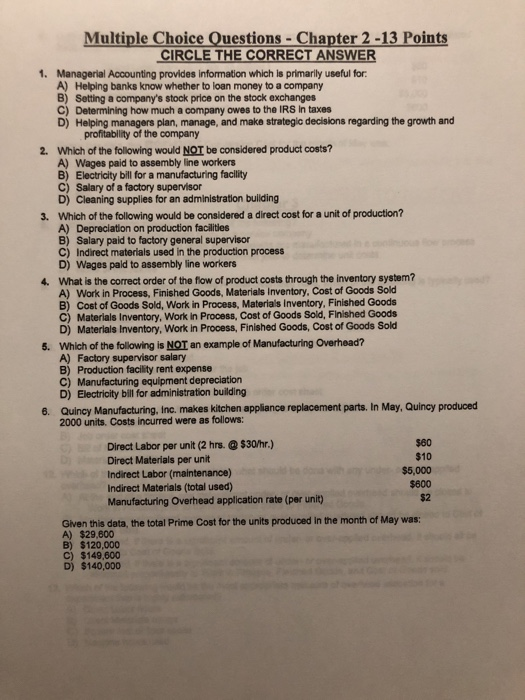

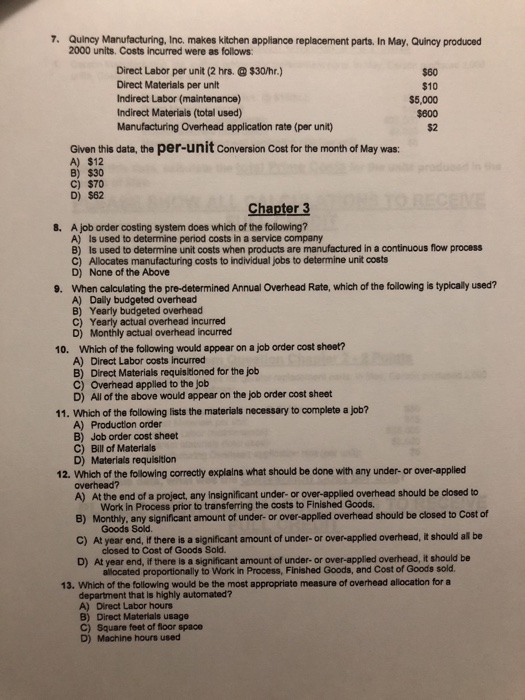

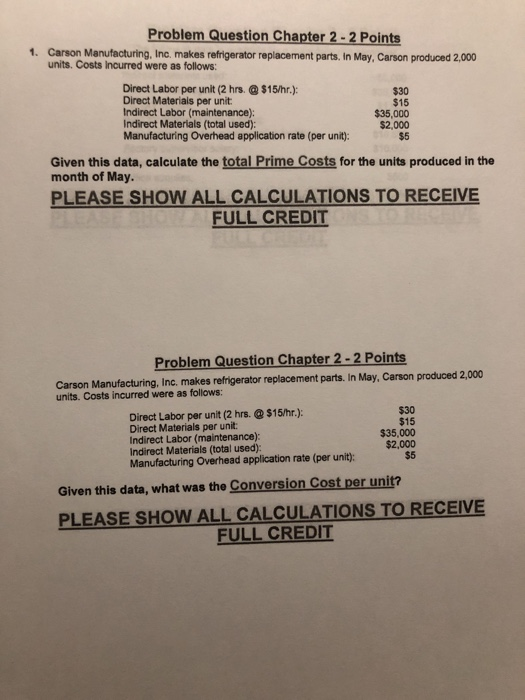

Multiple Choice Questions - Chapter 2-13 Points CIRCLE THE CORRECT ANSWER 1. Managerial Accounting provides information which is primarily useful for A) Helping banks know whether to loan money to a company B) Setting a company's stock price on the stock exchanges C) Determining how much a company owes to the IRS In taxes D) Helping managers plan, manage, and make strategio decisions regarding the growth and profitability of the company Which of the following would NOT be considered product costs? A) Wages paid to assembly line workers B) Electricity bill for a manufacturing faclity C) Salary of a factory supervisor D) Cleaning supplies for an administration building 2. Which of the following would be considered a direct cost for a unit of production? A) Depreciation on production facilities B) Salary paid to factory general supervisor C) Indirect materials used in the production process D) Wages pald to assembly line workers 3. 4. What is the correct order of the flow of product costs through the inventory system? A) Work in Process, Finished Goods, Materials Inventory, Cost of Goods Sold B) Cost of Goods Sold, Work in Process, Materials Inventory, Finished Goods C) Materials Inventory, Work in Process, Cost of Goods Soid, Finished Goods D) Materials Inventory, Work in Process, Finished Goods, Cost of Goods Sold Which of the following is NOI an example of Manufacturing Overhead? A) Factory supervisor salary B) Production facility rent expense C) Manufacturing equipment depreciation D) Electricity bill for administration building 5. 6. Quinoy Manufacturing, inc. makes kitchen appliance replacement parts. In May, Quincy produced 2000 units. Costs incurred were as follows: Direct Labor per unit (2 hrs.$30/hr.) Direct Materials per unit Indirect Labor (maintenance) Indirect Materials (total used) Manufacturing Overhead application rate (per unit) $60 $10 $5,000 $600 $2 Given this data, the total Prime Cost for the units produced in the month of May was A) $29,600 B) $120,000 C) $149,600 D) $140,000 Quincy Manufacturing, Inc. makes kitchen appliance replacement parts. In May, Quincy produced 2000 units. Costs incurred were as follows 7. Direct Labor per unit (2 hrs. $30/hr.) Direct Materials per unlt Indirect Labor (maintenance) Indirect Materials (total used) Manufacturing Overhead application rate (per unit) $60 $10 $5,000 $600 $2 Given this data, the per-unit Conversion Cost for the month of May was: A) $12 B) $30 C) $70 D) $62 Chapter 3 A job order costing system does which of the following? A) 8. Is used to determine period costs in a service company Is used to determine unit costs when products are manufactured in a continuous flow process Allocates manufacturing costs to individual jobs to determine unit costs None of the Above C) D) 9. When calculating the pre-determined Annual Overhead Rate, which of the following is typically used? A) Dally budgeted overhead B) Yearly budgeted overhead C) Yearly actual overhead incurred D) Monthly actual overhead incurred Which of the following would appear on a job order cost sheet? A) Direct Labor costs incurred B) Direct Materials requisitioned for the job C) Overhead applied to the job D) Al of the above would appear on the job order cost sheet 10. 11. Which of the following lists the materials necessary to complete a job? A) Production order B) Job order cost sheet C) Bill of Materials D) Materials requisition 12. Which of the following correcty explains what should be done with any under-or over-applied overhead? A) At the end of a project, any insignificant under- or over-applied overhead should be closed to Work in Process prior to transferring the costs to Finished Goods. Goods Sold. closed to Cost of Goods Sold. B) Monthly, any significant amount of under- or over-applied overhead should be closed to Cost cf C) At year end, there is a significant amount of under-or over-applied overhead,it should al be D) At year end, if there is a significant amount of under- or over-applied overhead, it should be allocated proportionally to Work in Process, Finished Goods, and Cost of Goods sold. 13. Which of the following would be the most appropriate measure of overhead allocation for a department that is highly automated? A) Direct Labor hours B) Direct Materials usage C) Square feet of floor space D) Machine hours used Problem Question Chapter 2-2 Points 1. Carson Manufacturing, Inc. makes refrigerator replacement parts. In May, Carson produced 2,000 units. Costs Incurred were as follows Direct Labor per unit (2 hrs.@$15/hr.) Direct Materials per unit Indirect Labor (maintenance): Indirect Materials (total used): Manufacturing Overhead application rate (per unit): $30 $15 $35,000 $2,000 $5 Given this data, calculate the total Prime Costs for the units produced in the month of May. PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT Problem Question Chapter 2-2 Points Carson Manufacturing, Inc. makes refrigerator replacement parts. In May, Carson produced 2,000 units. Costs incurred were as follows: Direct Labor per unit (2 hrs. $15/hr.): Direct Materials per unit: Indirect Labor (maintenance): Indirect Materials (total used) Manufacturing Overhead application rate (per unit): $30 $15 $35,000 $2,000 $5 Given this data, what was the Conversion Cost per unit? PLEASE SHOW ALL CALCULATIONS TO RECEIVE FULL CREDIT