Question

Need assistance Image transcription text Payback Period (Uneven cash flows) When the annual cash flows are unequal, the payback period is computed by adding

Image transcription text

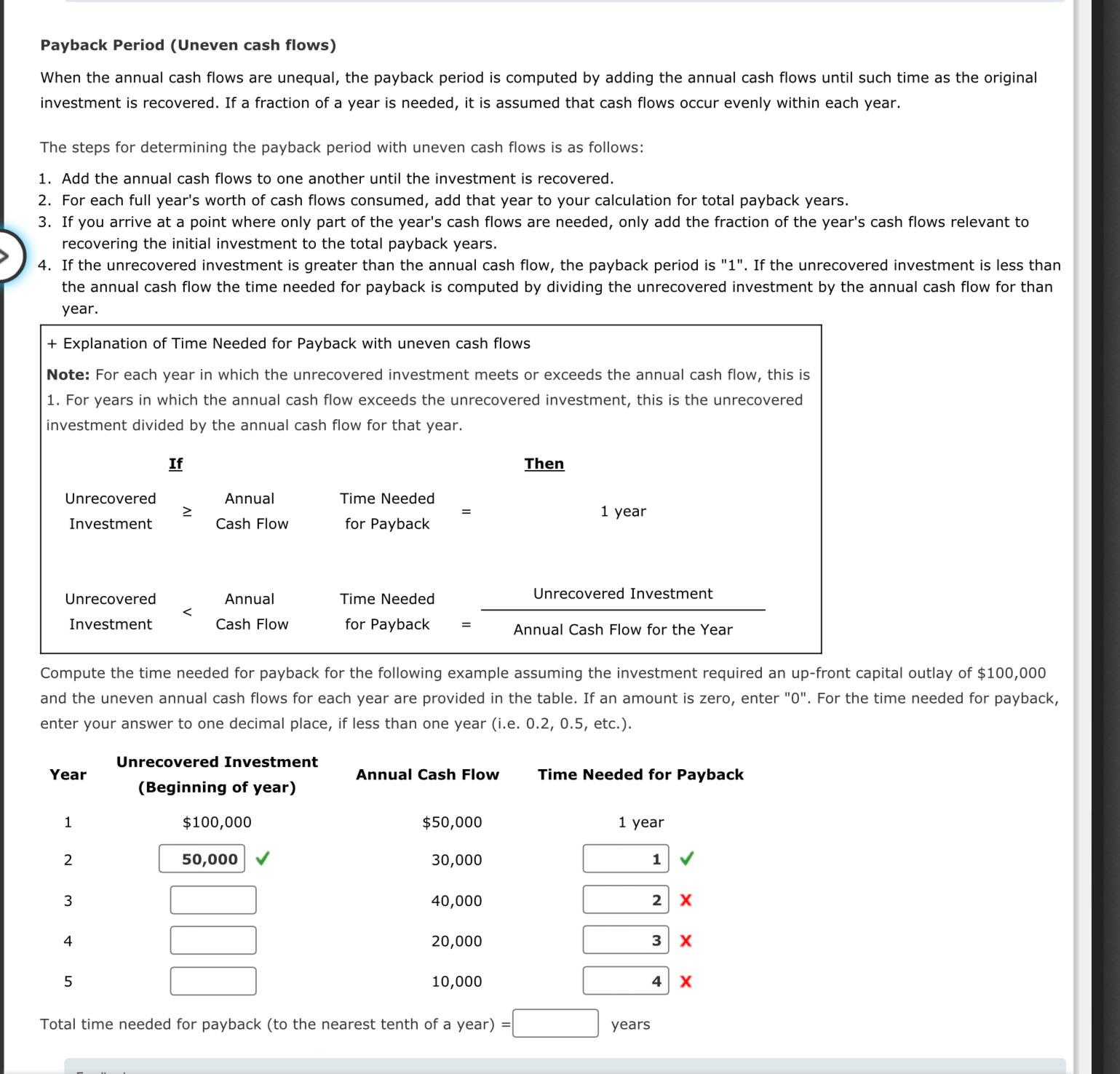

Payback Period (Uneven cash flows) When the annual cash flows are unequal, the payback period is computed by adding the annual cash flows until such time as the original investment is recovered. If a fraction of a year is needed, it is assumed that cash flows occur evenly within each year. The steps for determining the payback period with uneven cash flows is as follows: 1. Add the annual cash flows to one another until the investment is recovered. 2. For each full year's worth of cash flows consumed, add that year to your calculation for total payback years. . If you arrive at a point where only part of the year's cash flows are needed, only add the fraction of the year's cash flows relevant to recovering the initial investment to the total payback years. . If the unrecovered investment is greater than the annual cash flow, the payback period is "1". If the unrecovered investment is less than the annual cash flow the time needed for payback is computed by dividing the unrecovered investment by the annual cash flow for than year. + Explanation of Time Needed for Payback with uneven cash flows Note: For each year in which the unrecovered investment meets or exceeds the annual cash flow, this is 1. For years in which the annual cash flow exceeds the unrecovered investment, this is the unrecovered investment divided by the annual cash flow for that year. If Unrecovered o Annual Time Needed Investment ~ Cash Flow for Payback Unrecovered Annual Time Needed Unrecovered Investment < Investment Cash Flow for Payback = Annual Cash Flow for the Year Compute the time needed for payback for the following example assuming the investment required an up-front capital outlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter "0". For the time needed for payback, enter your answer to one decimal place, if less than one year (i.e. 0.2, 0.5, etc.). Unrecovered Investment Year (gl GEVESE) Annual Cash Flow Time Needed for Payback 1 $100,000 $50,000 1 year 2 v 30,000 [ av 3 {:} 40,000 E] X 4 () 20,000 I 5 () 10,000 [ 4x Total time needed for payback (to the nearest tenth of a year) =[: years

Payback Period (Uneven cash flows) When the annual cash flows are unequal, the payback period is computed by adding the annual cash flows until such time as the original investment is recovered. If a fraction of a year is needed, it is assumed that cash flows occur evenly within each year. The steps for determining the payback period with uneven cash flows is as follows: 1. Add the annual cash flows to one another until the investment is recovered. 2. For each full year's worth of cash flows consumed, add that year to your calculation for total payback years. 3. If you arrive at a point where only part of the year's cash flows are needed, only add the fraction of the year's cash flows relevant to recovering the initial investment to the total payback years. 4. If the unrecovered investment is greater than the annual cash flow, the payback period is "1". If the unrecovered investment is less than the annual cash flow the time needed for payback is computed by dividing the unrecovered investment by the annual cash flow for than year. + Explanation of Time Needed for Payback with uneven cash flows Note: For each year in which the unrecovered investment meets or exceeds the annual cash flow, this is 1. For years in which the annual cash flow exceeds the unrecovered investment, this is the unrecovered investment divided by the annual cash flow for that year. If Unrecovered Investment Annual Cash Flow Time Needed for Payback Then 1 year Unrecovered Investment < Annual Cash Flow Time Needed for Payback = Unrecovered Investment Annual Cash Flow for the Year Compute the time needed for payback for the following example assuming the investment required an up-front capital outlay of $100,000 and the uneven annual cash flows for each year are provided in the table. If an amount is zero, enter "0". For the time needed for payback, enter your answer to one decimal place, if less than one year (i.e. 0.2, 0.5, etc.). Year Unrecovered Investment (Beginning of year) Annual Cash Flow Time Needed for Payback 1 $100,000 1 year 2 50,000 1 $50,000 30,000 3 40,000 2 X 4 20,000 3 X 5 10,000 4 X Total time needed for payback (to the nearest tenth of a year) = years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image you sent describes how to calculate the payback period for an investment with uneven cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started