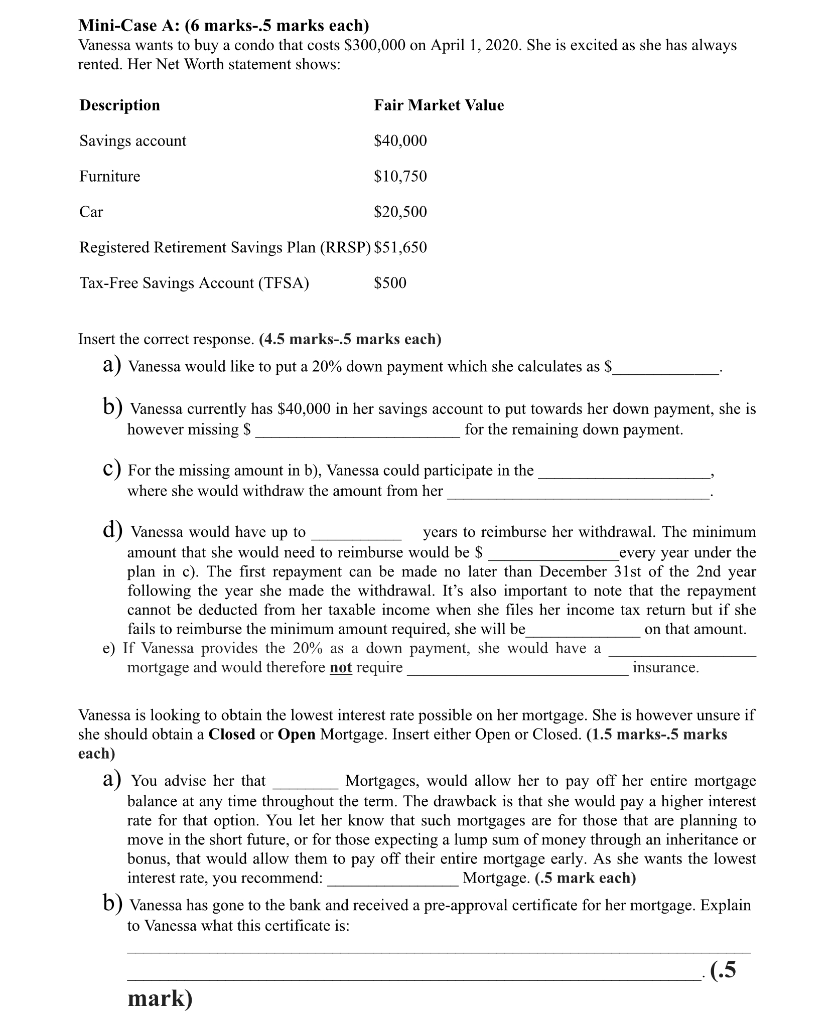

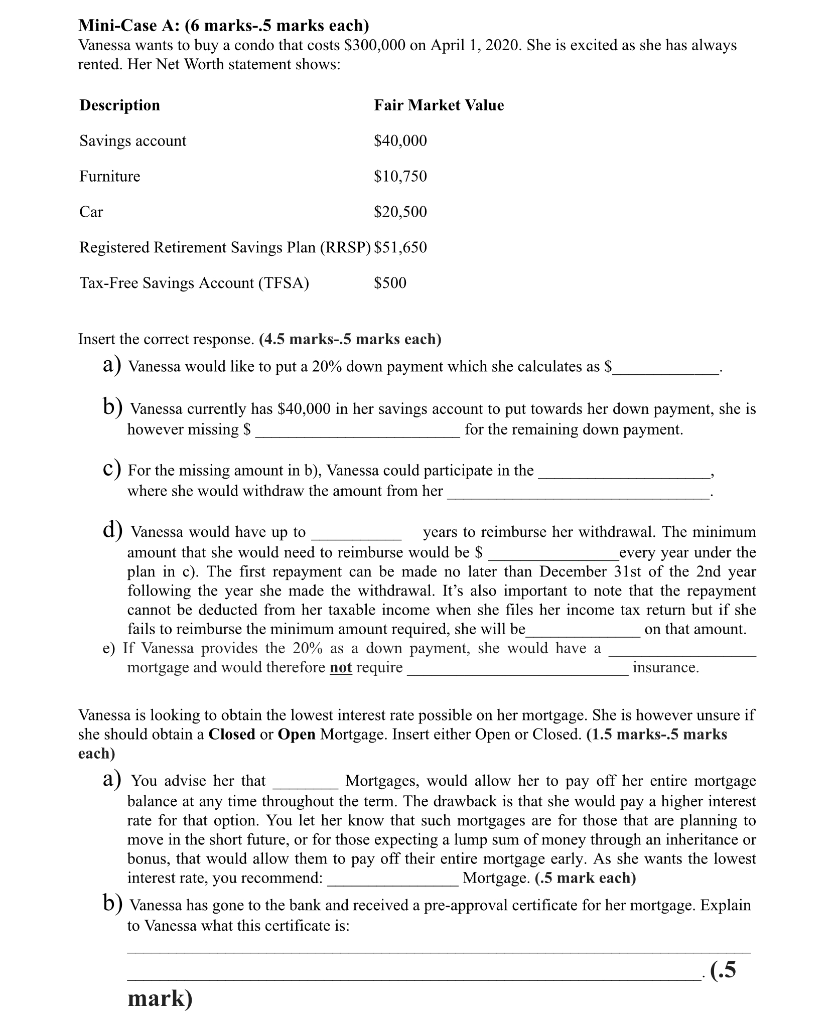

Mini-Case A: (6 marks-.5 marks each) Vanessa wants to buy a condo that costs $300,000 on April 1, 2020. She is excited as she has always rented. Her Net Worth statement shows: Description Fair Market Value Savings account $40,000 Furniture $10,750 Car $20,500 Registered Retirement Savings Plan (RRSP) $51,650 Tax-Free Savings Account (TFSA) $500 Insert the correct response. (4.5 marks-.5 marks each) a) Vanessa would like to put a 20% down payment which she calculates as $ b) Vanessa currently has $40,000 in her savings account to put towards her down payment, she is however missing S for the remaining down payment. c) For the missing amount in b), Vanessa could participate in the where she would withdraw the amount from her d) Vanessa would have up to years to reimburse her withdrawal. The minimum amount that she would need to reimburse would be $_ _every year under the plan in c). The first repayment can be made no later than December 31st of the 2nd year following the year she made the withdrawal. It's also important to note that the repayment cannot be deducted from her taxable income when she files her income tax return but if she fails to reimburse the minimum amount required, she will be on that amount e) If Vanessa provides the 20% as a down payment, she would have a mortgage and would therefore not require insurance. Vanessa is looking to obtain the lowest interest rate possible on her mortgage. She is however unsure if she should obtain a Closed or Open Mortgage. Insert either Open or Closed. (1.5 marks-.5 marks each) a) You advise her that Mortgages, would allow her to pay off her entire mortgage balance at any time throughout the term. The drawback is that she would pay a higher interest rate for that option. You let her know that such mortgages are for those that are planning to move in the short future, or for those expecting a lump sum of money through an inheritance or bonus, that would allow them to pay off their entire mortgage early. As she wants the lowest interest rate, you recommend: Mortgage. (.5 mark each) b) Vanessa has gone to the bank and received a pre-approval certificate for her mortgage. Explain to Vanessa what this certificate is: mark) Mini-Case A: (6 marks-.5 marks each) Vanessa wants to buy a condo that costs $300,000 on April 1, 2020. She is excited as she has always rented. Her Net Worth statement shows: Description Fair Market Value Savings account $40,000 Furniture $10,750 Car $20,500 Registered Retirement Savings Plan (RRSP) $51,650 Tax-Free Savings Account (TFSA) $500 Insert the correct response. (4.5 marks-.5 marks each) a) Vanessa would like to put a 20% down payment which she calculates as $ b) Vanessa currently has $40,000 in her savings account to put towards her down payment, she is however missing S for the remaining down payment. c) For the missing amount in b), Vanessa could participate in the where she would withdraw the amount from her d) Vanessa would have up to years to reimburse her withdrawal. The minimum amount that she would need to reimburse would be $_ _every year under the plan in c). The first repayment can be made no later than December 31st of the 2nd year following the year she made the withdrawal. It's also important to note that the repayment cannot be deducted from her taxable income when she files her income tax return but if she fails to reimburse the minimum amount required, she will be on that amount e) If Vanessa provides the 20% as a down payment, she would have a mortgage and would therefore not require insurance. Vanessa is looking to obtain the lowest interest rate possible on her mortgage. She is however unsure if she should obtain a Closed or Open Mortgage. Insert either Open or Closed. (1.5 marks-.5 marks each) a) You advise her that Mortgages, would allow her to pay off her entire mortgage balance at any time throughout the term. The drawback is that she would pay a higher interest rate for that option. You let her know that such mortgages are for those that are planning to move in the short future, or for those expecting a lump sum of money through an inheritance or bonus, that would allow them to pay off their entire mortgage early. As she wants the lowest interest rate, you recommend: Mortgage. (.5 mark each) b) Vanessa has gone to the bank and received a pre-approval certificate for her mortgage. Explain to Vanessa what this certificate is: mark)