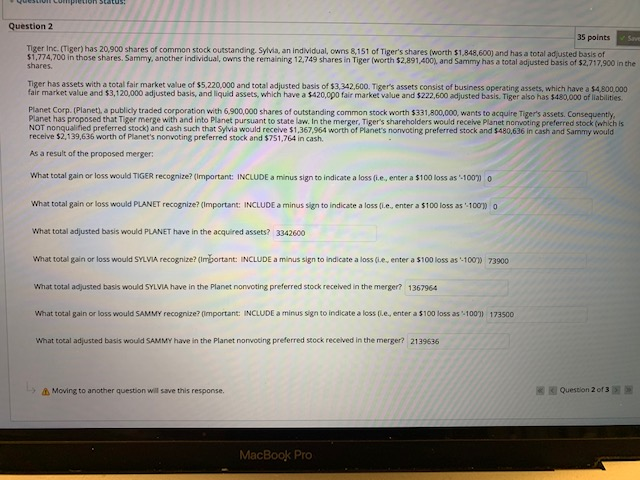

mpietion stal Question 2 35 points Save Tiger Inc. (Tiger) has 20,900 shares of common stock outstanding. Sylvia, an individual, owns 8,151 of Tiger's shares (worth $1.848,600) and has a total adjustted basis of $1,774,700 in those shares. Sammy, another individual, owns the remaining 12,749 shares in Tiger (worth $2,891,400), and Sammy has a total adjusted basis of $2,717,900 in the shares. Tiger has assets with a total fair market value of $5,220,000 and total adjusted basis of $3,342,600. Tiger's assets consist of business operating assets, which have a $4,800,000 fair market value and $3,120,000 adjusted basis, and liquid assets, which have a $420,000 fair market value and $222,600 adjusted basis. Tiger also has $480,,000 of liabilities Planet Corp. (Planet), a publicly traded corporation with 6,900,000 shares of outstanding common stock worth $331,800,000, wants to acquire Tiger's assets. Consequently, Planet has proposed that Tiger merge with and into Planet pursuant to state law. In the merger, Tiger's shareholders would receve Planet norvoting preferred stock (which is NOT nonqualified preferred stock) and cash such that Sylvia would receive $1,367,964 worth of Planet's nonvoting preferred stock and $480,636 in cash and Sammy would receive $2,139,636 worth of Planet's nonvoting preferred stock and $751,764 in cash As a result of the proposed merger What total gain or loss would TIGER recognize? (Important: INCLUDE a minus sign to indicate a loss (i.e, enter a $100 loss as -100) 0 What total gain or loss would PLANET recognize? (Important: INCLUDE a minus sign to indicate a loss (i.e, enter a $100 loss as-100) 0 What total adjusted basis would PLANET have in the acquired assets? 3342600 What total gain or loss would SYLVIA recognize? (Imbortant: INCLUDE a minus sign to indicate a loss (ie, enter a $100 loss as -100) 73900 What total adjusted basis would SYLVIA have in the Planet nonvoting preferred stock received in the merger? 1367964 What total gain or loss would SAMMY recognize? (mportant: INCLUDE a minus sign to indicate a loss (Le, enter a $100 loss as -100) 1735c0 What total adjusted basis would SAMMY have in the Planet nonvocing preferred stock received in the merger? 2139636 Question 2 of 3 &Moving to another question will save this response. MacBook Pro mpietion stal Question 2 35 points Save Tiger Inc. (Tiger) has 20,900 shares of common stock outstanding. Sylvia, an individual, owns 8,151 of Tiger's shares (worth $1.848,600) and has a total adjustted basis of $1,774,700 in those shares. Sammy, another individual, owns the remaining 12,749 shares in Tiger (worth $2,891,400), and Sammy has a total adjusted basis of $2,717,900 in the shares. Tiger has assets with a total fair market value of $5,220,000 and total adjusted basis of $3,342,600. Tiger's assets consist of business operating assets, which have a $4,800,000 fair market value and $3,120,000 adjusted basis, and liquid assets, which have a $420,000 fair market value and $222,600 adjusted basis. Tiger also has $480,,000 of liabilities Planet Corp. (Planet), a publicly traded corporation with 6,900,000 shares of outstanding common stock worth $331,800,000, wants to acquire Tiger's assets. Consequently, Planet has proposed that Tiger merge with and into Planet pursuant to state law. In the merger, Tiger's shareholders would receve Planet norvoting preferred stock (which is NOT nonqualified preferred stock) and cash such that Sylvia would receive $1,367,964 worth of Planet's nonvoting preferred stock and $480,636 in cash and Sammy would receive $2,139,636 worth of Planet's nonvoting preferred stock and $751,764 in cash As a result of the proposed merger What total gain or loss would TIGER recognize? (Important: INCLUDE a minus sign to indicate a loss (i.e, enter a $100 loss as -100) 0 What total gain or loss would PLANET recognize? (Important: INCLUDE a minus sign to indicate a loss (i.e, enter a $100 loss as-100) 0 What total adjusted basis would PLANET have in the acquired assets? 3342600 What total gain or loss would SYLVIA recognize? (Imbortant: INCLUDE a minus sign to indicate a loss (ie, enter a $100 loss as -100) 73900 What total adjusted basis would SYLVIA have in the Planet nonvoting preferred stock received in the merger? 1367964 What total gain or loss would SAMMY recognize? (mportant: INCLUDE a minus sign to indicate a loss (Le, enter a $100 loss as -100) 1735c0 What total adjusted basis would SAMMY have in the Planet nonvocing preferred stock received in the merger? 2139636 Question 2 of 3 &Moving to another question will save this response. MacBook Pro