Answered step by step

Verified Expert Solution

Question

1 Approved Answer

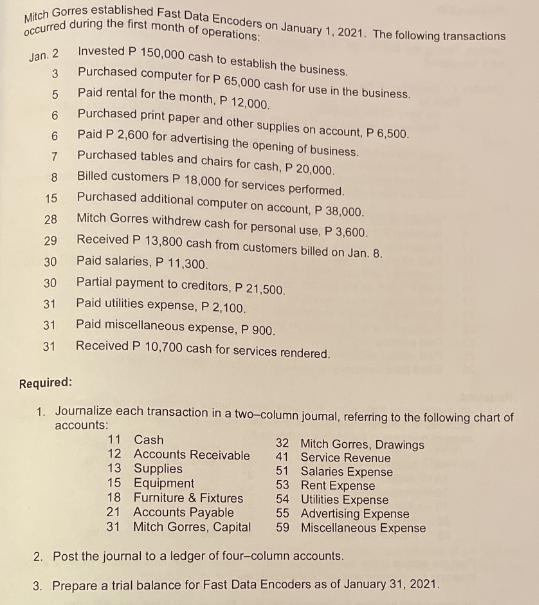

Mitch Gorres established Fast Data Encoders on January 1, 2021. The following transactions occurred during the first month of operations: Jan. 2 3 5

Mitch Gorres established Fast Data Encoders on January 1, 2021. The following transactions occurred during the first month of operations: Jan. 2 3 5 6 6 7 8 15 28 29 30 30 31 31 31 Invested P 150,000 cash to establish the business. Purchased computer for P 65,000 cash for use in the business. Paid rental for the month, P 12,000. Purchased print paper and other supplies on account, P 6,500. Paid P 2,600 for advertising the opening of business. Purchased tables and chairs for cash, P 20,000. Billed customers P 18,000 for services performed. Purchased additional computer on account, P 38,000. Mitch Gorres withdrew cash for personal use, P 3,600. Received P 13,800 cash from customers billed on Jan. 8. Paid salaries, P 11,300. Partial payment to creditors, P 21,500. Paid utilities expense, P 2,100. Paid miscellaneous expense, P 900. Received P 10,700 cash for services rendered. Required: 1. Journalize each transaction in a two-column journal, referring to the following chart of accounts: 11 Cash 12 Accounts Receivable 13 Supplies 15 Equipment 18 Furniture & Fixtures 21 Accounts Payable 31 Mitch Gorres, Capital 32 Mitch Gorres, Drawings 41 Service Revenuel 51 Salaries Expense 53 Rent Expense 54 Utilities Expense 55 Advertising Expense 59 Miscellaneous Expense 2. Post the journal to a ledger of four-column accounts. 3. Prepare a trial balance for Fast Data Encoders as of January 31, 2021.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Account Debit Credit Jan 2 Cash 150000 Mitch Gorres Capital 150000 Jan 3 Equipment 65000 Cash 65000 Jan 5 Rent Expense 12000 Cash 12000 Jan 6 Supplies 6500 Accounts Payable 6500 A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started