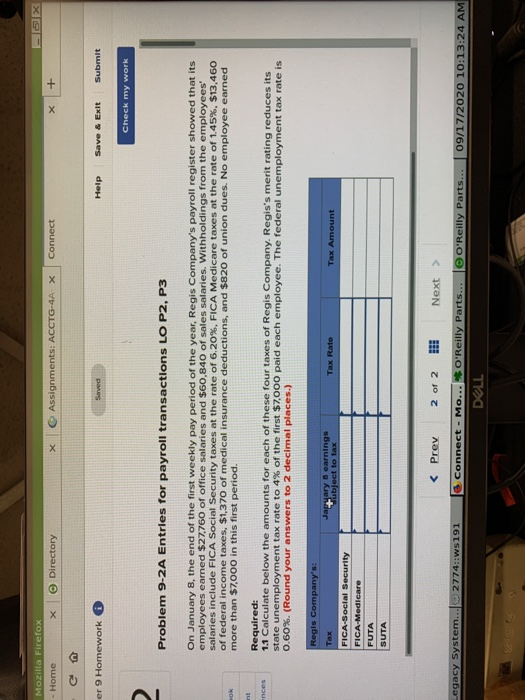

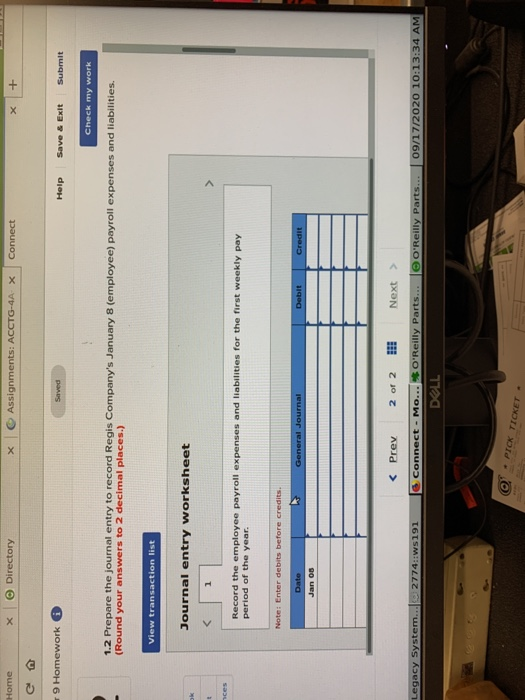

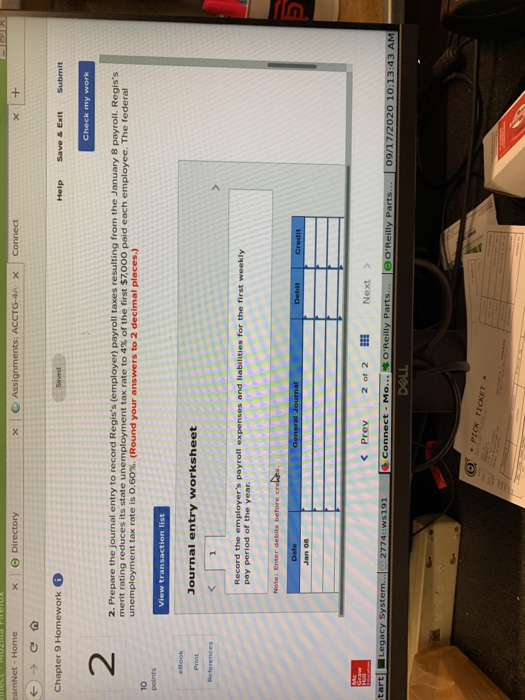

Mozilla Firefox - Home Assignments: ACCTG-4A X Directory Connect + er 9 Homework Sarved Help Save & Exit Submit Check my work 2 Problem 9-2A Entries for payroll transactions LO P2, P3 On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned $27,760 of office salaries and $60,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.20%, FICA Medicare taxes at the rate of 1.45%, $13,460 of federal income taxes, $1,370 of medical insurance deductions, and $820 of union dues. No employee earned more than $7,000 in this first period. OK E reets Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment tax rate to 4% of the first $7,000 paid each employee. The federal unemployment tax rate is 0.60%. (Round your answers to 2 decimal places.) Japyary 8 earnings Wubject to tax Tax Rate Tax Amount Regis Company's: Tax FICA-Social Security FICA-Medicare FUTA SUTA Legacy System... 2774::W5191 O'Reilly Parts... 09/17/2020 10:13:24 AM Connect - Mo... O'Reilly Parts... DELL Home X Directory Assignments: ACCTG-4A X Connect + e 9 Homework Saved Help Save & Exit Submit Check my work 1.2 Prepare the journal entry to record Regis Company's January 8 (employee) payroll expenses and liabilities. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet ces Record the employee payroll expenses and liabilities for the first weekly pay period of the year. Note: Enter debits before credits. Date General Journal Debit Credit Jan 08 Legacy System... 2774::ws191 O'Reilly Parts 09/17/2020 10:13:34 AM Connect - Mo... O'Reilly Parts... DELL PICK TICKET Mozilla Firefox - Home Assignments: ACCTG-4A X Directory Connect + er 9 Homework Sarved Help Save & Exit Submit Check my work 2 Problem 9-2A Entries for payroll transactions LO P2, P3 On January 8, the end of the first weekly pay period of the year, Regis Company's payroll register showed that its employees earned $27,760 of office salaries and $60,840 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.20%, FICA Medicare taxes at the rate of 1.45%, $13,460 of federal income taxes, $1,370 of medical insurance deductions, and $820 of union dues. No employee earned more than $7,000 in this first period. OK E reets Required: 1.1 Calculate below the amounts for each of these four taxes of Regis Company. Regis's merit rating reduces its state unemployment tax rate to 4% of the first $7,000 paid each employee. The federal unemployment tax rate is 0.60%. (Round your answers to 2 decimal places.) Japyary 8 earnings Wubject to tax Tax Rate Tax Amount Regis Company's: Tax FICA-Social Security FICA-Medicare FUTA SUTA Legacy System... 2774::W5191 O'Reilly Parts... 09/17/2020 10:13:24 AM Connect - Mo... O'Reilly Parts... DELL Home X Directory Assignments: ACCTG-4A X Connect + e 9 Homework Saved Help Save & Exit Submit Check my work 1.2 Prepare the journal entry to record Regis Company's January 8 (employee) payroll expenses and liabilities. (Round your answers to 2 decimal places.) View transaction list Journal entry worksheet ces Record the employee payroll expenses and liabilities for the first weekly pay period of the year. Note: Enter debits before credits. Date General Journal Debit Credit Jan 08 Legacy System... 2774::ws191 O'Reilly Parts 09/17/2020 10:13:34 AM Connect - Mo... O'Reilly Parts... DELL PICK TICKET