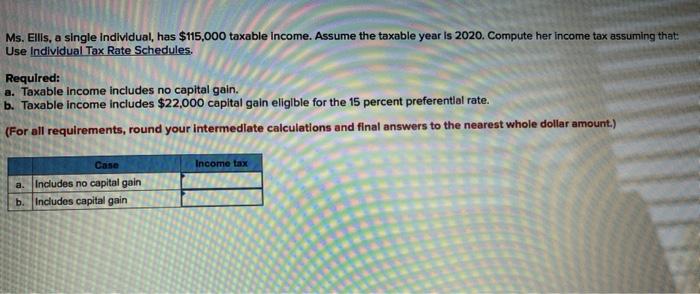

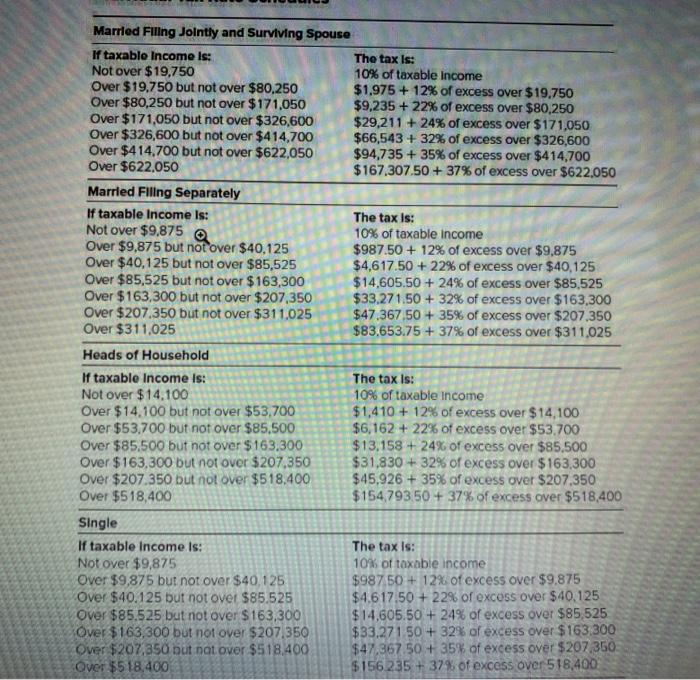

Ms. Ellis, a single individual, has $115,000 taxable income. Assume the taxable year is 2020. Compute her income tax assuming that: Use Individual Tax Rate Schedules. Required: a. Taxable income includes no capital gain. b. Taxable income includes $22,000 capital gain eligible for the 15 percent preferential rate. (For all requirements, round your intermediate calculations and final answers to the nearest whole dollar amount.) Income tax Case a. Includes no capital gain b. Includes capital gain Married Filing Jointly and Surviving Spouse If taxablo Income is: The tax is: Not over $19,750 10% of taxable income Over $19.750 but not over $80,250 $1,975 + 12% of excess over $19.750 Over $80,250 but not over $171,050 $9.235 + 22% of excess over $80,250 Over $171,050 but not over $326,600 $29,211 + 24% of excess over $171,050 Over $326,600 but not over $414,700 $66,543 + 32% of excess over $326,600 Over $414,700 but not over $622,050 $94,735 + 35% of excess over $414,700 Over $622,050 $167,307,50 + 37% of excess over $622,050 Married Flling Separately If taxable income is: The tax is: Not over $9,875 a 10% of taxable income Over $9,875 but not over $40,125 $987.50 + 12% of excess over $9,875 Over $40,125 but not over $85,525 $4,617,50 + 22% of excess over $40,125 Over $85,525 but not over $ 163,300 $14,605.50 +24% of excess over $85,525 Over $163,300 but not over $207,350 $33.271.50 + 32% of excess over $163,300 Over $207.350 but not over $311,025 $47.367,50 + 35% of excess over $207,350 Over $311,025 $83.653.75 + 37% of excess over $311,025 Heads of Household If taxable income is: The tax is: Not over $14,100 10% of taxable income Over $14,100 but not over $53.700 $1,410 + 12% of excess over $14,100 Over $53,700 but not over $85,500 $6,162 + 22% of excess over $53.700 Over $85,500 but not over $163.300 $13,158 + 24% of excess over $85,500 Over $163,300 but not over $207,350 $31,830 + 32% of excess over $ 163,300 Over $207.350 but not over $518.400 $45,926 + 35% of excess over $207,350 Over $518,400 $154,793.50 + 37% of excess over $518,400 Single If taxable income is: The tax is: Not over $9,875 10% of toxable income Over $9,875 but not over $40,125 $98750 + 12% of excess over $9.875 Over $40.125 but not over $85.525 $4.617.50 +22% of excess over $40.125 Over $85.525 but not over $ 163,300 $14,605.50 +24% of excess over $85,525 Over $163,300 but not over $207 350 $33.27150 + 32% of excess over $163,300 Over $207.850 but not over $518.400 $47,867.50 + 35% of excess over $207,350 Over $518,400 $156 235 + 37% of excess over 518,400