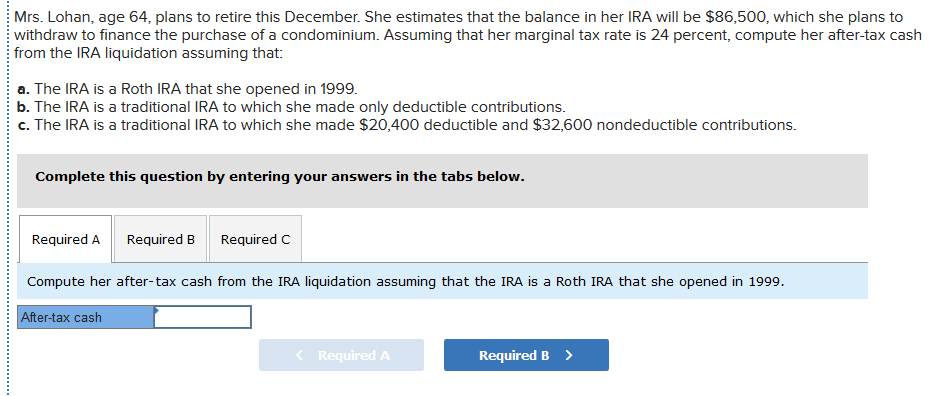

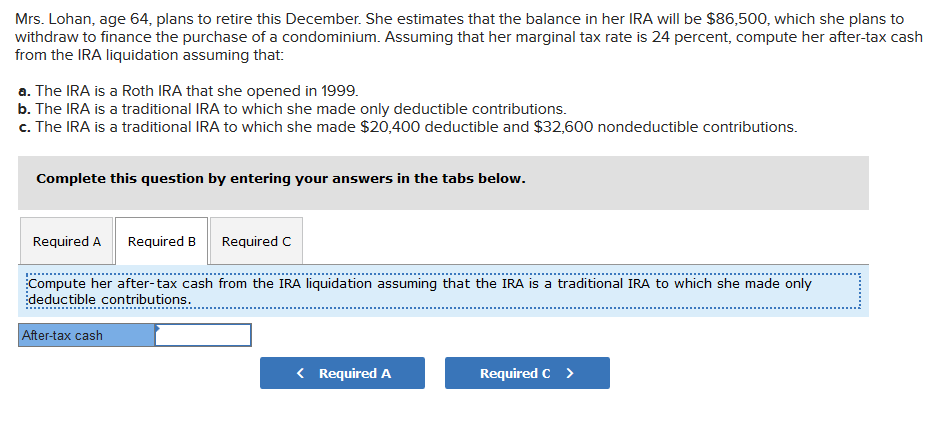

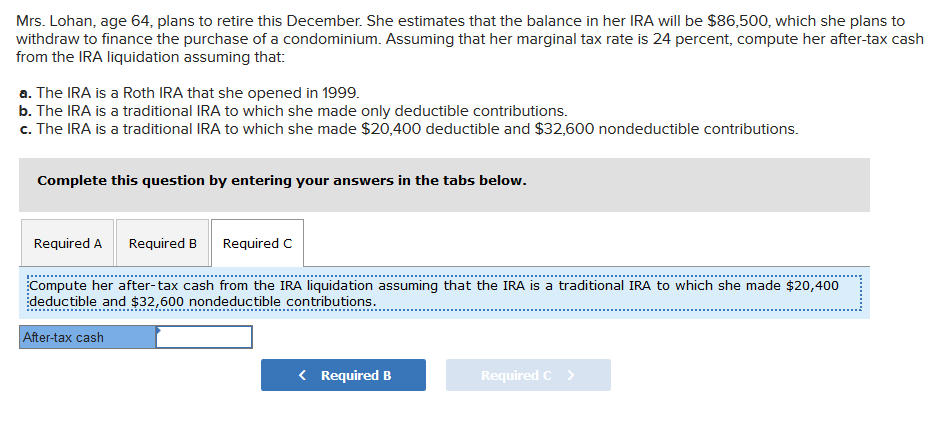

Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999. b. The IRA is a traditional IRA to which she made only deductible contributions c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a Roth IRA that she opened in 1999 er-tax cash Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999. b. The IRA is a traditional IRA to which she made only deductible contributions. c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a traditional IRA to which she made only deductible contributions After-tax cash Required A Required C> Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999 b. The IRA is a traditional IRA to which she made only deductible contributions. c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. er-tax cash Required B Requiredc Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999. b. The IRA is a traditional IRA to which she made only deductible contributions c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a Roth IRA that she opened in 1999 er-tax cash Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999. b. The IRA is a traditional IRA to which she made only deductible contributions. c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a traditional IRA to which she made only deductible contributions After-tax cash Required A Required C> Mrs. Lohan, age 64, plans to retire this December. She estimates that the balance in her IRA will be $86,500, which she plans to withdraw to finance the purchase of a condominium. Assuming that her marginal tax rate is 24 percent, compute her after-tax cash from the IRA liquidation assuming that: a. The IRA is a Roth IRA that she opened in 1999 b. The IRA is a traditional IRA to which she made only deductible contributions. c. The IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions Complete this question by entering your answers in the tabs below Required A Required B Required C Compute her after-tax cash from the IRA liquidation assuming that the IRA is a traditional IRA to which she made $20,400 deductible and $32,600 nondeductible contributions. er-tax cash Required B Requiredc