Answered step by step

Verified Expert Solution

Question

1 Approved Answer

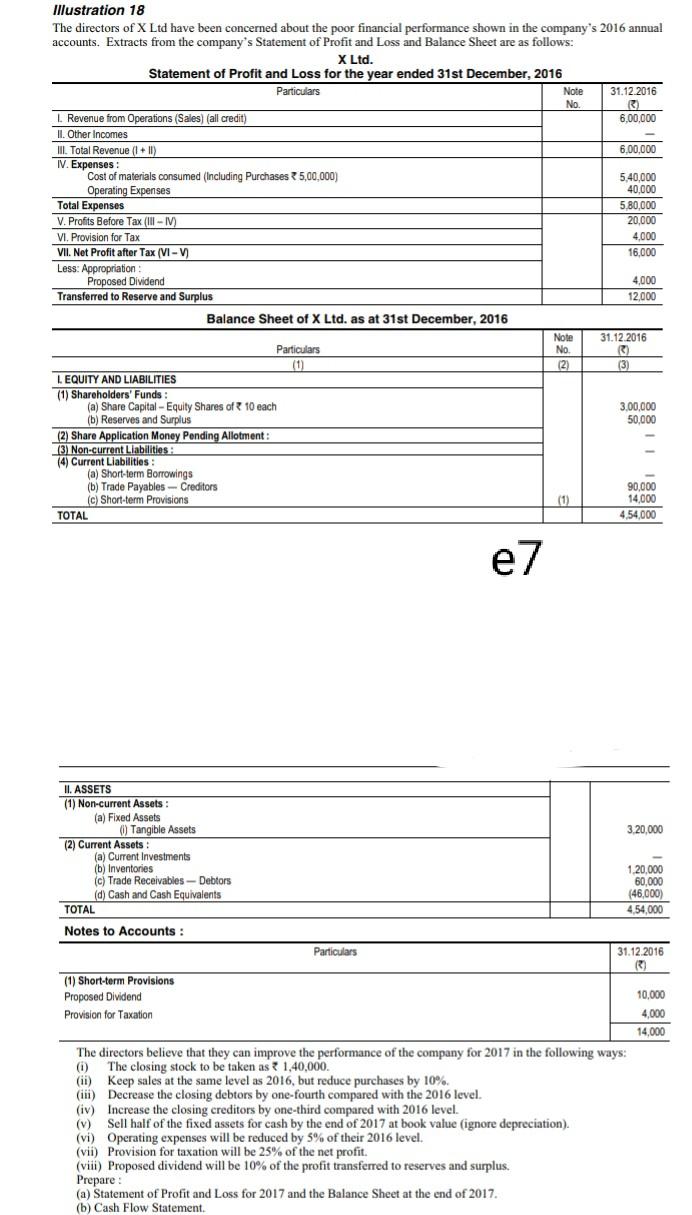

Mustration 18 The directors of X Ltd have been concerned about the poor financial performance shown in the company's 2016 annual accounts. Extracts from the

Mustration 18 The directors of X Ltd have been concerned about the poor financial performance shown in the company's 2016 annual accounts. Extracts from the company's Statement of Profit and Loss and Balance Sheet are as follows: X Ltd. Statement of Profit and Loss for the year ended 31st December, 2016 Particulars Note 31.12.2016 No. R3) L Revenue from Operations (Sales) (all credit) 6,00,000 II. Other Incomes III. Total Revenue (1 + II) 6,00,000 IV. Expenses Cost of materials consumed (Including Purchases 5,00,000) 5,40,000 Operating Expenses 40.000 Total Expenses 5,80,000 V. Profits Before Tax (III-IV) 20,000 VI. Provision for Tax 4,000 VII. Net Profit after Tax (VI-V 16,000 Less: Appropriation Proposed Dividend 4,000 Transferred to Reserve and Surplus 12.000 Balance Sheet of X Ltd. as at 31st December, 2016 Note 31.12.2016 Particulars No (3) (1) (2) (3) LEQUITY AND LIABILITIES (1) Shareholders' Funds (a) Share Capital - Equity Shares of 10 each 3,00,000 (b) Reserves and Surplus 50,000 (2) Share Application Money Pending Allotment (3) Non-current Liabilities: (4) Current Liabilities: (a) Short-term Borrowings (b) Trade Payables - Creditors 90,000 (c) Short-term Provisions 14,000 TOTAL 454.000 e7 3.20,000 II. ASSETS (1) Non-current Assets (a) Fixed Assets Tangible Assets (2) Current Assets (a) Current Investments (b) Inventories (c) Trade Receivables - Debtors (d) Cash and Cash Equivalents ) TOTAL 1.20,000 60,000 (46,000) 4,54,000 Notes to Accounts: Particulars 31.12.2016 (1) Short-term Provisions - Proposed Dividend Provision for Taxation 10,000 4,000 14,000 The directors believe that they can improve the performance of the company for 2017 in the following ways: (1) The closing stock to be taken as 1,40,000. (ii) Keep sales at the same level as 2016, but reduce purchases by 10%. (iii) Decrease the closing debtors by one-fourth compared with the 2016 level. (iv) Increase the closing creditors by one-third compared with 2016 level. (v) Sell half of the fixed assets for cash by the end of 2017 at book value (ignore depreciation). (vi) Operating expenses will be reduced by 5% of their 2016 level. (vii) Provision for taxation will be 25% of the net profit. (viii) Proposed dividend will be 10% of the profit transferred to reserves and surplus. Prepare : (a) Statement of Profit and Loss for 2017 and the Balance Sheet at the end of 2017. (b) Cash Flow Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started