Answered step by step

Verified Expert Solution

Question

1 Approved Answer

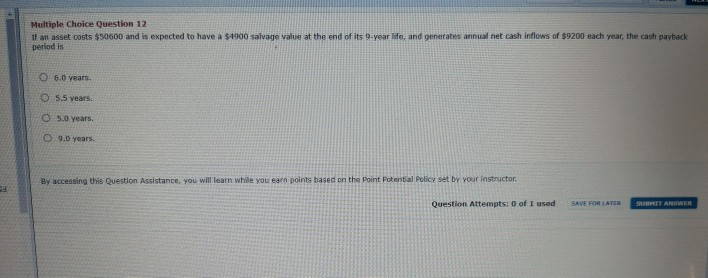

Multiple Choice Question 12 If an asset costs $50600 and is expected to have a $4900 salvage value at the end of its 9-year life,

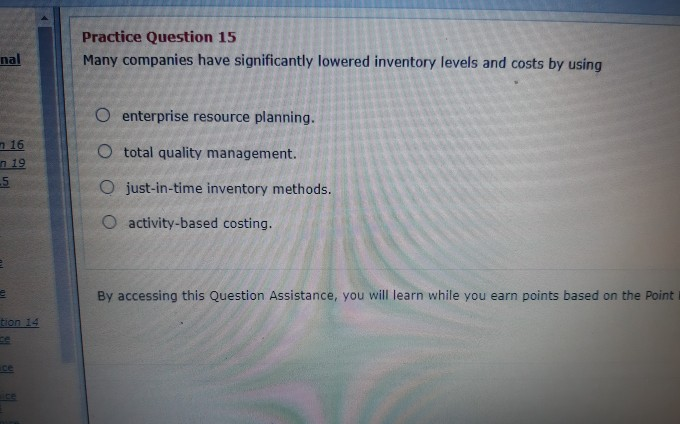

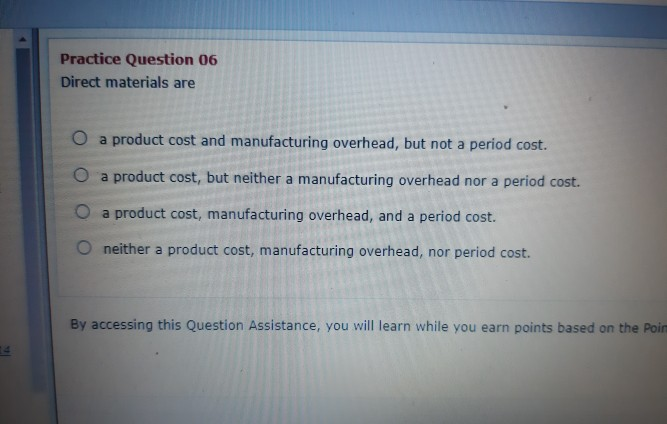

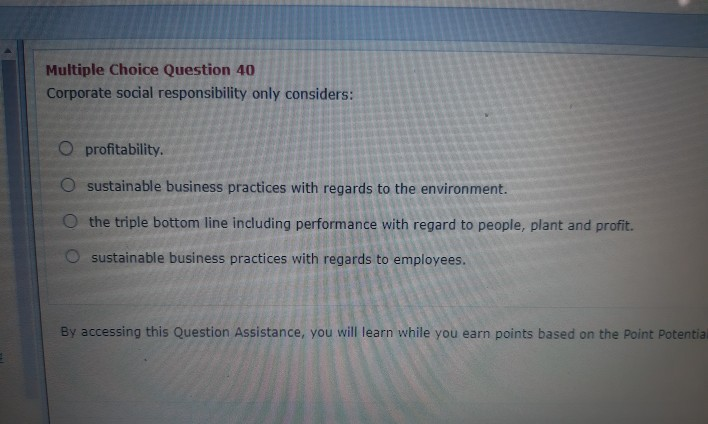

Multiple Choice Question 12 If an asset costs $50600 and is expected to have a $4900 salvage value at the end of its 9-year life, and generates annual net cash inflows of $9200 each year, the cash payback period is 6.0 years. 5.5 years. 5.0 years. 9.0 years By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor Question Attempts: 0 of 1 used SAVE FOR LATER SUBMET ANSWER Practice Question 15 Many companies have significantly lowered inventory levels and costs by using nal O enterprise resource planning. 216 O total quality management. n 19 5 O just-in-time inventory methods. O activity-based costing. By accessing this Question Assistance, you will learn while you earn points based on the Point Practice Question 06 Direct materials are O a product cost and manufacturing overhead, but not a period cost. O a product cost, but neither a manufacturing overhead nor a period cost. a product cost, manufacturing overhead, and a period cost. neither a product cost, manufacturing overhead, nor period cost. By accessing this Question Assistance, you will learn while you earn points based on the Poir Multiple Choice Question 40 Corporate social responsibility only considers: profitability. O sustainable business practices with regards to the environment. O the triple bottom line including performance with regard to people, plant and profit. sustainable business practices with regards to employees. By accessing this Question Assistance, you will learn while you earn points based on the Point Potential

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started