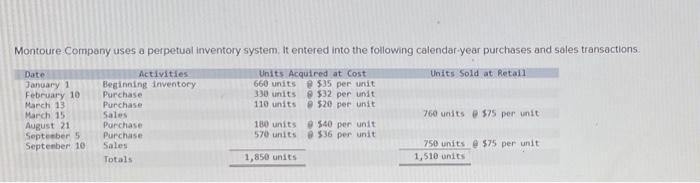

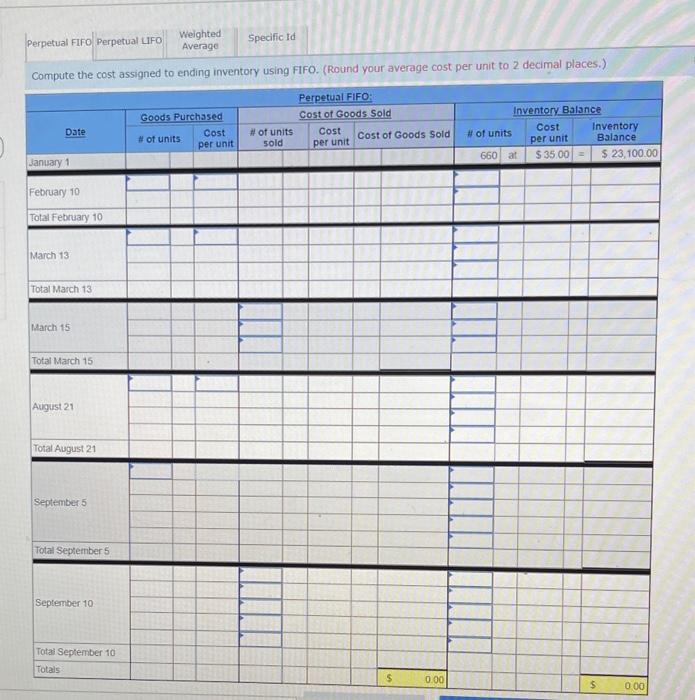

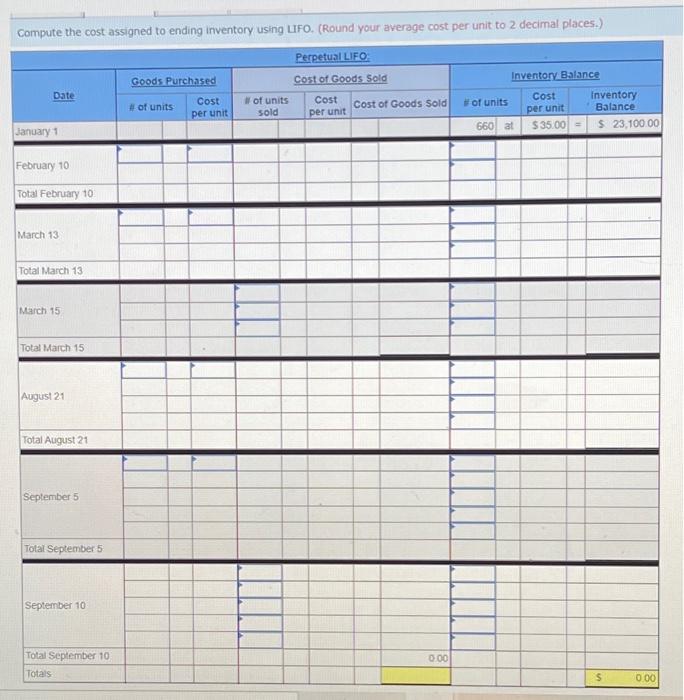

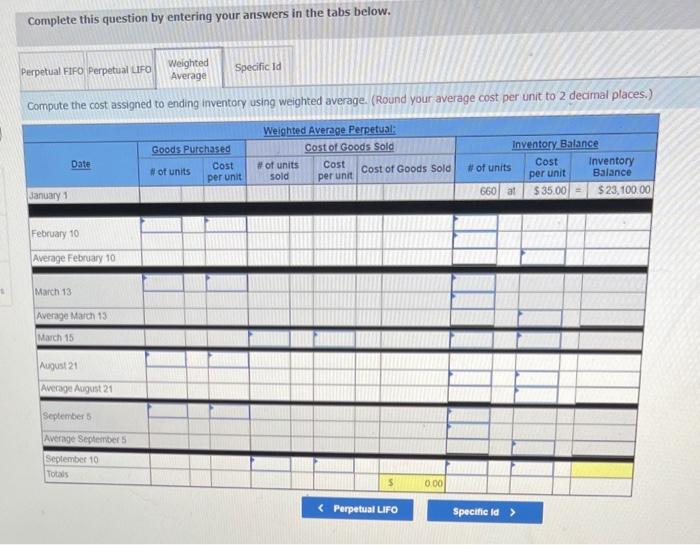

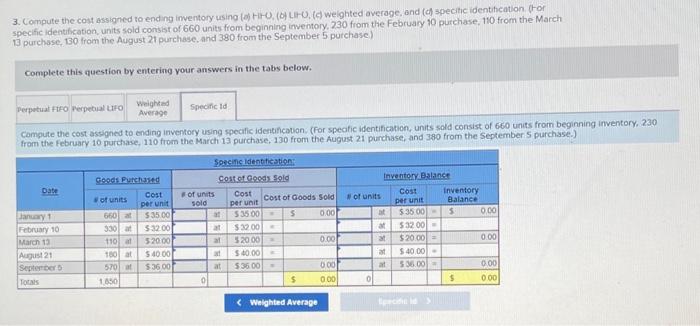

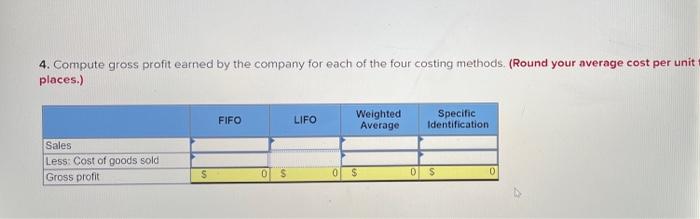

Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Date Activities Units Acquired at Cost Units Sold at Retail January 1 Beginning inventory 660 units 535 per unit February 10 Purchase 330 units $32 per unit March 13 Purchase 110 units $20 per unit March 15 Sales 760 units @ $75 per unte August 21 Purchase 180 units 540 per unit September 5 Purchase 570 units $36 per unit September 10 Sales 750 units @ $75 per unit Totals 1,850 units 1,510 units Perpetual Fifo Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) Perpetual FIFO: Cost of Goods Sold Cost Cost of Goods Sold per unit Goods Purchased # of units Cost per unit Date # of units sold Inventory Balance Cost Inventory # of units per unit Balance 660 at $ 35.00 = $ 23,100.00 January 1 February 10 Total February 10 March 13 Total March 13 March 15 Total March 15 August 21 Total August 21 September 5 Total September 5 September 10 Total September 10 Totals 0.00 $ 0.00 Compute the cost assigned to ending inventory using LIFO. (Round your average cost per unit to 2 decimal places.) Perpetual LIFO Cost of Goods Sold Date Goods Purchased # of units Cost per unit of units Inventory Balance of units Cost Inventory per unit Balance 660 at $ 35.00 = $ 23,100.00 Cost Cost of Goods Sold per unit sold January 1 February 10 Total February 10 March 13 Total March 13 March 15 Total March 15 August 21 Total August 21 September 5 Total September 5 September 10 0.00 Total September 10 Totals 0.00 Complete this question by entering your answers in the tabs below. Perpetual FIFO Perpetual CIFO Weighted Average Specific id Compute the cost assigned to ending Inventory using weighted average. (Round your average cost per unit to 2 decimal places.) Weighted Average Perpetual: Cost of Goods Sold #of units Cost sold Cost of Goods Sold per unit Goods Purchased Cost # of units Date Inventory Balance Cost Inventory #of units Balance 660 at $35.00 $ 23,100.00 per unit per unit January 1 February 10 Average February 10 March 13 Average March 13 March 15 August 21 Average August 21 September Average September September 10 Totals S 0.00 ( Perpetual LIFO Specific ld 3. Compute the cost assigned to ending inventory using H. (LIHO, a weighted average, and (c) specific identification (For specific identification units sold consist of 660 units from beginning inventory 230 from the February 90 purchase, 110 from the March 13 purchase, 130 from the August 21 purchase, and 380 from the September 5 purchase) Complete this question by entering your answers in the tabs below. Perpetuat FIFO perpetual uro Weighted Specific id Average Compute the cost assigned to ending inventory using specific identification (For specific identification, units sold consist of 660 units from beginning inventory 230 from the February 10 purchase, 110 from the March 13 purchase, 130 from the August 21 purchase, and 380 from the September Spurchase.) Date Goods Purchased Cost of units per unit 660 at $ 3500 3301 5:32.00 110 at 52000 180 at $40.00 570 $3600 1650 January February 10 March 13 August 21 September Totals Specins Identification Costogoods Sold of units Cost Cost of Goods Sold sold per unit at $35.00 $ 0.00 $3200 al 52000 S6000 at 536.00 000 0 $ 000 Inventory Balance Cost of units Inventory per unit Balance 5 35 00 5 0.00 53200 1 $20.00 0.00 $40.00 - at 536.00 0.00 $ 0.00 000