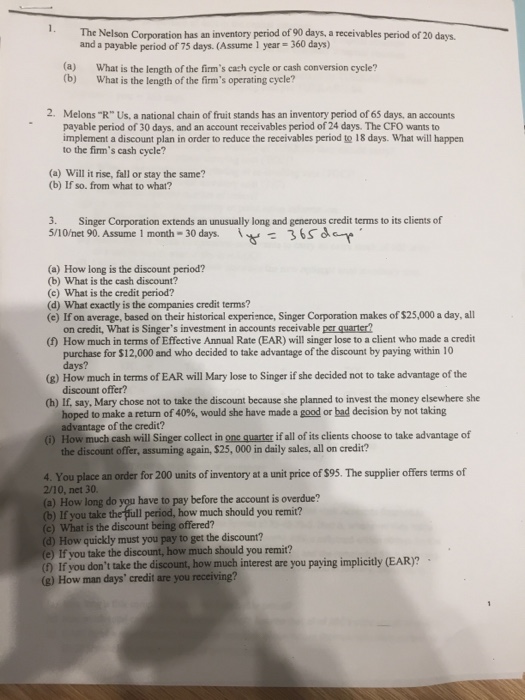

Need answers to these questions

The Nelson Corporation has an inventory period of 90 days, a receivables period of 20 days a payable period of 75 days. (Assume 1 year - 360 days) What is the length of the firm's cash cycle or cash conversion cycle? What is the length of the firm's operating cycle? Melons "R" Us, a national chain of fruit stands has an inventory period of 65 days, an accounts payable period of 30 days, and an account receivables period of 24 days. The CFO wants to implement a discount plan in order to reduce the receivables period to 18 days. What will happen to the firm's cash cycle? Will it rise, fall or stay the same? If so. from what to what? Singer Corporation extends an unusually long and generous credit terms to its clients of 5/10et 90. Assume 1 month = 30 days. How long is the discount period? What is the cash discount? What is the credit period? What exactly is the companies credit terms? If on average, based on their historical experience. Singer Corporation makes of $25,000 a day, all on credit. What is Singer's investment in accounts receivable per quarter? How much in terms of Effective Annual Rate (EAR) will singer lose to a client who made a credit purchase for $12,000 and who decided to take advantage of the discount by paying within 10 days? How much in terms of EAR will Mary lose to Singer if she decided not to take advantage of the discount offer? If, say, Mary chose not to take the discount because she planned to invest the money elsewhere she hoped to make a return of 40%, would she have made a good or decision by not taking advantage of the credit? How much cash will Singer collect in one quarter if all of its clients choose to take advantage of the discount offer, assuming again. $25,000 in daily sales, all on credit? You place an order for 200 units of inventory at a unit price of $95 The supplier offers terms of 2/10, net 30. How long do you have to pay before the account is overdue? f you take the full period, how much should you remit? What is the discount being offered? How quickly must you pay to get the discount? If you take the discount, how much should you remit? If you don't take the discount, how much interest are you paying implicitly (EAR)? How man days' credit are you receiving