Answered step by step

Verified Expert Solution

Question

1 Approved Answer

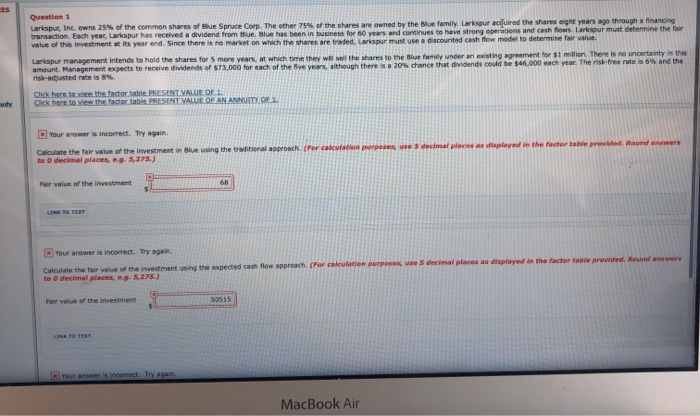

Need help for both parts!! Please show work Question Larispur, Inc. owns 25% of the common shares of Blue Spruce Corp The other 74 of

Need help for both parts!! Please show work

Question Larispur, Inc. owns 25% of the common shares of Blue Spruce Corp The other 74 of the share are owned by the Blue family arou acred the shares egne years ago through a financing transaction. Each year, Larkspur has received a dividend from Hue Blue has been in business for 50 years and continues to have strong operations and cash flow Larkspur must determine the value of this investment wits year and since there is no market on which the shares are traded, Larkspur must use a discounted cash flow model to determine fair value Larisspur management intends to hold the shares for more years, at which they wiw the whares to the Blue family under an existing agreement for 1 million. There is no uncertainty in this amount Management expects to receive dividends of 573,000 for each of the five years, although there a 20% chance that dividends could be $46,000 each year. The risk-free rates 6% and the sk-adjusted rate is 8%. here to the factor table. PESENT VALUE OF 1 Ook here to view the factor PRESENT VALUE OF AN ANNUITY OF Your answers incorrect. Try again Bluewing the traditional approach (or calculati Calculate the fair value of the investment to decimal place 5275.) Fair value of the investment Your answer is incorrect. Tym in the expected cash flow approach Calculate the fair value of the westment to decimal places, eg. 5,275.) Fair value of the investment MacBook Air Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started