Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MHZ. Inc. is a high-tech company that produces miniature computer processor chips. The company is one of the most successful companies in its industry because

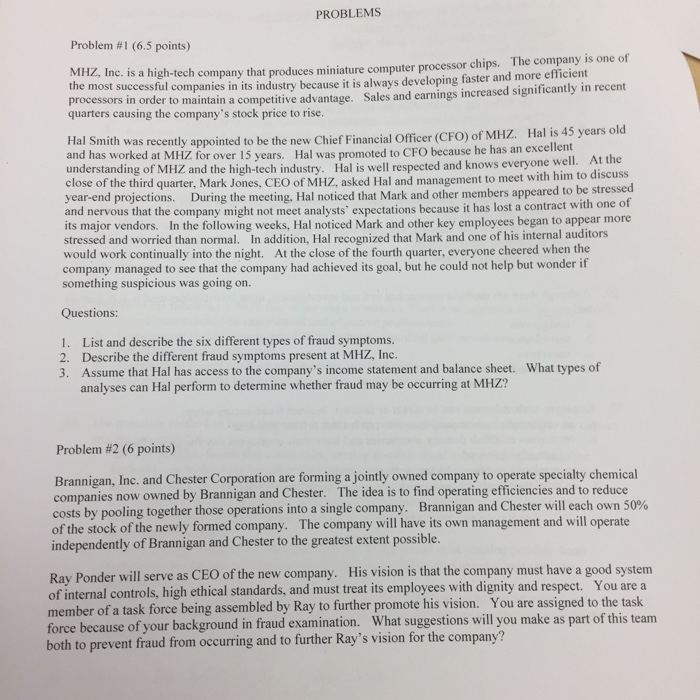

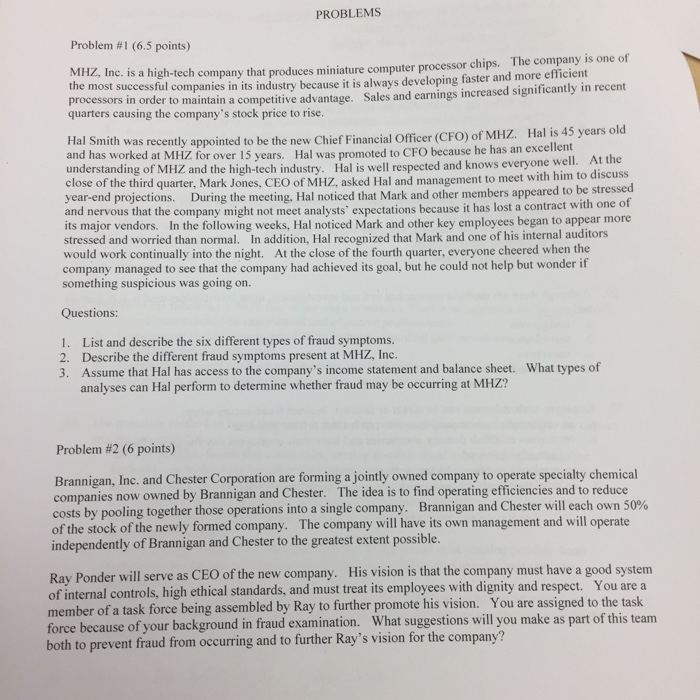

MHZ. Inc. is a high-tech company that produces miniature computer processor chips. The company is one of the most successful companies in its industry because it is always developing faster and more efficient processors in order to maintain a competitive advantage. Sales and earnings increased significantly in recent quarters causing the company's stock price to rise. Hal Smith was recently appointed to be the new Chief Financial Officer (CFO) of MHZ. Hal is 45 years old and has worked at MHZ for over 15 years. Hal was promoted to CFO because he has an excellent understanding of MHZ and the high-tech industry. Hal is well respected and knows everyone well. At the close of the third quarter. Mark Jones. CEO of MHZ. asked Hal and management to meet with him to discuss year-end projections. During the meeting. Hal noticed that Mark and other members appeared to be stressed and nervous that the company might not meet analysts' expectations because it has lost a contract with one of its major vendors. In the following weeks. Hal noticed Mark and other key employees began to appear more stressed and worried than normal. In addition. Hal recognized that Mark and one of his internal auditors would work continually into the night. At the close of the fourth quarter, everyone cheered when the company managed to see that the company had achieved its goal, but he could not help but wonder if something suspicious was going on. List and describe the six different types of fraud symptoms. Describe the different fraud symptoms present at MHZ. Inc. Assume that Hal has access to the company's income statement and balance sheet. What types of analyses can Hal perform to determine whether fraud may be occurring at MHZ? Brannigan, Inc. and Chester Corporation are forming a jointly owned company to operate specialty chemical companies now owned by Brannigan and Chester. The idea is to find operating efficiencies and to reduce costs by pooling together those operations into a single company. Brannigan and Chester will each own 50% of the stock of the newly formed company. The company will have its own management and will operate independently of Brannigan and Chester to the greatest extent possible. Ray Ponder will serve as CEO of the new company. His vision is that the company must have a good system of internal controls, high ethical standards, and must treat its employees with dignity and respect. You are a member of a task force being assembled by Ray to further promote his vision. You are assigned to the task force because of your background in fraud examination. What suggestions will you make as part of this team both to prevent fraud from occurring and to further Ray's vision for the company? MHZ. Inc. is a high-tech company that produces miniature computer processor chips. The company is one of the most successful companies in its industry because it is always developing faster and more efficient processors in order to maintain a competitive advantage. Sales and earnings increased significantly in recent quarters causing the company's stock price to rise. Hal Smith was recently appointed to be the new Chief Financial Officer (CFO) of MHZ. Hal is 45 years old and has worked at MHZ for over 15 years. Hal was promoted to CFO because he has an excellent understanding of MHZ and the high-tech industry. Hal is well respected and knows everyone well. At the close of the third quarter. Mark Jones. CEO of MHZ. asked Hal and management to meet with him to discuss year-end projections. During the meeting. Hal noticed that Mark and other members appeared to be stressed and nervous that the company might not meet analysts' expectations because it has lost a contract with one of its major vendors. In the following weeks. Hal noticed Mark and other key employees began to appear more stressed and worried than normal. In addition. Hal recognized that Mark and one of his internal auditors would work continually into the night. At the close of the fourth quarter, everyone cheered when the company managed to see that the company had achieved its goal, but he could not help but wonder if something suspicious was going on. List and describe the six different types of fraud symptoms. Describe the different fraud symptoms present at MHZ. Inc. Assume that Hal has access to the company's income statement and balance sheet. What types of analyses can Hal perform to determine whether fraud may be occurring at MHZ? Brannigan, Inc. and Chester Corporation are forming a jointly owned company to operate specialty chemical companies now owned by Brannigan and Chester. The idea is to find operating efficiencies and to reduce costs by pooling together those operations into a single company. Brannigan and Chester will each own 50% of the stock of the newly formed company. The company will have its own management and will operate independently of Brannigan and Chester to the greatest extent possible. Ray Ponder will serve as CEO of the new company. His vision is that the company must have a good system of internal controls, high ethical standards, and must treat its employees with dignity and respect. You are a member of a task force being assembled by Ray to further promote his vision. You are assigned to the task force because of your background in fraud examination. What suggestions will you make as part of this team both to prevent fraud from occurring and to further Ray's vision for the company

MHZ. Inc. is a high-tech company that produces miniature computer processor chips. The company is one of the most successful companies in its industry because it is always developing faster and more efficient processors in order to maintain a competitive advantage. Sales and earnings increased significantly in recent quarters causing the company's stock price to rise. Hal Smith was recently appointed to be the new Chief Financial Officer (CFO) of MHZ. Hal is 45 years old and has worked at MHZ for over 15 years. Hal was promoted to CFO because he has an excellent understanding of MHZ and the high-tech industry. Hal is well respected and knows everyone well. At the close of the third quarter. Mark Jones. CEO of MHZ. asked Hal and management to meet with him to discuss year-end projections. During the meeting. Hal noticed that Mark and other members appeared to be stressed and nervous that the company might not meet analysts' expectations because it has lost a contract with one of its major vendors. In the following weeks. Hal noticed Mark and other key employees began to appear more stressed and worried than normal. In addition. Hal recognized that Mark and one of his internal auditors would work continually into the night. At the close of the fourth quarter, everyone cheered when the company managed to see that the company had achieved its goal, but he could not help but wonder if something suspicious was going on. List and describe the six different types of fraud symptoms. Describe the different fraud symptoms present at MHZ. Inc. Assume that Hal has access to the company's income statement and balance sheet. What types of analyses can Hal perform to determine whether fraud may be occurring at MHZ? Brannigan, Inc. and Chester Corporation are forming a jointly owned company to operate specialty chemical companies now owned by Brannigan and Chester. The idea is to find operating efficiencies and to reduce costs by pooling together those operations into a single company. Brannigan and Chester will each own 50% of the stock of the newly formed company. The company will have its own management and will operate independently of Brannigan and Chester to the greatest extent possible. Ray Ponder will serve as CEO of the new company. His vision is that the company must have a good system of internal controls, high ethical standards, and must treat its employees with dignity and respect. You are a member of a task force being assembled by Ray to further promote his vision. You are assigned to the task force because of your background in fraud examination. What suggestions will you make as part of this team both to prevent fraud from occurring and to further Ray's vision for the company? MHZ. Inc. is a high-tech company that produces miniature computer processor chips. The company is one of the most successful companies in its industry because it is always developing faster and more efficient processors in order to maintain a competitive advantage. Sales and earnings increased significantly in recent quarters causing the company's stock price to rise. Hal Smith was recently appointed to be the new Chief Financial Officer (CFO) of MHZ. Hal is 45 years old and has worked at MHZ for over 15 years. Hal was promoted to CFO because he has an excellent understanding of MHZ and the high-tech industry. Hal is well respected and knows everyone well. At the close of the third quarter. Mark Jones. CEO of MHZ. asked Hal and management to meet with him to discuss year-end projections. During the meeting. Hal noticed that Mark and other members appeared to be stressed and nervous that the company might not meet analysts' expectations because it has lost a contract with one of its major vendors. In the following weeks. Hal noticed Mark and other key employees began to appear more stressed and worried than normal. In addition. Hal recognized that Mark and one of his internal auditors would work continually into the night. At the close of the fourth quarter, everyone cheered when the company managed to see that the company had achieved its goal, but he could not help but wonder if something suspicious was going on. List and describe the six different types of fraud symptoms. Describe the different fraud symptoms present at MHZ. Inc. Assume that Hal has access to the company's income statement and balance sheet. What types of analyses can Hal perform to determine whether fraud may be occurring at MHZ? Brannigan, Inc. and Chester Corporation are forming a jointly owned company to operate specialty chemical companies now owned by Brannigan and Chester. The idea is to find operating efficiencies and to reduce costs by pooling together those operations into a single company. Brannigan and Chester will each own 50% of the stock of the newly formed company. The company will have its own management and will operate independently of Brannigan and Chester to the greatest extent possible. Ray Ponder will serve as CEO of the new company. His vision is that the company must have a good system of internal controls, high ethical standards, and must treat its employees with dignity and respect. You are a member of a task force being assembled by Ray to further promote his vision. You are assigned to the task force because of your background in fraud examination. What suggestions will you make as part of this team both to prevent fraud from occurring and to further Ray's vision for the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started