Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Message is stating Answer is not complete Message is stating Answer is not complete. Prepare journal entries for each transaction and identify the financial statement

Message is stating "Answer is not complete"

Message is stating "Answer is not complete."

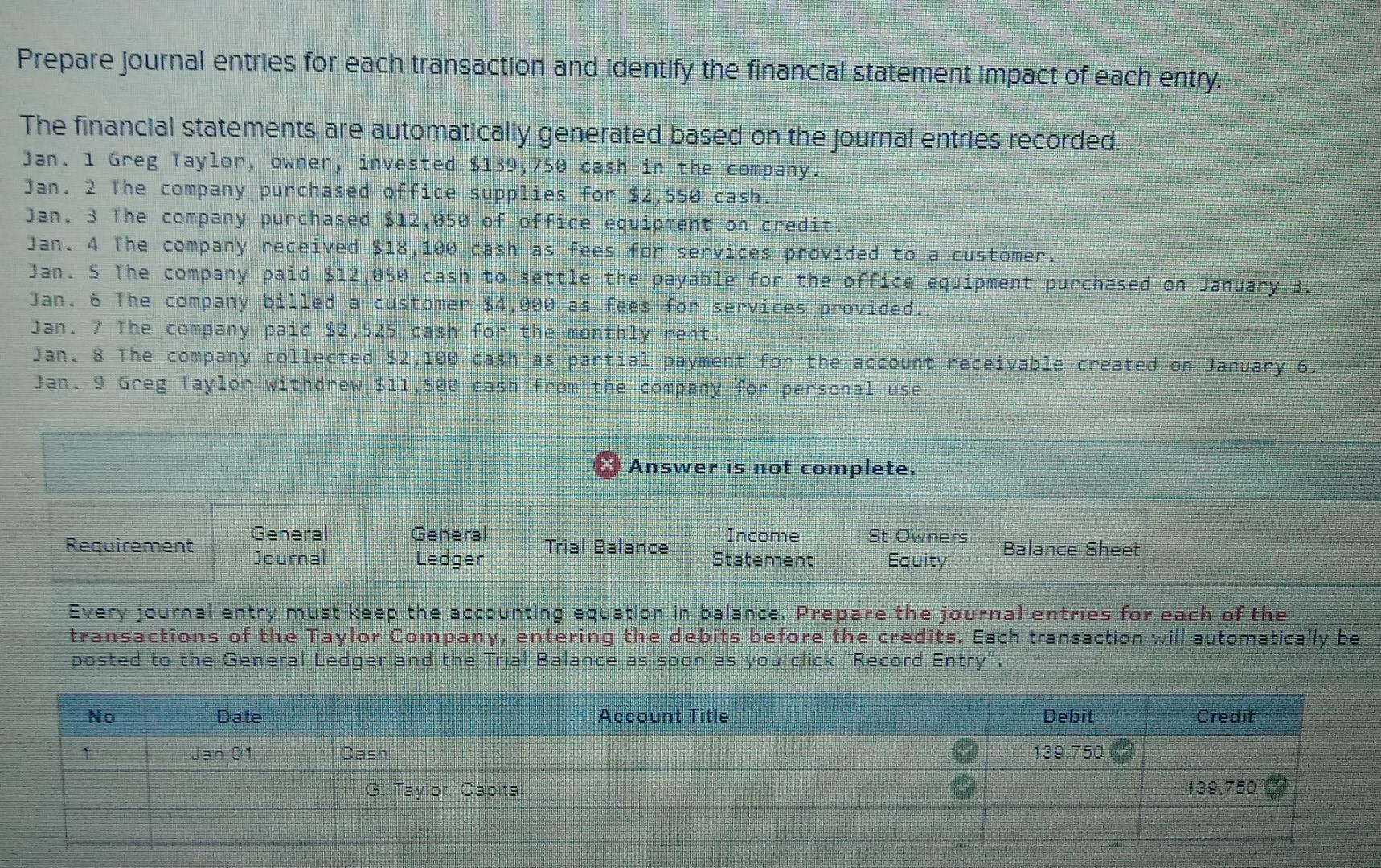

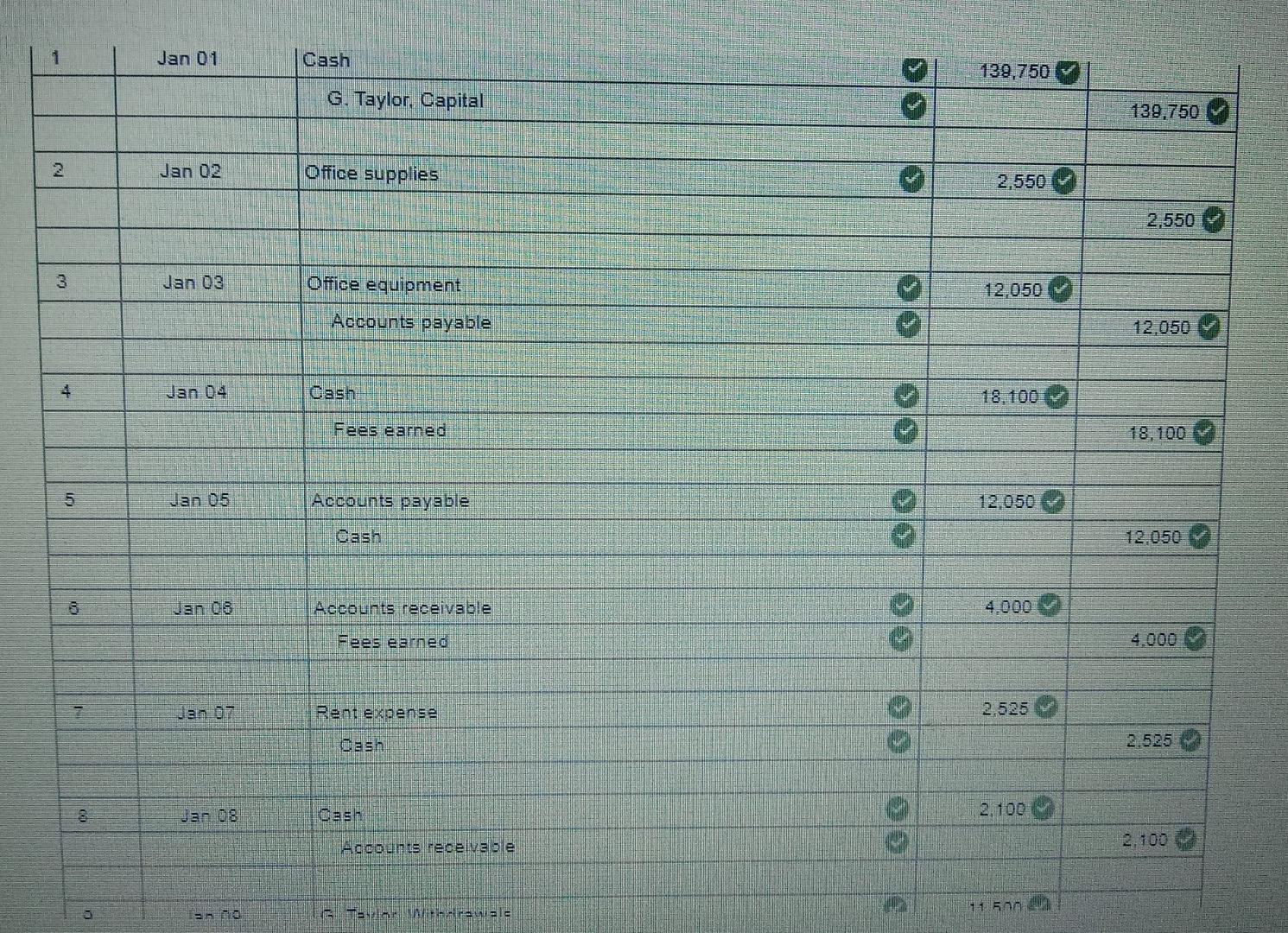

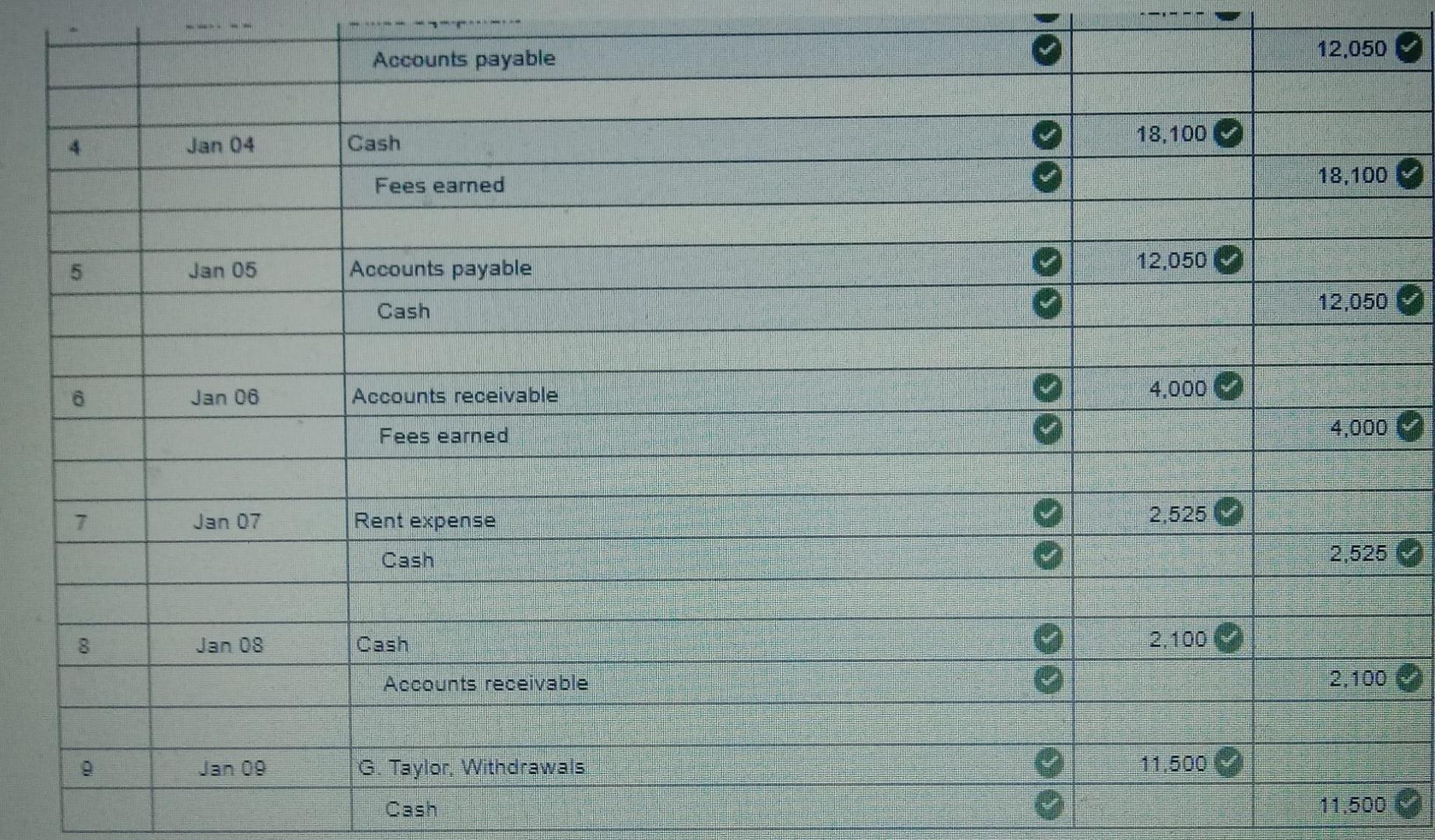

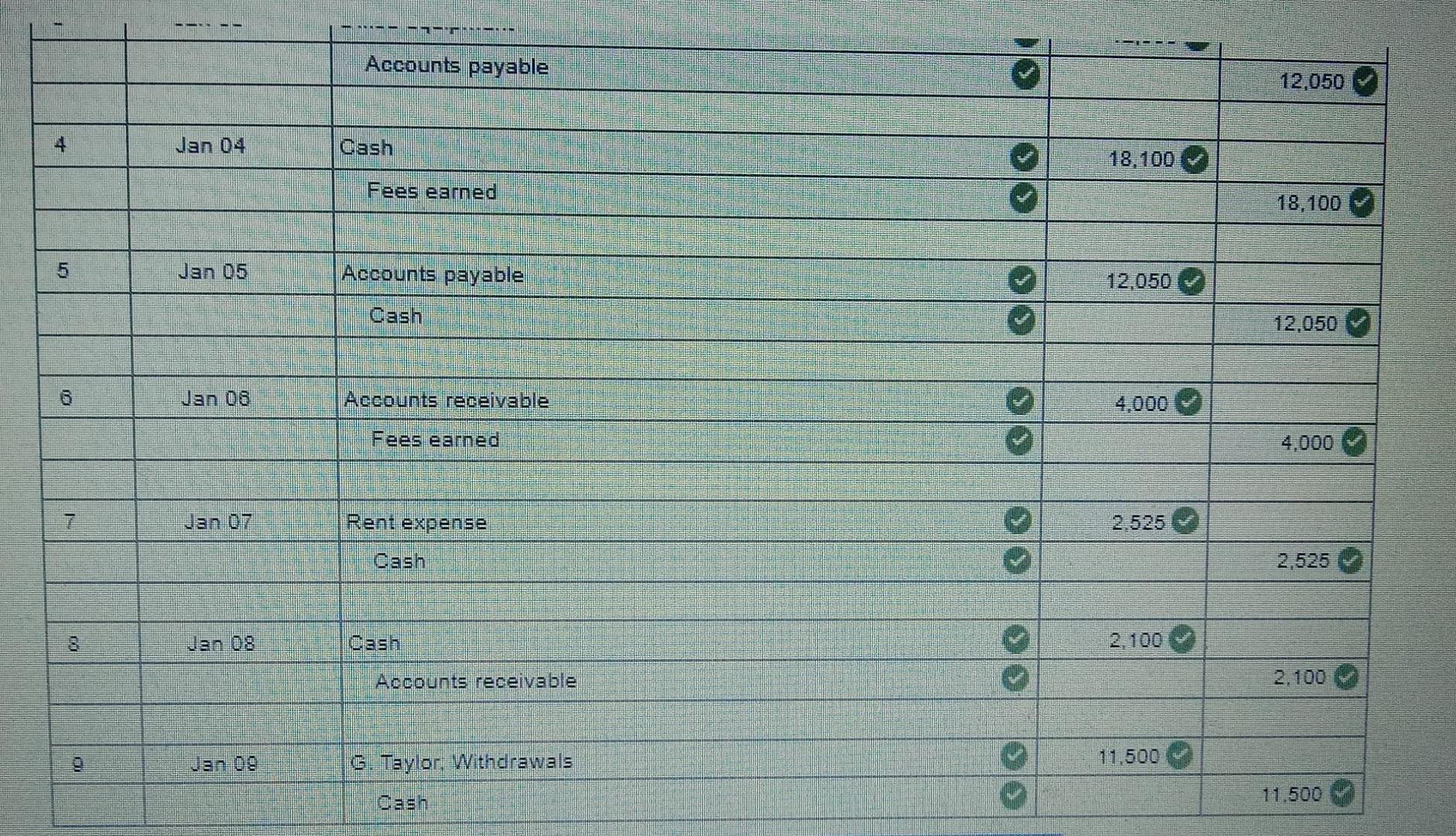

Prepare journal entries for each transaction and identify the financial statement Impact of each entry. The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Greg Taylor, owner, invested $139,250 cash in the company. Jan. 2 The company purchased office supplies for $2,550 cash. Jan. 3 The company purchased $12,858 of office equipment on credit. Jan. 4 The company received $18,100 cash as fees for services provided to a customer. Jan. 5 The company paid $12,850 cash to settle the payable for the office equipment purchased on January 3. Jan. 6 The company billed a customer $4,000 as fees for services provided. Jan. 7 The company paid $2,525 cash for the monthly rent. Jan. 8 The company collected $2.190 cash as partial payment for the account receivable created on January 5. Jan. 9 Greg Taylor withdrew $11,5ee cash from the company for personal use. * Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Every journal entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions of the Taylor Company, entering the debits before the credits. Each transaction will automatically be posted to the General Ledger and the Triat Balance as soon as you click "Record Entry". Date Account Title Debit Credit van 01 Cash 139.750 G. Taylor Capita 139.750 Jan 01 Cash 1139,750 G. Taylor, Capital 139,750 Jan 02 Office supplies 2,550 2,550 3 Jan 03 Office equipment 12,050 Accounts payable 12.050 4 Jan 04 Cash 18.100 Fees earned 18.100 5 Jan 05 Accounts payable 12.050 Cash 12.050 8 Jan 08 Accounts receivable 4.000 Fees earned Jan 07 Rent ecoense 2,525 Cash 2.525 Jan 08 Oasin 2.100 2.100 AQOounts receivable Garau ale 150 g 12.050 Accounts payable 18,100 Jan 04 Cash 18,100 Fees earned 5 12,050 Jan 05 Accounts payable 12,050 Cash 6 Jan 06 4.000 Accounts receivable Fees earned 4,000 Jan 07 Rent expense 2.525 Cash 8 Jan 08 Cash Accounts receivable 2,100 KD Jan 09 G. Taylor. Withdrawals 11.500 Cash 11.500 Accounts payable 12,050 4 Jan 04 bash 18.100 Fees earned 18,100 5 Jan 05 Accounts payable 12,050 Cash 12,050 6 Jan 0.8 Accounts receivable Fees earned 4,000 Jan 0.7 Rent expense 2.525 Cash 2,525 Jan 08 Oash 2.100 Accounts receivable 2.100 9 Jan 09 G. Taylor, Withdrawals 11.500 11.500 CashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started