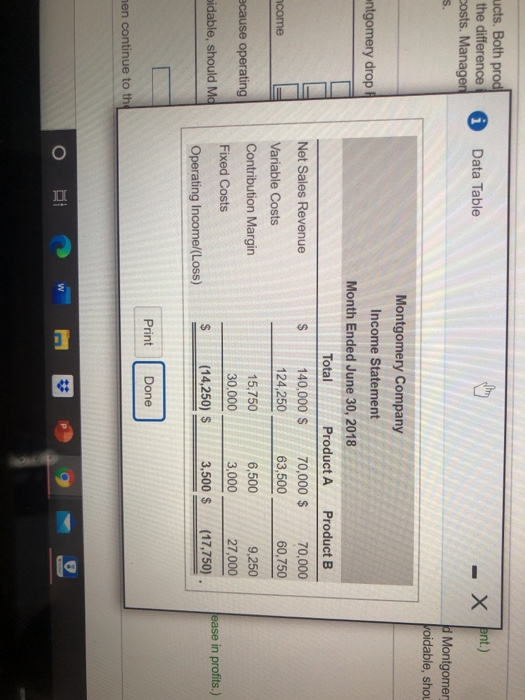

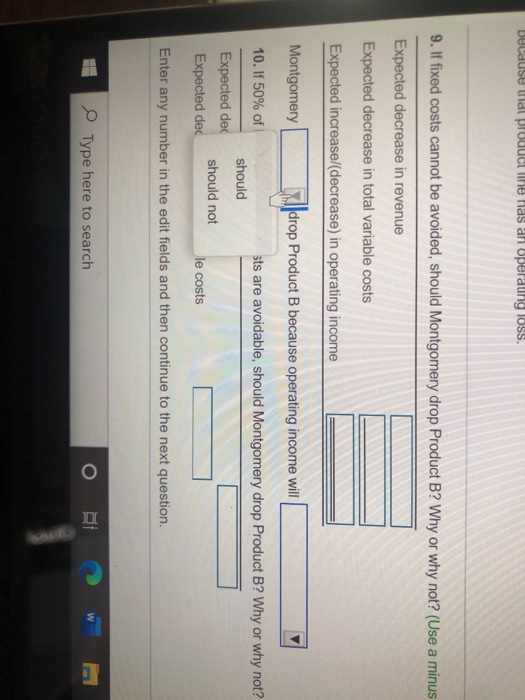

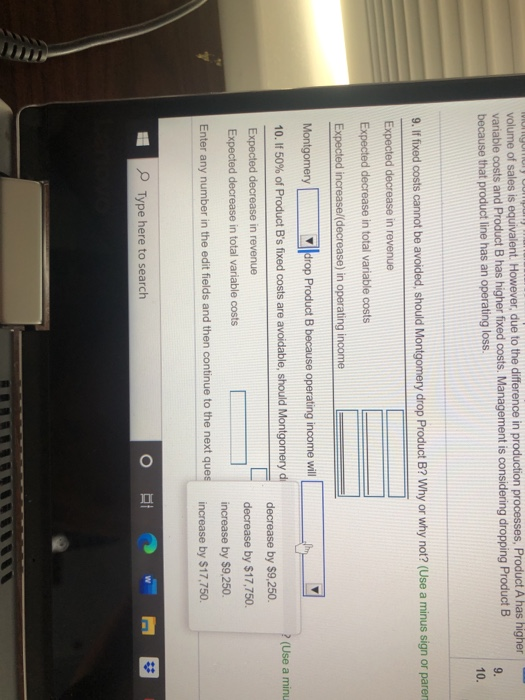

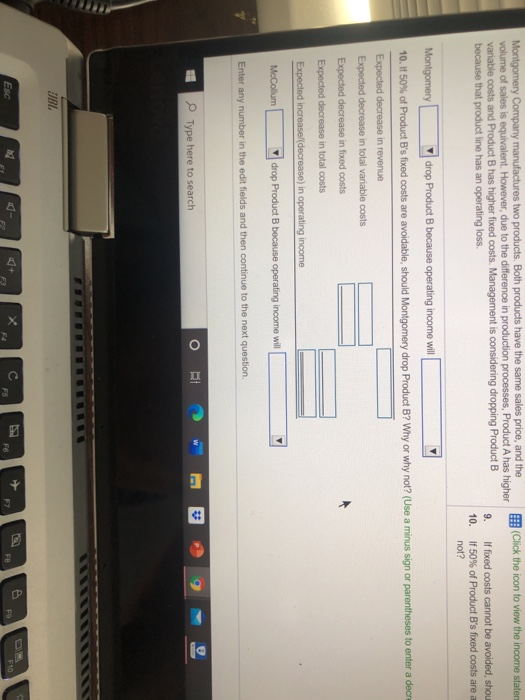

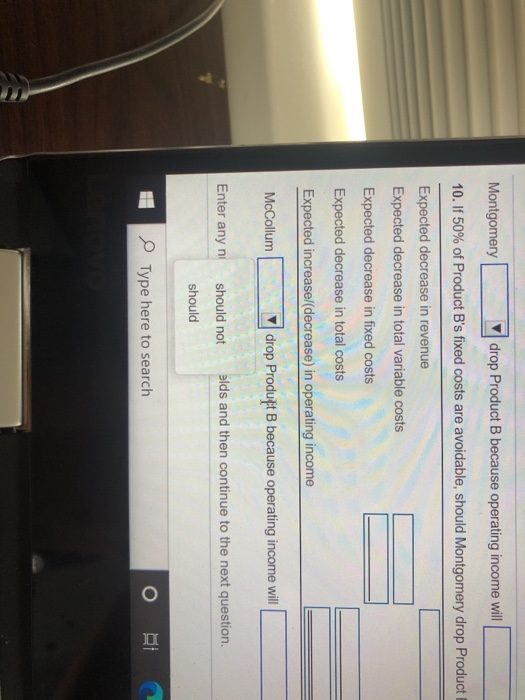

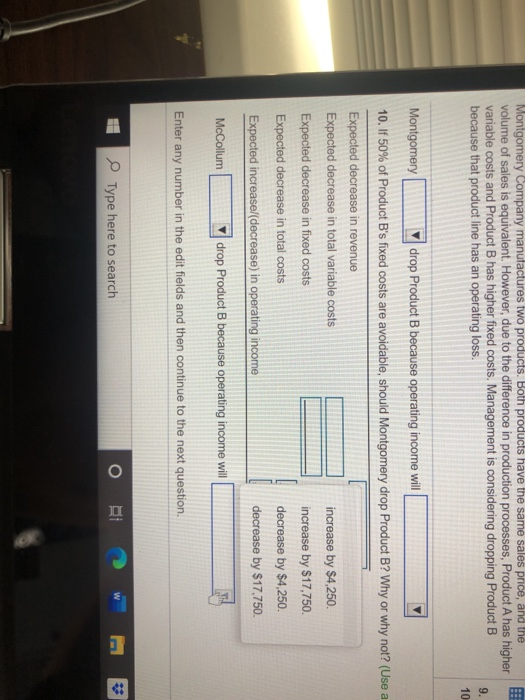

Montgomery Company manufactures two products. Both products have the same sales price and the volume of is evert. However, due to the difference in production processes Product A has higher click the loon to view the income statement.) variable costs and Product has higher feed costs Management is considering dropping Products because that product line has an operating loss 9. I foed costs cannot be avoided should Montgomery drop Product B7 Why or why not? 10. 50% of Product B's fred costs are avoidable, should Montgomery drop Product B? Why or why nor 8. fed cols cannot be avoided should Montgomery drop Product B? Why or why not? (Use a minus signor parentheses to enter a decrease in profil Expected decrease in Expected decrease in total variable costs Expected increase in conting income Montgomery drop Product capating income wil 10. 50% of Proofed costs are should Montgomery drop Product By Whyer why not? (Use a minus ir parents to enter a decrease in profits Enter any number in the edit fields and then continue to the next cuestion ucts. Both prod the difference posts. Manager S. Data Table - X pent.) d Montgomer voidable, shou entgomery drop Montgomery Company Income Statement Month Ended June 30, 2018 Total Product A Product B 140,000 $ 70,000 $ 70,000 124,250 63,500 60,750 Net Sales Revenue $ ncome ecause operating Variable Costs Contribution Margin Fixed Costs 15,750 30,000 6,500 3,000 9,250 27,000 bidable, should Md ease in profits.) (14,250) S $ 3,500 $ (17,750). Operating Income/(Loss) Print Done men continue to the o DI C because und product he has an operating loss. 9. If fixed costs cannot be avoided, should Montgomery drop Product B? Why or why not? (Use a minus Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income Montgomery drop Product B because operating income will 10. If 50% of sts are avoidable, should Montgomery drop Product B? Why or why not? should Expected dec Expected dec should not le costs Enter any number in the edit fields and then continue to the next question. Type here to search I VI volume of sales is equivalent. However, due to the difference in production processes, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. 9. 10. 9. If fixed costs cannot be avoided, should Montgomery drop Product B? Why or why not? (Use a minus sign or paren Expected decrease in revenue Expected decrease in total variable costs Expected increase/(decrease) in operating income ? (Use a minu Montgomery drop Product B because operating income will 10. If 50% of Product B's fixed costs are avoidable, should Montgomery di Expected decrease in revenue Expected decrease in total variable costs decrease by $9,250 decrease by $17,750. increase by $9,250 increase by $17,750 Enter any number in the edit fields and then continue to the next ques O E Type here to search (Click the icon to view the income stater Montgomery Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in production processes, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. 9. 10. If fixed costs cannot be avoided, shou If 50% of Product B's fixed costs are a not? Montgomery drop Product B because operating income will 10. If 50% of Product B's fixed costs are avoidable, should Montgomery drop Product B? Why or why not? (Use a minus sign or parentheses to enter a decre Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increasel(decrease) in operating income McCollum drop Product B because operating income will Enter any number in the edit fields and then continue to the next question. Type here to search JBL Esc FB FS F10 Montgomery drop Product B because operating income will 10. If 50% of Product B's fixed costs are avoidable, should Montgomery drop Product Expected decrease in revenue Expected decrease in total variable costs Expected decrease in fixed costs Expected decrease in total costs Expected increase (decrease) in operating income McCollum drop Product B because operating income will Enter any ni should not elds and then continue to the next question. should Type here to search Montgomery Company manufactures two products. Both products have the same sales price, and the volume of sales is equivalent. However, due to the difference in production processes, Product A has higher variable costs and Product B has higher fixed costs. Management is considering dropping Product B because that product line has an operating loss. 9. 10 Montgomery drop Product B because operating income will 10. If 50% of Product B's fixed costs are avoidable, should Montgomery drop Product B? Why or why not? (Use a Expected decrease in revenue Expected decrease in total variable costs increase by $4,250 Expected decrease in fixed costs increase by $17,750 Expected decrease in total costs decrease by $4,250 Expected increase (decrease) in operating income decrease by $17.750 McCollum drop Product B because operating income will Enter any number in the edit fields and then continue to the next question. o Type here to search 43 C