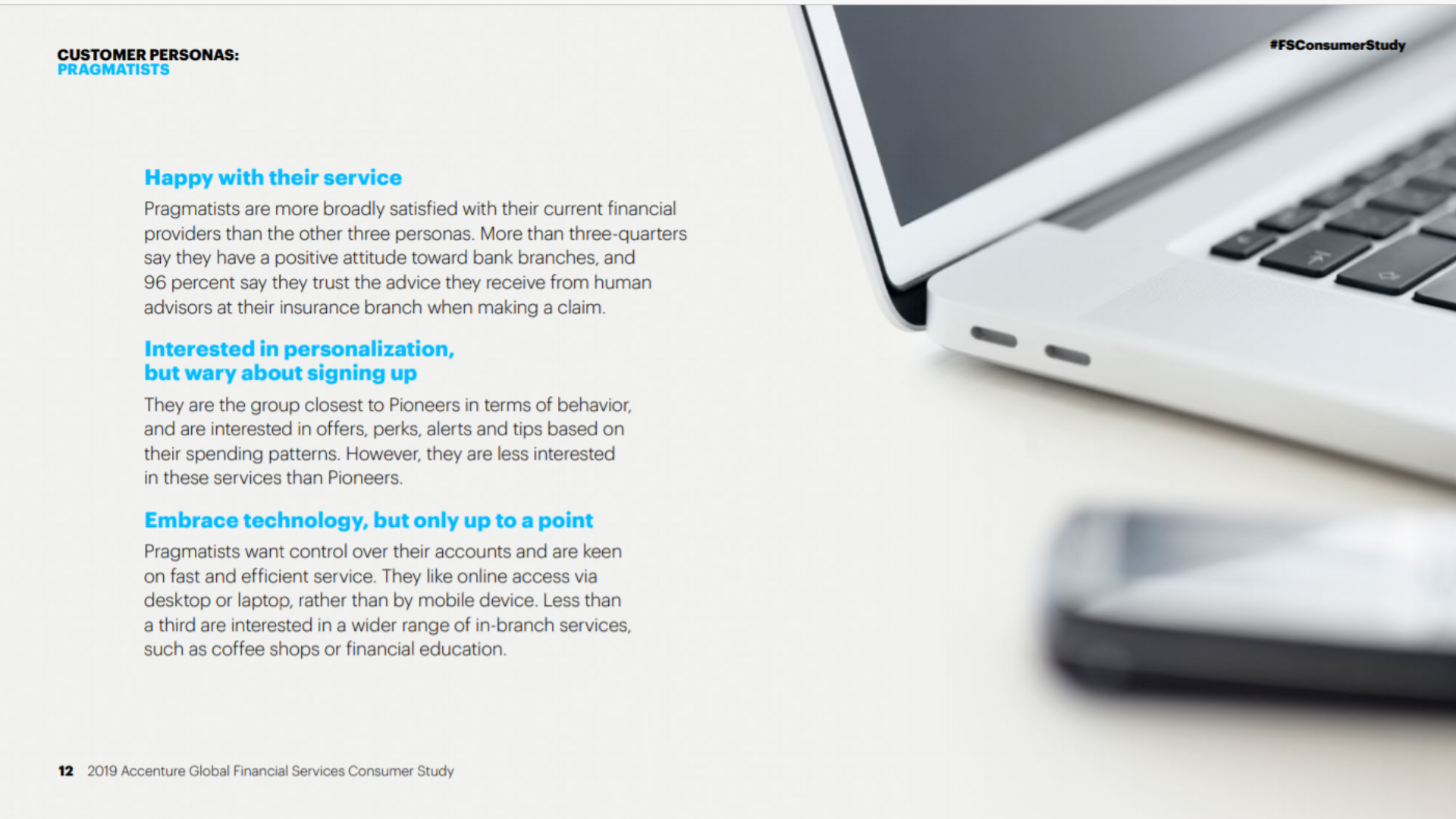

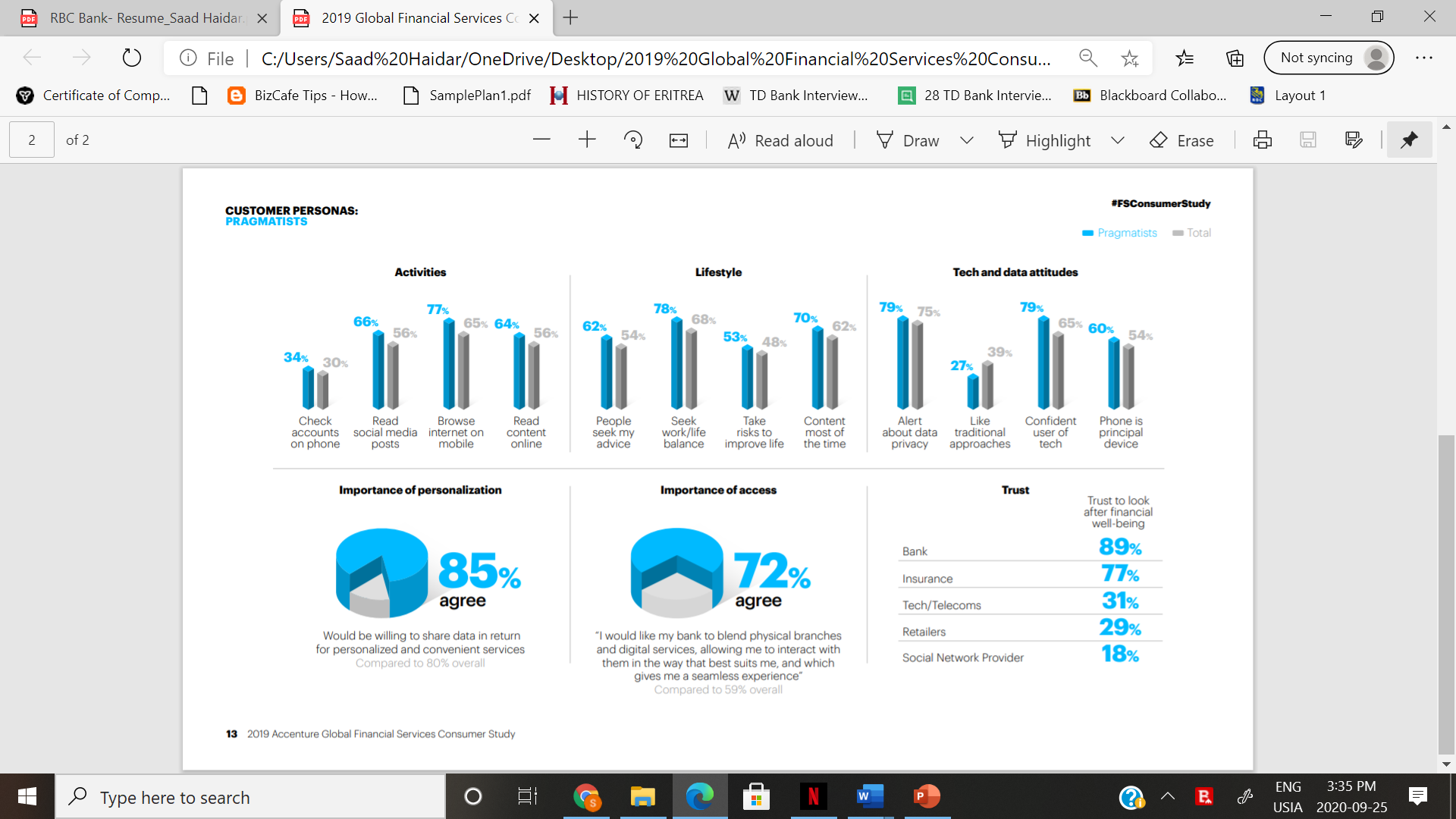

mom m PRAG MATIS'I'S Happy with their service Pragmatists are more broadly satisfied with their current financial providers than the other three personas. More than three-quarters say they have a positive attitude toward bank branches. and 96 percent say they trust the advice they receive from human advisers at their insurance branch when making a claim. Interested in personalization, but wary about signing up They are the group closest to Pioneers in terms of behavior, and are interested in offers, perks. alerts and tips based on their spending patterns. However, they are less interested in these services than Pioneers. Embrace technologv. but only up to a point Pragmatists want control over their accounts and are keen on fast and efficient service. They like online access via desktop or laptop, rather than by mobile device. Less than a third are interested in a wider range of in-branch services, such as coffee shops or financial education. I! 2649 Accenture Globei Flnanclsi Services Consumer Study RBC Bank- Resume_Saad Haidar. X PDE 2019 Global Financial Services Cc X + X File | C:/Users/Saad%20Haidar/OneDrive/Desktop/2019%20Global%20Financial%20Services%20Consu... Not syncing Certificate of Comp... BizCafe Tips - How.. SamplePlan1.pdf [ HISTORY OF ERITREA W TD Bank Interview.. 28 TD Bank Intervieh Blackboard Collabo... Layout 1 2 of 2 A' Read aloud | Draw V Highlight Erase #FSConsumerStudy CUSTOMER PERSONAS: PRAGMATISTS Pragmatists Total Activities Lifestyle Tech and data attitudes 77% 78% 79% 66% 65% 64% 70% 56% 62% 68% 79% 75% 56% 54% 62% 65% 60% 54% 53% 48% 39% 34% 30% 27% Check Read Browse Read People Seek Take Content Alert Like Confident Phone is accounts social media internet on content seek my work/life risks to most of about data traditional user of principal on phone posts mobile online advice balance improve life the time privacy approaches tech device Importance of personalization Importance of access Trust Trust to look after financial well-being 72% Bank 89% 85% Insurance 77% agree agree Tech/Telecoms 31% Would be willing to share data in return "I would like my bank to blend physical branches Retailers 29% for personalized and convenient services and digital services, allowing me to interact with Compared to 80% overall them in the way that best suits me, and which Social Network Provider 18% gives me a seamless experience" Compared to 59% overall 13 2019 Accenture Global Financial Services Consumer Study Type here to search O M N w P B ENG 3:35 PM USIA 2020-09-25