Question

Need guidance creating a balance sheet: I computed the info below from: Rebecca Newton has loved animals from a very young age. After graduating from

Need guidance creating a balance sheet: I computed the info below from:

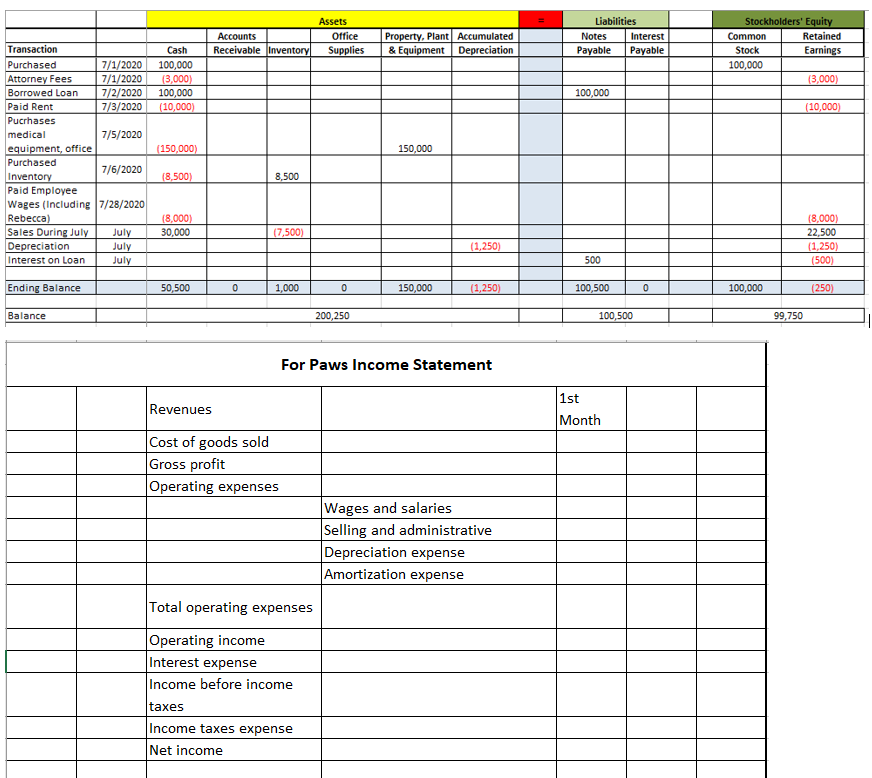

Rebecca Newton has loved animals from a very young age. After graduating from Auburn University with a degree in Veterinary Medicine and working as a veterinarian at the Auburn Veterinary School, she decided to open her own practice in suburban Atlanta. On July 1, 2020, Rebecca incorporated her business under the name For Paws, Inc. Listed below are various transactions that occurred during the remainder of the year:

(a) On July 1, Rebecca purchased all of For Paws common stock for $100,000 cash.

(b) On July 1, For Paws paid $3,000 to an attorney to prepare and file incorporation documents with the State of Georgia.

(c) On July 2, For Paws borrowed $100,000 from a local bank. The bank note required payment of principal in four annual installments of $25,000 beginning on July 1, 2021. In addition, the note specified annual interest payments of 6%, with the first payment due on July 1, 2021.

(d) On July 3, For Paws paid, in cash, $10,000 for the monthly rental on a building to be used as the veterinary clinic.

(e) On July 5, For Paws paid $150,000 for medical equipment, office furniture, and other equipment.

(f) On July 6, For Paws purchased various inventory items for $8,500 cash.

(g) Also on July 6, For Paws purchased $500 worth of office supplies for cash.

(h) On July 28, For Paws paid employees wages of $8,000 (which included Rebeccas salary of $6,000).

(i) During July, For Paws received $30,000 from clients for office visits and sales of merchandise (pet food, medicine, etc.).

A review of For Paws records at July 31, 2020, revealed the following:

(j) Clients still owed For Paws $3,500 for services performed during July but not yet billed. These amounts are expected to be billed and collected in August.

(k) At the end of July, a physical count of inventory revealed that $1,000 of inventory was still on-hand.

(l) At the end of July, a physical count of office supplies revealed that $100 of supplies were still on-hand.

(m) Depreciation on the equipment for July was estimated to be $1,250.

(n) Interest needs to be recorded on the note payable.

Required:

- Prepare a balance sheet and income statement for For Paws in July 2020.

- Is the large decline in cash a concern?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started