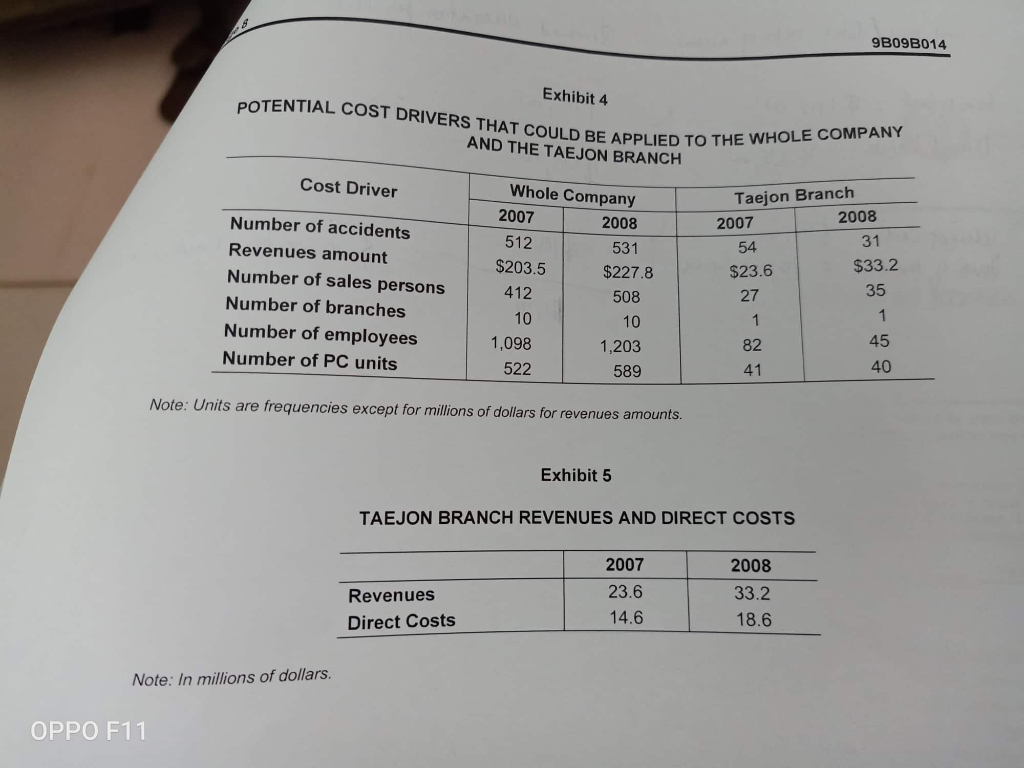

MBA 6131 Case Analysis Questions Case 1: Korea Auto Insurance Read the case and consider the following issues: 1. What is the rational for allocating central overhead to the business units? 2. What would be the net income of the Taejon branch as of 2007 and 2008 if the headquarters' overhead costs were allocated by the current method? Calculate the amounts of revenue, and direct and indirect costs of the Taejon branch for these two years. 3. The current overhead cost driver, branch revenue, is criticized because it lacks any logical relationship to the overhead costs allocated by headquarters. Choose more appropriate cost drivers for the 17 overhead costs listed in case Exhibit 3. You may refer to descriptions of the 17 overhead costs incurred by the five teams at the headquarters. 4. Using your cost drivers from (2) above, compute the net income of the Taejon branch as of 2007 and 2008. Compare your answer to the amount from (1). Do you agree that Kim's performance in 2008 would now be evaluated more properly? Why or why not? 5. Which cost drivers make the biggest differences between the net incomes of (1) and (3)? Do these cost drivers have anything to do with Kim's effort in 2008? 6. The ABC method matches specific reasonable cost drivers with corresponding overhead costs. Discuss why the ABC method would reward a manager with higher motivation in a competitive market. Also, discuss the shortcomings of the ABC method at the level of the entire organization. OPPO F11 Exhibit 1 KOREA AUTO INSURANCE CO. INC.'S COST ST INC'S COST STRUCTURE IN 2008 Amount (mil$) 104.5 Proportion (%) 48 Operating Direct Costs Costs Administrative Costs Indirect Costs Total Costs 26.0 12 40 89.4 219.9 100 Note: $1 = 1000 Korean won. Exhibit 2 HEADQUARTERS' OVERHEAD COSTS AND CURRENT ALLOCATION BAS COSTS AND CURRENT ALLOCATION BASE TO BRANCHES Team 2007 2008 Current Allocation Base 18.4 18.1 IT Team OS Team Investment Team Marketing Team GA Team Total 24.3 24.2 12.5 12.7 Total Revenues 11.8 10.0 14.7 73.0 15.7 89.4 Notes: In millions of dollars. IT stands for information technology, OS stands for operating support, and GA stands for general administrative. OPPO F11 OPPO F11 9B09B01 Exhibit 3 VARIOUS OVERHEAD COSTS INCURRED AT HEAD (in millions of $) URRED AT HEADQUARTERS Team IT Team 2007 $5.3 3.6 5.1 4.4 $18.4 $5.3 1.1 11.7 $18.1 $7.4 2008 $4.8 7.7 7.6 4.2 $24.3 $7.1 0.7 OS Team Activity Branch PC maintenance Headquarters IT system support Branch IT system support Employee training Total Training of sales people Operating performance evaluation and reporting Handling traffic accident cases Total Equity investment Debt investment Investment performance evaluation and reporting Total Advertisement New productew channel development Total Payroll administration Performance evaluation Education and training Headquarters building maintenance Branch building maintenance Total Investment Team 3.6 16.4 $24.2 $7.6 4.2 0.7 $12.5 $8.9 0.8 $11.8 $7.9 Marketing Team 2.1 - L 3.8 $10 $1.6 $12.7 $1.4 1.9 1.7 4.5 GA Team 5.1 2.3 2.5 4.6 4.8 Grand Total $14.7 $73.0 $15.7 $89.4 9B09B014 Exhibit 4 POTENTIAL COST DRIVERS THAT COULD BE APPLIED TO TH AND THE TAEJON BRANCH APPLIED TO THE WHOLE COMPANY Cost Driver Taejon Branch 2007 2008 2008 Whole Company 2007 512 531 $203.5 412 31 Number of accidents Revenues amount Number of sales persons Number of branches Number of employees Number of PC units 54 $23.6 27 $33.2 35 $227.8 508 10 1,203 10 1,098 522 589 - 41 Note: Units are frequencies except for millions of dollars for revenues amounts. Exhibit 5 TAEJON BRANCH REVENUES AND DIRECT COSTS Revenues Direct Costs 2007 23.6 14.6 2008 33.2 18.6 Note: In millions of dollars. OPPO F11 MBA 6131 Case Analysis Questions Case 1: Korea Auto Insurance Read the case and consider the following issues: 1. What is the rational for allocating central overhead to the business units? 2. What would be the net income of the Taejon branch as of 2007 and 2008 if the headquarters' overhead costs were allocated by the current method? Calculate the amounts of revenue, and direct and indirect costs of the Taejon branch for these two years. 3. The current overhead cost driver, branch revenue, is criticized because it lacks any logical relationship to the overhead costs allocated by headquarters. Choose more appropriate cost drivers for the 17 overhead costs listed in case Exhibit 3. You may refer to descriptions of the 17 overhead costs incurred by the five teams at the headquarters. 4. Using your cost drivers from (2) above, compute the net income of the Taejon branch as of 2007 and 2008. Compare your answer to the amount from (1). Do you agree that Kim's performance in 2008 would now be evaluated more properly? Why or why not? 5. Which cost drivers make the biggest differences between the net incomes of (1) and (3)? Do these cost drivers have anything to do with Kim's effort in 2008? 6. The ABC method matches specific reasonable cost drivers with corresponding overhead costs. Discuss why the ABC method would reward a manager with higher motivation in a competitive market. Also, discuss the shortcomings of the ABC method at the level of the entire organization. OPPO F11 Exhibit 1 KOREA AUTO INSURANCE CO. INC.'S COST ST INC'S COST STRUCTURE IN 2008 Amount (mil$) 104.5 Proportion (%) 48 Operating Direct Costs Costs Administrative Costs Indirect Costs Total Costs 26.0 12 40 89.4 219.9 100 Note: $1 = 1000 Korean won. Exhibit 2 HEADQUARTERS' OVERHEAD COSTS AND CURRENT ALLOCATION BAS COSTS AND CURRENT ALLOCATION BASE TO BRANCHES Team 2007 2008 Current Allocation Base 18.4 18.1 IT Team OS Team Investment Team Marketing Team GA Team Total 24.3 24.2 12.5 12.7 Total Revenues 11.8 10.0 14.7 73.0 15.7 89.4 Notes: In millions of dollars. IT stands for information technology, OS stands for operating support, and GA stands for general administrative. OPPO F11 OPPO F11 9B09B01 Exhibit 3 VARIOUS OVERHEAD COSTS INCURRED AT HEAD (in millions of $) URRED AT HEADQUARTERS Team IT Team 2007 $5.3 3.6 5.1 4.4 $18.4 $5.3 1.1 11.7 $18.1 $7.4 2008 $4.8 7.7 7.6 4.2 $24.3 $7.1 0.7 OS Team Activity Branch PC maintenance Headquarters IT system support Branch IT system support Employee training Total Training of sales people Operating performance evaluation and reporting Handling traffic accident cases Total Equity investment Debt investment Investment performance evaluation and reporting Total Advertisement New productew channel development Total Payroll administration Performance evaluation Education and training Headquarters building maintenance Branch building maintenance Total Investment Team 3.6 16.4 $24.2 $7.6 4.2 0.7 $12.5 $8.9 0.8 $11.8 $7.9 Marketing Team 2.1 - L 3.8 $10 $1.6 $12.7 $1.4 1.9 1.7 4.5 GA Team 5.1 2.3 2.5 4.6 4.8 Grand Total $14.7 $73.0 $15.7 $89.4 9B09B014 Exhibit 4 POTENTIAL COST DRIVERS THAT COULD BE APPLIED TO TH AND THE TAEJON BRANCH APPLIED TO THE WHOLE COMPANY Cost Driver Taejon Branch 2007 2008 2008 Whole Company 2007 512 531 $203.5 412 31 Number of accidents Revenues amount Number of sales persons Number of branches Number of employees Number of PC units 54 $23.6 27 $33.2 35 $227.8 508 10 1,203 10 1,098 522 589 - 41 Note: Units are frequencies except for millions of dollars for revenues amounts. Exhibit 5 TAEJON BRANCH REVENUES AND DIRECT COSTS Revenues Direct Costs 2007 23.6 14.6 2008 33.2 18.6 Note: In millions of dollars. OPPO F11