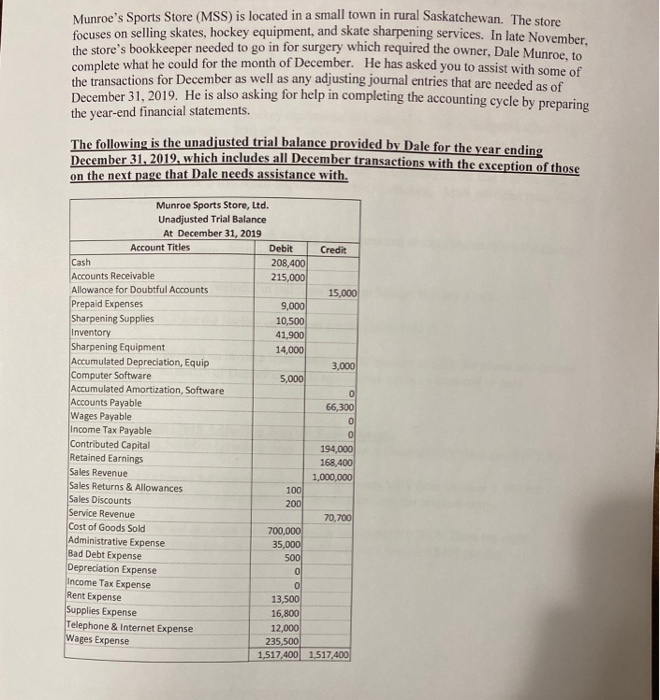

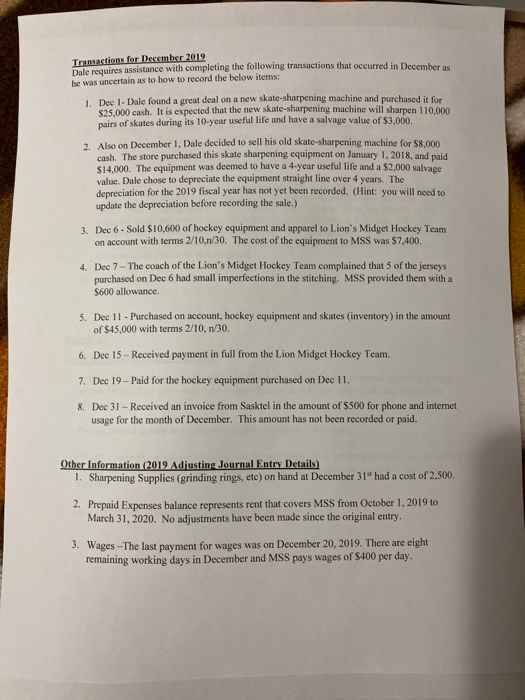

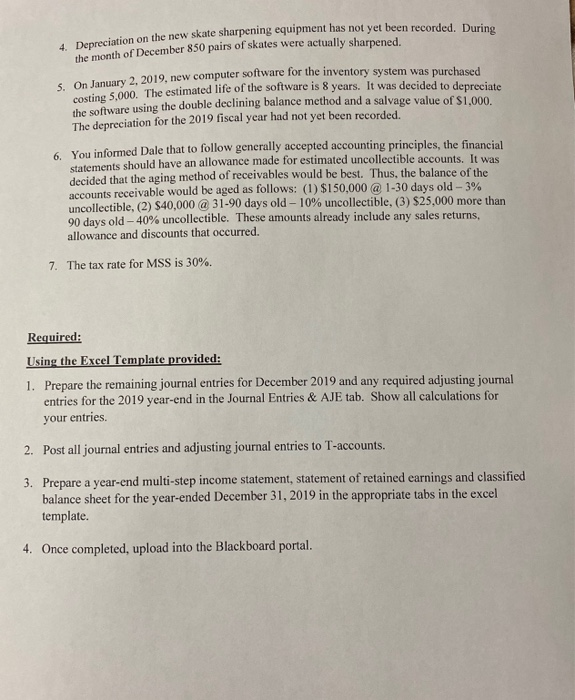

Munroe's Sports Store (MSS) is located in a small town in rural Saskatchewan. The sto focuses on selling skates, hockey equipment, and skate sharpening services. In late Novemb the store's bookkeeper needed to go in for surgery which required the owner, Dale Munroe complete what he could for the month of December. He has asked you to assist with some of the transactions for December as well as any adjusting journal entries that are needed as of umber 31, 2019. He is also asking for help in completing the accounting cycle by preparing the year-end financial statements. The following is the unadjusted trial balance provided by Dale for the yea al Dalance provided by Dale for the year ending her 31. 2019, which includes all December transactions with the exception of those on the next page that Dale needs assistance with. Credit 15,000 3,000 66,300 Munroe Sports Store, Ltd. Unadjusted Trial Balance At December 31, 2019 Account Titles Debit Cash 208,400 Accounts Receivable 215,000 Allowance for Doubtful Accounts Prepaid Expenses 9,000 Sharpening Supplies 10,500 Inventory 41,900 Sharpening Equipment 14,000 Accumulated Depreciation, Equip Computer Software 5,000 Accumulated Amortization, Software Accounts Payable Wages Payable Income Tax Payable Contributed Capital Retained Earnings Sales Revenue Sales Returns & Allowances Sales Discounts 200 Service Revenue Cost of Goods Sold 700.000 Administrative Expense 35,000 Bad Debt Expense 500 Depreciation Expense Income Tax Expense Rent Expense 13,500 Supplies Expense 16,800 Telephone & Internet Expense 12,000 Wages Expense 235,500 1,517,400 194,000 168,400 1,000,000 100 70,700 1,517,400 Transactions for Desember 2019 Dale requires assistance with completing the following transactions that occurred in December he was uncertain as to how to record the below items: 1. Dec - Dale found a great deal on a new skate-sharpening machine and purchased it for $25.000 cash. It is expected that the new skate-sharpening machine will sharpen 110.000 pairs of skates during its 10-year useful life and have a salvage value of $3.000 Also on December 1, Dale decided to sell his old skate-sharpening machine for $8.000 cash. The store purchased this skate sharpening equipment on January 1, 2018, and paid $14,000. The equipment was deemed to have a 4-year useful life and a $2,000 salvage value. Dale chose to depreciate the equipment straight line over 4 years. The depreciation for the 2019 fiscal year has not yet been recorded. (Hint: you will need to update the depreciation before recording the sale.) 3. Dec 6 - Sold $10.600 of hockey equipment and apparel to Lion's Midget Hockey Team on account with terms 2/10./30. The cost of the cquipment to MSS was $7,400. 4. Dec 7 - The coach of the Lion's Midget Hockey Team complained that 5 of the jerseys purchased on Dec 6 had small imperfections in the stitching. MSS provided them with a $600 allowance. 5. Dec 11 - Purchased on account, hockey equipment and skates (inventory) in the amount of $45,000 with terms 2/10, n/30. 6. Dec 15 - Received payment in full from the Lion Midget Hockey Team. 7. Dec 19 - Paid for the hockey equipment purchased on Dec 11. 8. Dec 31 - Received an invoice from Sasktel in the amount of $500 for phone and internet usage for the month of December. This amount has not been recorded or paid. Other Information 2019 Adjusting Journal Entry Details) 1. Sharpening Supplies (grinding rings, etc) on hand at December 31" had a cost of 2.500. 2. Prepaid Expenses balance represents rent that covers MSS from October 1, 2019 to March 31, 2020. No adjustments have been made since the original entry. 3. Wages -The last payment for wages was on December 20, 2019. There are eight remaining working days in December and MSS pays wages of $400 per day. Danneciation on the new Skate Sharpening equipment has not yet been recorded Du the month of December 850 pairs of skates were actually sharpened. s On January 2, 2019, new computer software for the inventory system was purchased The estimated life of the software is 8 years. It was decided to denrecinte the software using the double declining balance method and a salvage value of $1.000 The depreciation for the 2019 fiscal year had not yet been recorded. 6. You informed Dale that to follow generally accepted accounting principles, the financial statements should have an allowance made for estimated uncollectible accounts. It was decided that the aging method of receivables would be best. Thus, the balance of the accounts receivable would be aged as follows: (1) $150,000 @ 1-30 days old - 3% uncollectible, (2) $40,000 @ 31-90 days old - 10% uncollectible, (3) $25,000 more than 90 days old -40% uncollectible. These amounts already include any sales returns, allowance and discounts that occurred. 7. The tax rate for MSS is 30%. Required: Using the Excel Template provided: 1. Prepare the remaining journal entries for December 2019 and any required adjusting journal entries for the 2019 year-end in the Journal Entries & AJE tab. Show all calculations for your entries. 2. Post all journal entries and adjusting journal entries to T-accounts. 3. Prepare a year-end multi-step income statement, statement of retained earnings and classified balance sheet for the year-ended December 31, 2019 in the appropriate tabs in the excel template. 4. Once completed, upload into the Blackboard portal