Question

Name the company or companies its CFCs and state what functions they perform. (According to the diagrams, using Subpart F's Foreign Based Company Services Income,

Name the company or companies its CFCs and state what functions they perform.

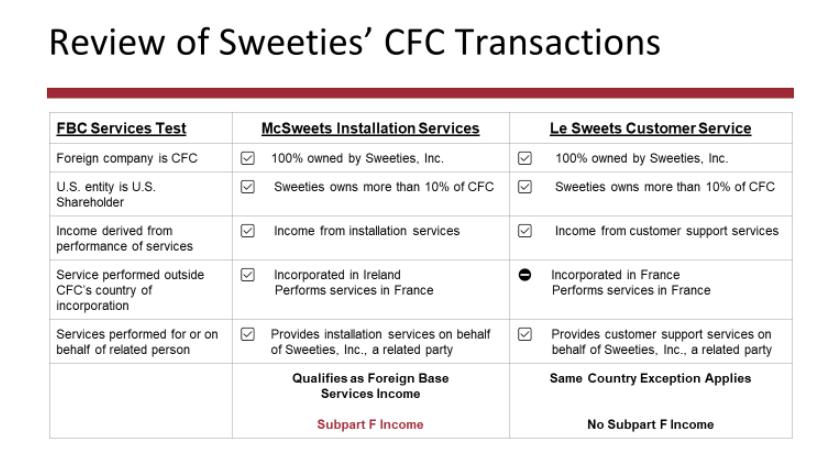

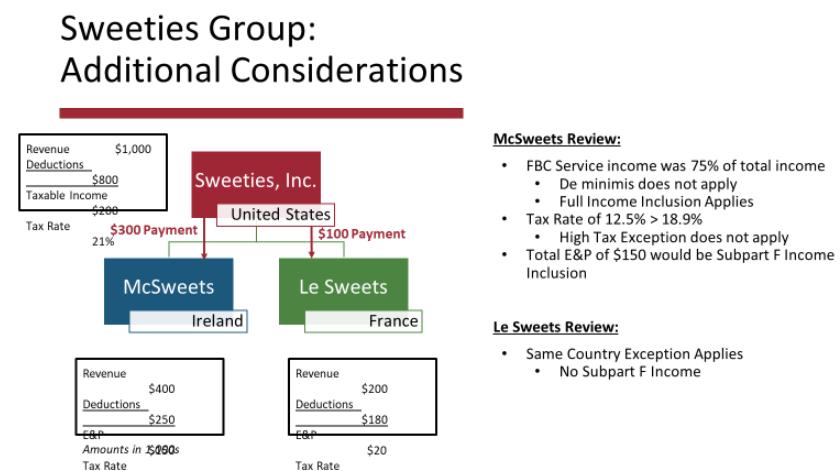

(According to the diagrams, using Subpart F's Foreign Based Company Services Income, analyze their cross functions between the US based co and its CFCs by also adding GILTI and the Participation Exemption.)

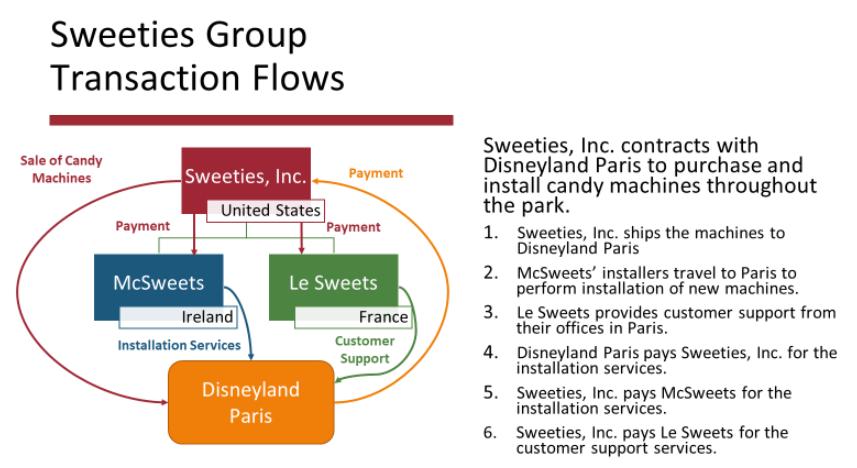

Case Study: Sweeties, Inc. Sweeties multinational company group, specializing in the production and installation of large candy machines. Sweeties, Inc. - Parent company and Manufacturer of candy machines McSweets - Provides Installation Services Le Sweets - Provides Customer Service Sweeties, Inc. McSweets Ireland United States Le Sweets France

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The company in question is Sweeties Inc which serves as the parent company and manufacturer of candy ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Management Science A Modeling And Cases Studies Approach With Spreadsheets

Authors: Frederick S. Hillier, Mark S. Hillier

5th Edition

978-0077825560, 78024064, 9780077498948, 007782556X, 77498941, 978-0078024061

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App