Need help on this problem. Thanks

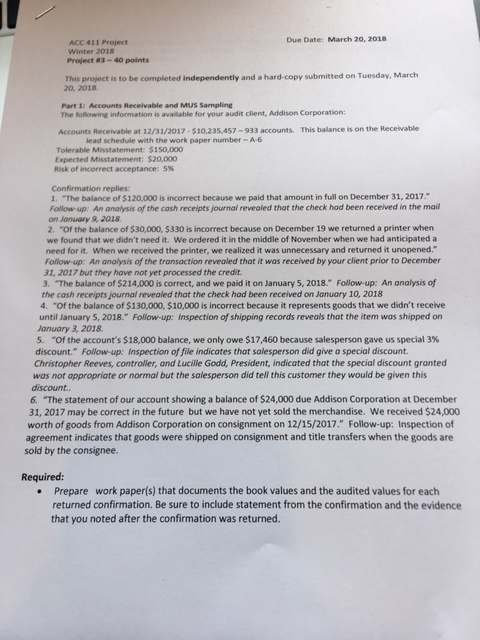

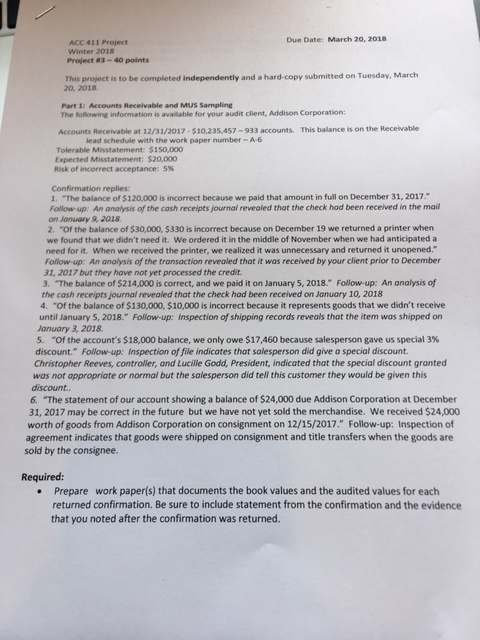

Due Date: March 20, 2018 ACC 411 Project Winter 2018 Project #3-40 points This project is to be completed independently and a hard-copy submitted on Tuesday, March 20, 2018 Part 1: Accounts Receivable and MUS Sampling The following information is available for your audit client, Addison Corporation: This balance is on the Receivable Accounts Receivable at 12/31/2017-$10,235,457-933 accounts. lead schedule with the work paper number- A-6 Tolerable Misstatement $150,000 Expected Misstatement: $20,000 Risk of incorrect acceptance: 5% Confirmation replies: 1. "The balance of $120,000 is incorrect because we paid that amount in full on December 31, 2017. Follow-up: An analysis of the cash receipts journal revealed that the check had been received in the mail on January 9, 2018 2. -Of the balance of $30,000, $330 is incorrect because on December 19 we returned a printer when we found that we didn't need it. We ordered it in the middle of November when we had anticipated a need for it. When we received the printer, we realized it was unnecessary and returned it unopened Follow-up: An analysis of the transaction revealed that it was received by your client prior to December 31, 2017 but they have not yet processed the credit 3. "The balance of $214,000 is correct, and we paid it on January 5, 2018." Follow-up: An analysis of the cash receipts journal revealed that the check had been received on January 10, 2018 until January 5, 2018." Follow-up: Inspection of shipping records reveals that the item was shipped on 5, "Of the account's $18,000 balance, we only owe $17,460 because salesperson gave us special 3% Christopher Reeves, controller, and Lucille Godd, President, indicated that the special discount granted 4. "Of the balance of $130,000, $10,000 is incorrect because it represents goods that we didn't receive January 3, 2018 discount." Follow-up: Inspection of file indicates that salesperson did give a special discount. was not appropriate or normal but the salesperson did tell this customer they would be given this discount.. 6. "The statement of our account showing a balance of $24,000 due Addison Corporation at December 31, 2017 may be correct in the future but we have not yet sold the merchandise. We received $24,000 worth of goods from Addison Corporation on consignment on 12/15/2017." Follow-up: Inspection of agreement indicates that goods were shipped on consignment and title transfers when the goods are sold by the consignee. Required: .Prepare work paper(s) that documents the book values and the audited values for each returned confirmation. Be sure to include statement from the confirmation and the evidence that you noted after the confirmation was returned. Due Date: March 20, 2018 ACC 411 Project Winter 2018 Project #3-40 points This project is to be completed independently and a hard-copy submitted on Tuesday, March 20, 2018 Part 1: Accounts Receivable and MUS Sampling The following information is available for your audit client, Addison Corporation: This balance is on the Receivable Accounts Receivable at 12/31/2017-$10,235,457-933 accounts. lead schedule with the work paper number- A-6 Tolerable Misstatement $150,000 Expected Misstatement: $20,000 Risk of incorrect acceptance: 5% Confirmation replies: 1. "The balance of $120,000 is incorrect because we paid that amount in full on December 31, 2017. Follow-up: An analysis of the cash receipts journal revealed that the check had been received in the mail on January 9, 2018 2. -Of the balance of $30,000, $330 is incorrect because on December 19 we returned a printer when we found that we didn't need it. We ordered it in the middle of November when we had anticipated a need for it. When we received the printer, we realized it was unnecessary and returned it unopened Follow-up: An analysis of the transaction revealed that it was received by your client prior to December 31, 2017 but they have not yet processed the credit 3. "The balance of $214,000 is correct, and we paid it on January 5, 2018." Follow-up: An analysis of the cash receipts journal revealed that the check had been received on January 10, 2018 until January 5, 2018." Follow-up: Inspection of shipping records reveals that the item was shipped on 5, "Of the account's $18,000 balance, we only owe $17,460 because salesperson gave us special 3% Christopher Reeves, controller, and Lucille Godd, President, indicated that the special discount granted 4. "Of the balance of $130,000, $10,000 is incorrect because it represents goods that we didn't receive January 3, 2018 discount." Follow-up: Inspection of file indicates that salesperson did give a special discount. was not appropriate or normal but the salesperson did tell this customer they would be given this discount.. 6. "The statement of our account showing a balance of $24,000 due Addison Corporation at December 31, 2017 may be correct in the future but we have not yet sold the merchandise. We received $24,000 worth of goods from Addison Corporation on consignment on 12/15/2017." Follow-up: Inspection of agreement indicates that goods were shipped on consignment and title transfers when the goods are sold by the consignee. Required: .Prepare work paper(s) that documents the book values and the audited values for each returned confirmation. Be sure to include statement from the confirmation and the evidence that you noted after the confirmation was returned