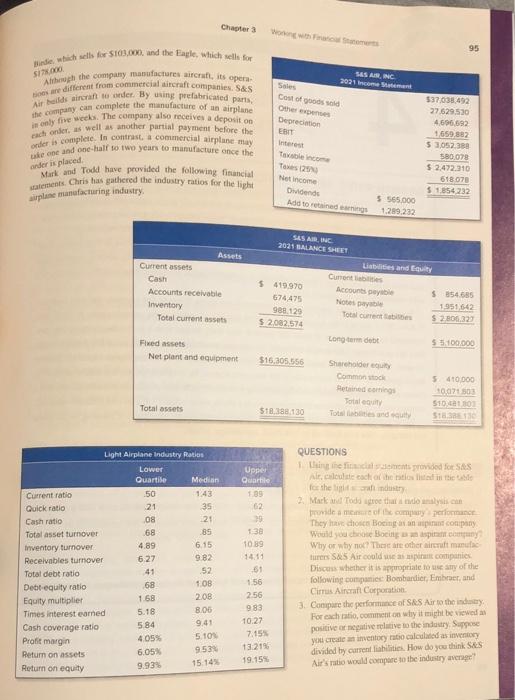

MINICASE Ratio Analysis at S&S Air, Inc. Chris Guthrie was recently hired by S&S Air, Inc., to assist the company with its financial planning and to evaluate the company's performance. Chris graduated from college five years ago with a finance degree. Since then, he has been employed in the finance department of a Fortune 500 company S&S Air was founded 10 years ago by friends Mark Sexton and Todd Story. The company has manufactured and sold light airplanes over this period, and the company's products have received high reviews for safety and reliability. The company has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models: the Chapter 3 Some 95 Si. Bide which well for 100.000 and the Eagle, which is for Alth the company manufactures is opera be different from commercial craft companies. S&S Air bilder order. By using peabricated parts, the company can complete the manufacture of an airplane only five weeks. The company also receives a deposit on each onders well as another partial payment before the order is complete. In contrast, commercial airplane-may one and one-half two years to manufacture once the Mark and Todd have provided the following financial ment. Chris has gathered the industry ratios for the light SAS AN INC 2021 Income tamam Se Cost of goods said Oer expenses Depreciation EBIT rest Tosino Toes 2014 Not income Dividends Add to retained earnings 537038492 27.629.530 4,696 692 1 659.382 $ 1.052 38 380.079 $ 2,472,310 618.07 $ 1.854232 under is placed sirplane manufacturing industry. 5 565.000 1.289.232 Assets Current assets Cash Accounts receivable Inventory Total current assets SASARINE 2021 BALANCE SHEET Liabilities and out Current $ 419.970 Accounts payable $854685 676475 Note 1951642 988 129 Total currentie $ 2800.220 $ 2002.574 Long term debt $ 100.000 Fixed assets Net plant and equipment $15.305556 Shareholder Commons Stine coming Total 5410.000 10.07 50 5100 STS Total assets $18.388.130 Upper Quartie 189 62 Light Airplane Industry Ratios Lower Quartie Median Current ratio 50 Quick ratio 21 35 Cash ratio 08 21 Total asset turnover 68 85 Inventory turnover 4.89 6.15 Receivables turnover 6.27 9.82 Total debt ratio 41 52 Debt equity ratio 68 1.08 Equity multiplier 1.68 2.08 Times interest earned 5.18 8.06 Cash coverage ratio 584 9.41 Profit margin 405% 5.10 Return on assets 6.05 953 Return on equity 9.939 15:14 138 1089 14.11 51 1.56 256 983 10.27 7.15% 13.21% 19.15% QUESTIONS in the centrovided for SAS Altcoute each others in the ce the industry Mark Todo o that only provide a more company pro They don Bonant company Would you choose Boeing com Why or why not? There are other aircraft man tures S&S Air could set companies Discs whether it is appropriate to use of the following companie Bombardier, Embraer, and Cims Aircraft Corporation 3. Compare the performance of SRS Air to the industry For eachtato comment on why it might be viewed positive or negative sitive to the industry. Surpose you create a inventory to calculated as inventory divided by current liabilities. How do you think S&S Air's ratio would compare to the industry avera MINICASE Ratio Analysis at S&S Air, Inc. Chris Guthrie was recently hired by S&S Air, Inc., to assist the company with its financial planning and to evaluate the company's performance. Chris graduated from college five years ago with a finance degree. Since then, he has been employed in the finance department of a Fortune 500 company S&S Air was founded 10 years ago by friends Mark Sexton and Todd Story. The company has manufactured and sold light airplanes over this period, and the company's products have received high reviews for safety and reliability. The company has a niche market in that it sells primarily to individuals who own and fly their own airplanes. The company has two models: the Chapter 3 Some 95 Si. Bide which well for 100.000 and the Eagle, which is for Alth the company manufactures is opera be different from commercial craft companies. S&S Air bilder order. By using peabricated parts, the company can complete the manufacture of an airplane only five weeks. The company also receives a deposit on each onders well as another partial payment before the order is complete. In contrast, commercial airplane-may one and one-half two years to manufacture once the Mark and Todd have provided the following financial ment. Chris has gathered the industry ratios for the light SAS AN INC 2021 Income tamam Se Cost of goods said Oer expenses Depreciation EBIT rest Tosino Toes 2014 Not income Dividends Add to retained earnings 537038492 27.629.530 4,696 692 1 659.382 $ 1.052 38 380.079 $ 2,472,310 618.07 $ 1.854232 under is placed sirplane manufacturing industry. 5 565.000 1.289.232 Assets Current assets Cash Accounts receivable Inventory Total current assets SASARINE 2021 BALANCE SHEET Liabilities and out Current $ 419.970 Accounts payable $854685 676475 Note 1951642 988 129 Total currentie $ 2800.220 $ 2002.574 Long term debt $ 100.000 Fixed assets Net plant and equipment $15.305556 Shareholder Commons Stine coming Total 5410.000 10.07 50 5100 STS Total assets $18.388.130 Upper Quartie 189 62 Light Airplane Industry Ratios Lower Quartie Median Current ratio 50 Quick ratio 21 35 Cash ratio 08 21 Total asset turnover 68 85 Inventory turnover 4.89 6.15 Receivables turnover 6.27 9.82 Total debt ratio 41 52 Debt equity ratio 68 1.08 Equity multiplier 1.68 2.08 Times interest earned 5.18 8.06 Cash coverage ratio 584 9.41 Profit margin 405% 5.10 Return on assets 6.05 953 Return on equity 9.939 15:14 138 1089 14.11 51 1.56 256 983 10.27 7.15% 13.21% 19.15% QUESTIONS in the centrovided for SAS Altcoute each others in the ce the industry Mark Todo o that only provide a more company pro They don Bonant company Would you choose Boeing com Why or why not? There are other aircraft man tures S&S Air could set companies Discs whether it is appropriate to use of the following companie Bombardier, Embraer, and Cims Aircraft Corporation 3. Compare the performance of SRS Air to the industry For eachtato comment on why it might be viewed positive or negative sitive to the industry. Surpose you create a inventory to calculated as inventory divided by current liabilities. How do you think S&S Air's ratio would compare to the industry avera