Answered step by step

Verified Expert Solution

Question

1 Approved Answer

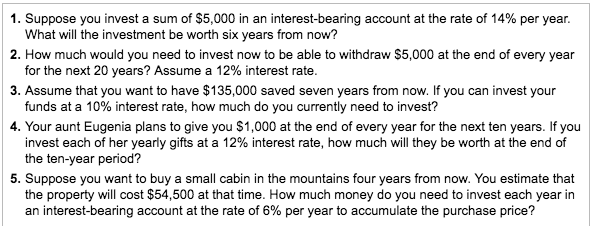

need help pls 1. Suppose you invest a sum of $5,000 in an interest-bearing account at the rate of 14% per year 2. How much

need help pls

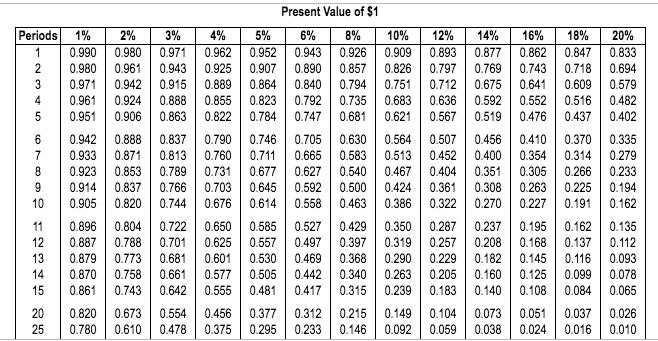

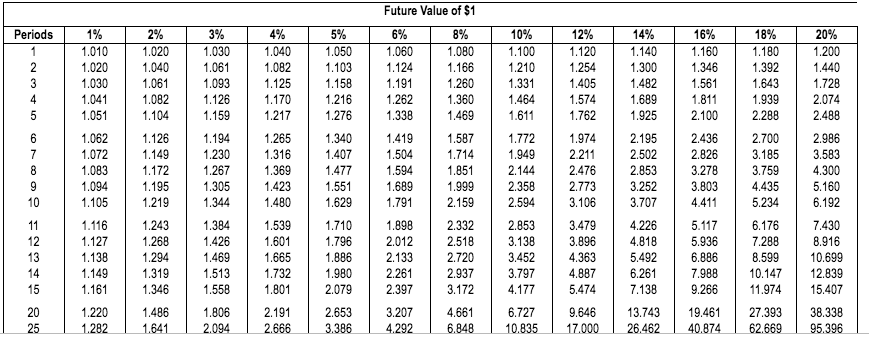

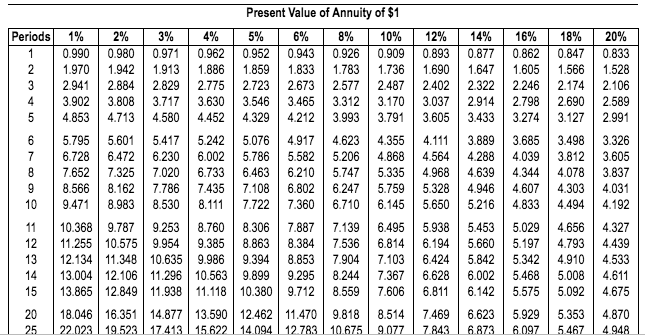

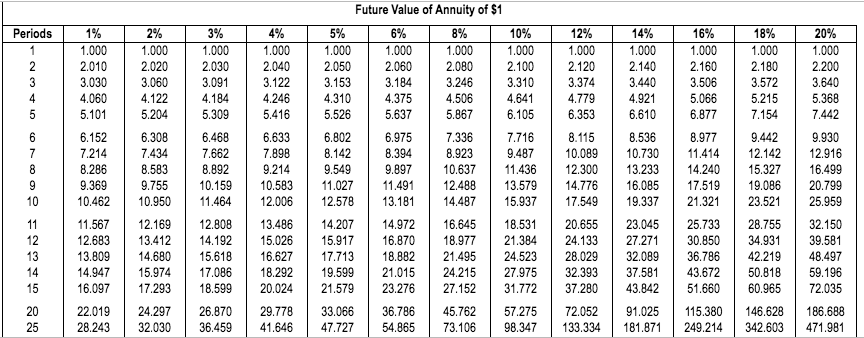

1. Suppose you invest a sum of $5,000 in an interest-bearing account at the rate of 14% per year 2. How much would you need to invest now to be able to withdraw $5,000 at the end of every year 3. Assume that you want to have $135,000 saved seven years from now. If you can invest your 4. Your aunt Eugenia plans to give you $1,000 at the end of every year for the next ten years. If you What will the investment be worth six years from now? for the next 20 years? Assume a 12% interest rate funds at a 10% interest rate, how much do you currently need to invest? invest each of her yearly gifts at a 12% interest rate, how much will they be worth at the end of the ten-year period? 5. Suppose you want to buy a small cabin in the mountains four years from now. You estimate that the property will cost $54,500 at that time. How much money do you need to invest each year in an interest-bearing account at the rate of 6% per year to accumulate the purchase price? Present Value of $1 Periods 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 10.990 0.980 0.971 0.9620.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 2 0.980 0.961 0.943 0.9250.907 0.8900.857 0.826 0.797 0.769 0.743 0.718 0.694 3 0.971 0.942 0.915 0.8890.8640.8400.7940.751 0.712 0.675 0.6410.609 0.579 4 0.9610.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 5 0.951 0.906 0.863 0.8220.7840.747 0.6810.621 0.567 0.519 0.476 0.437 0.402 6 0.942 0.888 0.837 0.7900.746 0.705 0.6300.564 0.507 0.456 0.410 0.370 0.335 7 0.933 0.871 0.813 0.7600.710.665 0.583 0.513 0.452 0.400 0.3540.314 0.279 8 0.923 0.853 0.789 0.7310.6770.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 90.914 0.837 0.766 0.7030.6450.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 10 0.905 0.820 0.744 0.676 0.6140.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 11 0.896 0.804 0.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.135 12 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.112 13 0.879 0.773 0.681 0.6010.530 0.4690.368 0.290 0.229 0.182 0.145 0.116 0.093 14 0.870 0.758 0.661 0.5770.505 0442 0.340 0.263 0.205 0.160 0.125 0.099 0.078 15 0.861 0.743 0.642 0.555 0.481 0417 0.315 0.239 0.183 0.140 0.108 0.084 0.065 20 0.820 0.673 0.554 0.456 0.377 0.312 0.215 0.149 0.1040.073 0.051 0.037 0.026 25 0.780 0.610 0.478 0.375 0.295 0.233 0.146 0.092 0.059 0.038 0.024 0.016 0.010 2 8 2 1 2-1 1 1 2 2 23456 78 10 12 4 5 .1 9 1-1112 23345 67801 22 7 4 4% 140 300 4 8 5 922 8 2 7 220 4 7 92471 48 0%-100 210 33 ASA 011 mg 44 35 85 38 52 97 77 27 iss 87595 31297 4 7 %029 801 % 05 10 .1 .2 8 8 4 8 rio 0 12345 25 12345 6789 1 Present Value of Annuity of $1 Periods 1% | 2% | 3% | 4% | 5% | 6% | 8% | 10% | 12% | 14% | 16% | 18% | 20% 0.990 0.980 0.971 0.9620.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 2 1.970 1.942 1.913 1.8861.8591.833 1.783 1.736 1.690 1.647 1.605 1.566 1.528 3 2.941 2.884 2.829 2.7752.7232.673 2.577 2487 2.402 2.322 2.246 2.174 2.106 4 3.902 3.808 3.717 3.630 3.546 3.465 3.312 3.170 3.037 2.914 2.798 2.690 2.589 54.853 4.713 4.580 4.4524.3294.212 3.9933.791 3.605 | 3.433 3.274 3.127 2.991 6 5.795 5.601 5.417 5.2425.0764.917 4.623 4.3554.111 3.889 3.685 3.498 3.326 7 6.728 6.472 6.230 6.0025.7865.582 5.206 4.868 4.564 4.288 4.039 3.812 3.605 8 7.652 7.325 7.020 6.7336.4636.210 5.747 5.335 4.968 4.639 4.344 4.078 3.837 98.566 8.162 7.786 7.4357.1086.802 6.2475.759 5.328 4.946 4.607 4.303 4.031 10 9.4718.983 8.530 8.1117.7227.3606.710 6.145 5.650 5.216 4.833 4.494 4.192 11 10.368 9.787 9.253 8.760 8.3067.887 7.139 6.495 5.938 5.453 5.029 4.656 4.327 12 11.255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5.660 5.197 4.793 4.439 13 12.134 11.348 10.635 9.9869.394 8.853 7.9047.103 6.424 5.842 5.342 4.910 4.533 14 13.004 12.106 11.296 10.5639.8999.2958.2447.367 6.628 6.002 5.468 5.008 4.611 15 13.865 12.849 11.938 11.118 10.3809.7128.559 7.606 6.811 6.142 5.575 5.092 4.675 20 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7469 6.623 5.929 5.353 4.870 25- 22 023 I 19 523 I 17 413 I 15 622 I 14 094 I 12 783 1 10 675 l g 0777 843 1 6 873 I 6 0975 467 1 4 948 Future Value of Annuity of $1 10% 1.000 2.100 12% 1.000 14% 1.000 2.140 3.440 18% 1.000 2.180 3.572 5.215 1.000 2.010 3.030 4.060 1.000 2.020 3.060 1.000 2.030 1.000 1.000 1.000 2.060 1.000 1.000 2.160 3.506 5.066 6.877 8.977 1.000 2.200 3.640 5.368 7.442 5.204418431222050 6.802 8.142 9.549 5.63745063.3102120 6.975 8.394 9.897 1014122 3091 2040 6.633 7.898 9.214 2.080 4.506 7.336 303.122 4310 5.637 4.779 6.353 4 5.309 6.468 7.662 8.892 5.526 6.308 7.434 8.583 9.930 10.08910.730 11.414 12.14212.916 0.63711.436 2.30013.23314.240 15.327 16.499 9.75510.15910.583 11.027 11491 12.48813.57914.776 16.085 17.519 19.086 20.799 7.716 9.487 8.536 9.442 7.214 8.286 9.369 8.923 10.462 10.95011464 12.006 12.578 13.1814.487 15.937 17.549 19.337 21.32123.52125.959 11.56712.169 2.808 13.486 14.207 14972 16.64518.531 20.655 23.045 25.733 28.755 32.150 12.683 13.41214.192 5.026 15.917 16.8708.977 21.384 24.133 27.271 30.85034.931 39.581 13.80914.68015.618 16.627 17.713 18.88221.495 24.523 28.029 32.089 36.78642.21948.497 14.947 15.97417.086 18.292 19.599 21.01524.215 27.975 32.393 37.581 43.67250.81859.196 16.097 17.29318.599 20.024 21.579 23.27627.152 31.772 37.280 43.842 51.66060.965 72.035 22.019 24.297 26.870 29.778 33.066 36.78645.76257.275 72.052 91.025 115.380146.628 186.688 28.24332.030 36.459 41.646 47.727 54.86573.106 98.347 133.334 181.871 249.214342.603471.981 12 13 14 15 25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started