Answered step by step

Verified Expert Solution

Question

1 Approved Answer

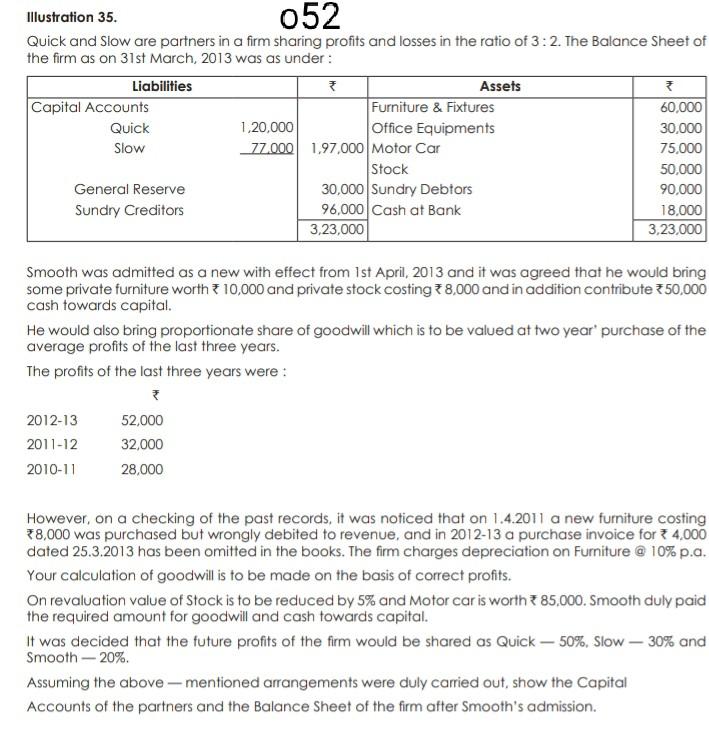

ndn Illustration 35. 052 Quick and Slow are partners in a firm sharing profits and losses in the ratio of 3:2. The Balance Sheet of

ndn

Illustration 35. 052 Quick and Slow are partners in a firm sharing profits and losses in the ratio of 3:2. The Balance Sheet of the firm as on 31st March, 2013 was as under: Liabilities Assets Capital Accounts Furniture & Fixtures 60,000 Quick 1,20,000 Office Equipments 30,000 Slow 77.000 1.97,000 Motor Car 75,000 Stock 50,000 General Reserve 30,000 Sundry Debtors 90,000 Sundry Creditors 96,000 Cash at Bank 18.000 3,23,000 3,23,000 Smooth was admitted as a new with effect from 1st April, 2013 and it was agreed that he would bring some private furniture worth = 10,000 and private stock costing 78,000 and in addition contribute 350,000 cash towards capital. He would also bring proportionate share of goodwill which is to be valued at two year' purchase of the average profits of the last three years. The profits of the last three years were : 2012-13 2011-12 2010-11 52,000 32,000 28,000 However, on a checking of the past records, it was noticed that on 1.4.2011 a new furniture costing 38,000 was purchased but wrongly debited to revenue, and in 2012-13 a purchase invoice for 4.000 dated 25.3.2013 has been omitted in the books. The firm charges depreciation on Furniture @ 10% p.a. Your calculation of goodwill is to be made on the basis of correct profits. On revaluation value of Stock is to be reduced by 5% and Motor car is worth 85.000. Smooth duly paid the required amount for goodwill and cash towards capital. It was decided that the future profits of the firm would be shared as Quick 50%, Slow 30% and Smooth - 20% Assuming the above-mentioned arrangements were duly carried out, show the Capital Accounts of the partners and the Balance Sheet of the firm after Smooth's admissionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started