Must 11 quick multiple choice!!

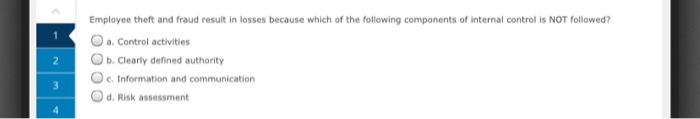

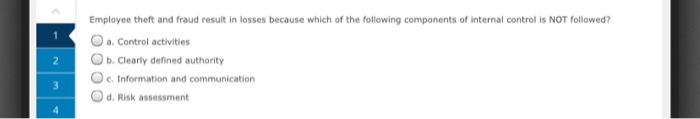

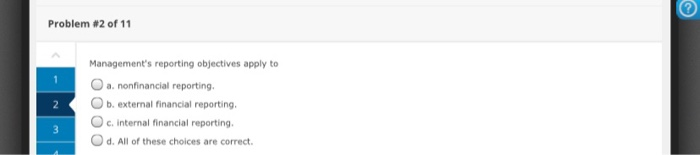

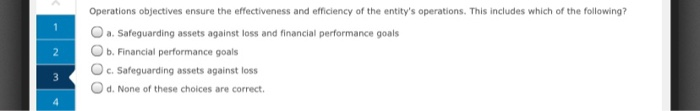

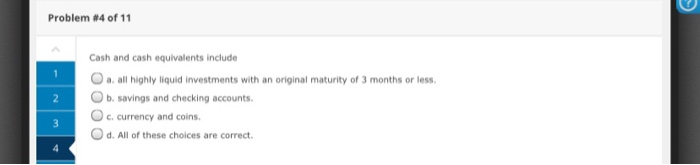

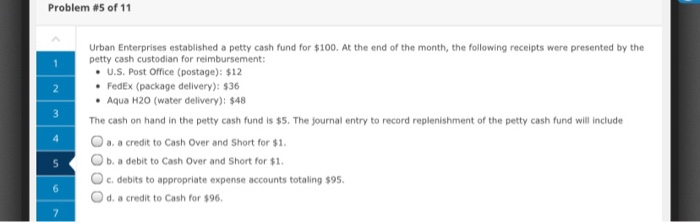

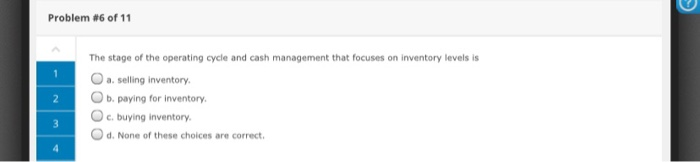

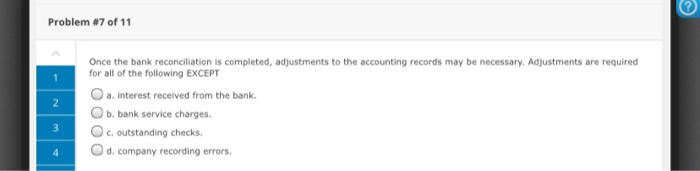

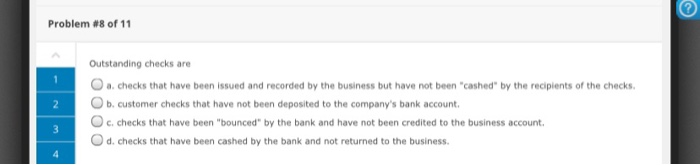

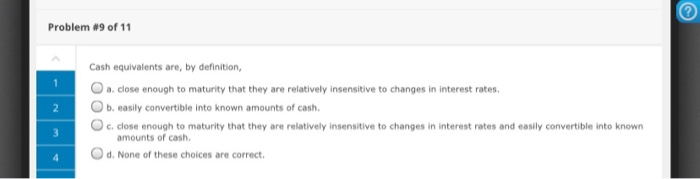

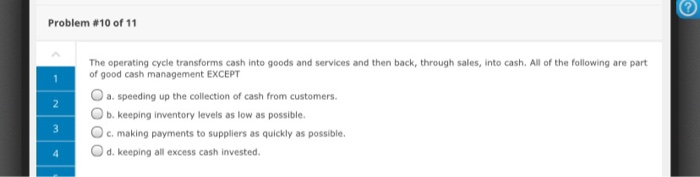

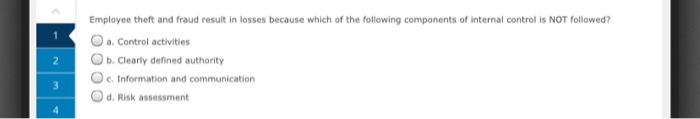

Employee theft and fraud result in losses because which of the following components of internal control is NOT followed? O a Control activities b. Clearly defined authority c. Information and communication 2 3 Oo d. Risk assessment Problem #2 of 11 1 2 Management's reporting objectives apply to a nonfinancial reporting, b. external financial reporting. c. internal financial reporting, d. All of these choices are correct. 3 0 1 2 Operations objectives ensure the effectiveness and efficiency of the entity's operations. This includes which of the following? a. Safeguarding assets against loss and financial performance goals Ob. Financial performance goals O c. Safeguarding assets against loss d. None of these choices are correct. 3 4 Problem #4 of 11 1 Cash and cash equivalents include a all highly liquid investments with an original maturity of 3 months or less. b. savings and checking accounts. c. currency and coins 2 3 d. All of these choices are correct. Problem #5 of 11 1 2 3 Urban Enterprises established a petty cash fund for $100. At the end of the month, the following receipts were presented by the petty cash custodian for reimbursement: U.S. Post Office (postage): $12 FedEx (package delivery): $36 Aqua H20 (water delivery): $48 The cash on hand in the petty cash fund is $. The journal entry to record replenishment of the petty cash fund will include Oa a credit to Cash Over and Short for $1. b. a debit to Cash Over and Short for $1. c. debits to appropriate expense accounts totaling $95. d. a credit to Cash for $96. 4 un 6 7 Problem #6 of 11 1 2 The stage of the operating cycle and cash management that focuses on inventory levels is a. selling inventory O b. paying for inventory. c. buying inventory d. None of these choices are correct. 3 Problem #7 of 11 1 2 Once the bank reconciliation is completed, adjustments to the accounting records may be necessary. Adjustments are required for all of the following EXCEPT a. Interest received from the bank. Ob bank service charges. c. outstanding checks d. company recording errors. 3 4 Problem #8 of 11 1 Outstanding checks are a.checks that have been issued and recorded by the business but have not been "cashed" by the recipients of the checks. b. customer checks that have not been deposited to the company's bank account O c.checks that have been "bounced" by the bank and have not been credited to the business account. Od checks that have been cashed by the bank and not returned to the business. 2 3 4 Problem #9 of 11 1 2 Cash equivalents are, by definition, a close enough to maturity that they are relatively insensitive to changes in interest rates. Ob easily convertible into known amounts of cash. c. close enough to maturity that they are relatively insensitive to changes in interest rates and easily convertible into known amounts of cash Od. None of these choices are correct. 3 4 Problem #10 of 11 1 2 The operating cycle transforms cash into goods and services and then back, through sales, into cash. All of the following are part of good cash management EXCEPT a. speeding up the collection of cash from customers. Ob. keeping inventory levels as low as possible. c. making payments to suppliers as quickly as possible. d. keeping all excess cash invested. 3 4 Problem #11 of 11 1 2 All of the following are strategic risks EXCEPT a. competitors. b. employees. c. the economic environment. d. customers 4