Question

Meir, Benson, and Lau are partners and share income and loss in a 3:2:5 ratio (in percents: Meir, 30%; Benson, 20%; and Lau, 50%). The

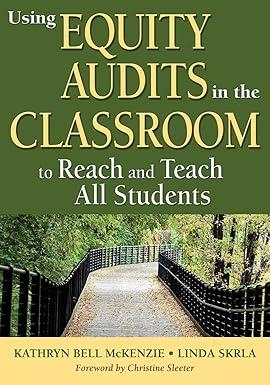

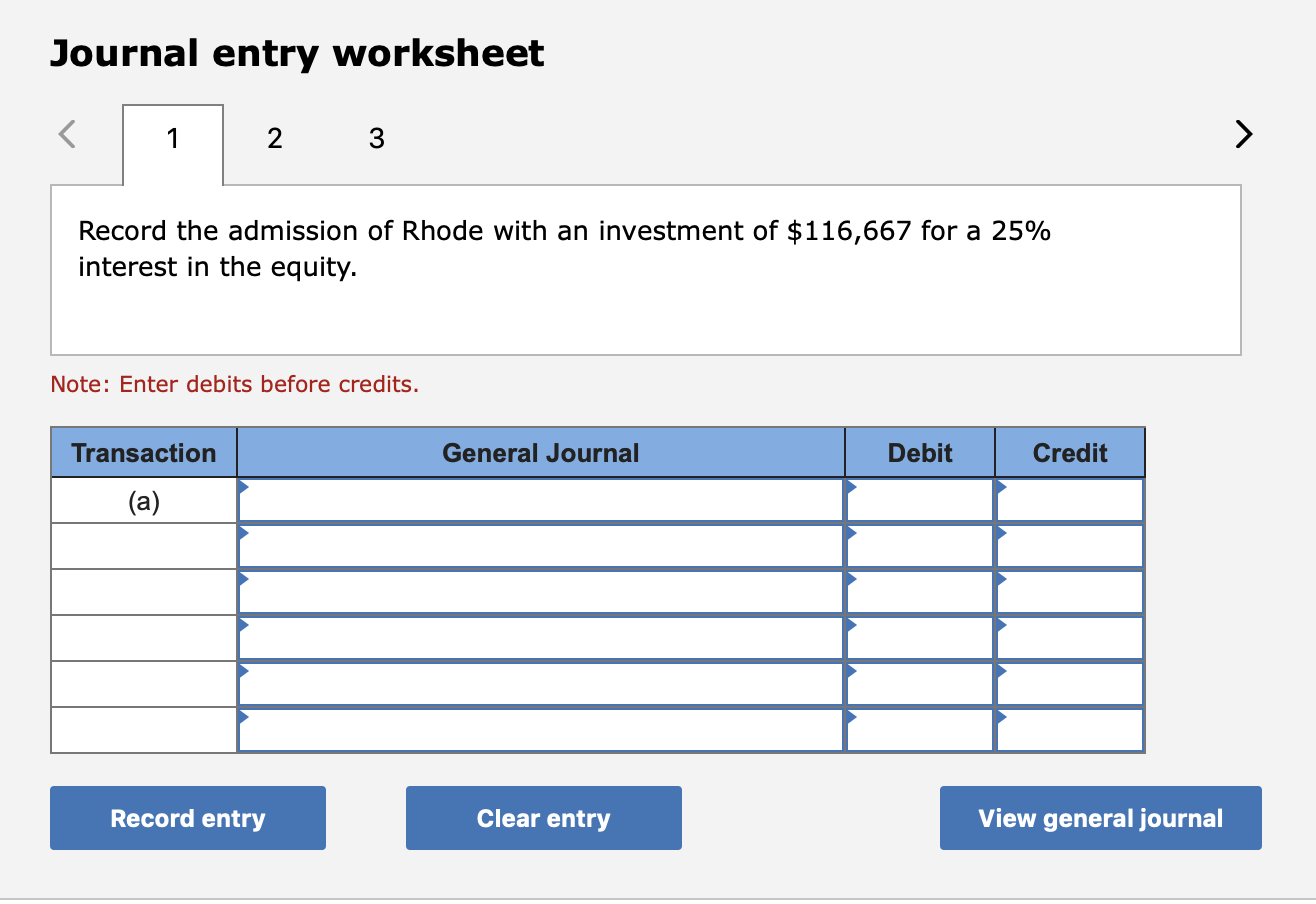

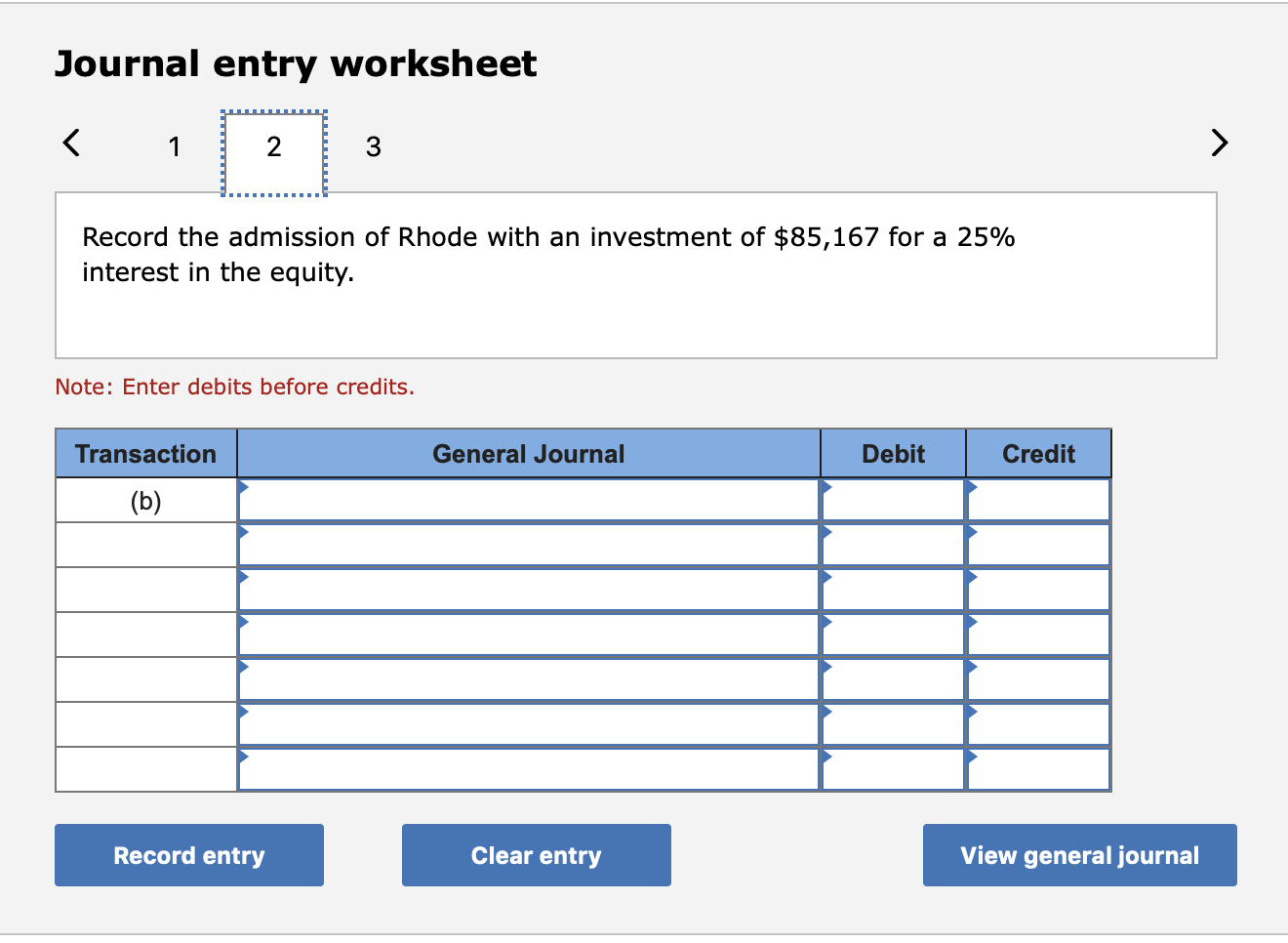

Meir, Benson, and Lau are partners and share income and loss in a 3:2:5 ratio (in percents: Meir, 30%; Benson, 20%; and Lau, 50%). The partnership's capital balances are as follows: Meir, $103,000; Benson, $69,000; and Lau, $178,000. Benson decides to withdraw from the partnership. 2. Assume that Benson does not retire from the partnership described in Part 1. Instead, Rhode is admitted to the partnership on February 1 with a 25% equity. Prepare journal entries to record Rhodes entry into the partnership under each separate assumption: Rhode invests (a) $116,667; (b) $85,167; and (c) $152,834. (Do not round your intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started