Need help posting closing entries and completing the closing process

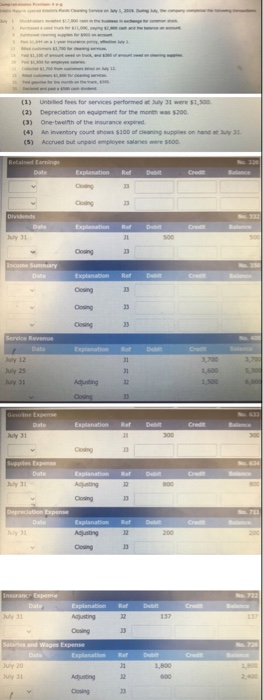

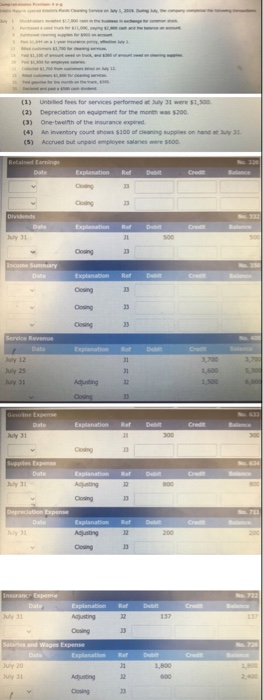

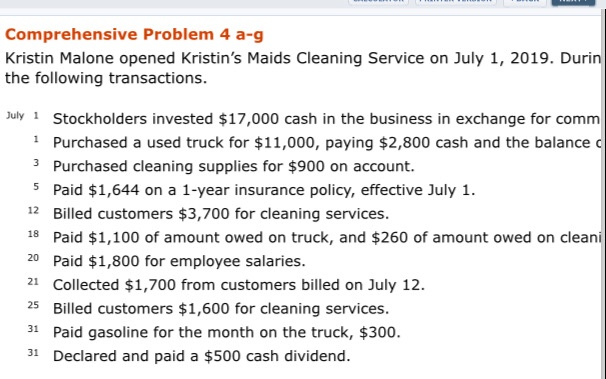

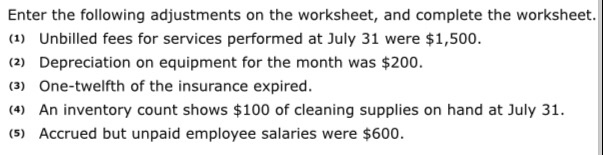

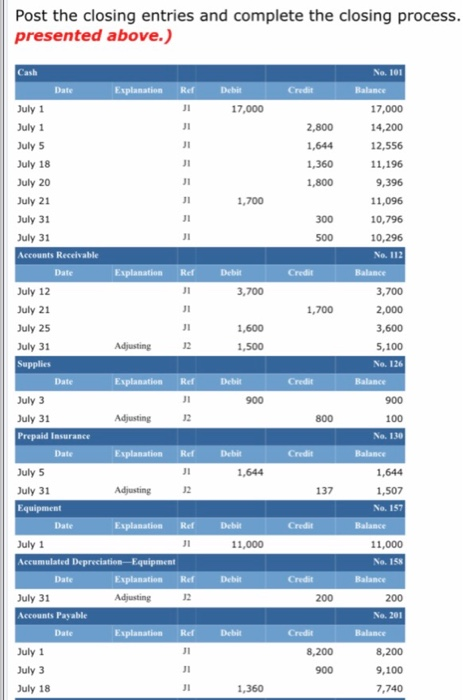

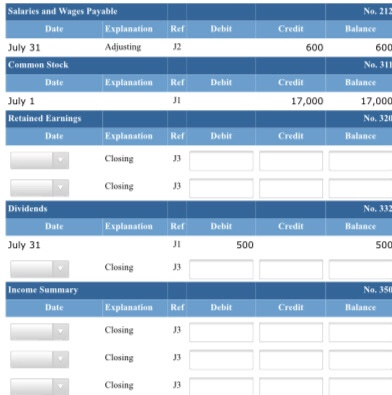

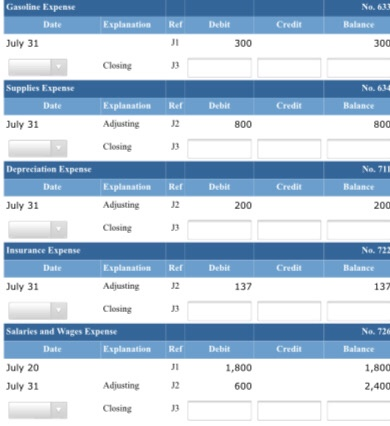

(1) United Toes for services performed By 31 were 51,300 (2) Depreciation on equipment for the month was $200 (3) One-twelfth of the insurance expired. (4) An Inventory count show $100 of cleaning up on hand at (5) Accrued but unpaid employee salaries were on 23 Date Rel Diwed Jy 31 31 we Casing Income D Cosing Going RRR Casing Service Revenue 31 31 July 25 July 31 Aquisiting Cosing 33 Gone Expense Explanation De July 31 300 Date July 3 Explanation Acting Going Depreciation Expense Explanation of Adjusting 2 Cosing 200 Insurance Expense July 3 Austing 137 Desing Sean Wages Expense Jy20 De 1,500 500 Adjusting Casing Comprehensive Problem 4 a-g Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2019. Durin the following transactions. July 1 Stockholders invested $17,000 cash in the business in exchange for comm 1 Purchased a used truck for $11,000, paying $2,800 cash and the balanced 3 Purchased cleaning supplies for $900 on account. 5 Paid $1,644 on a 1-year insurance policy, effective July 1. 12 Billed customers $3,700 for cleaning services. 18 Paid $1,100 of amount owed on truck, and $260 of amount owed on cleani 20 Paid $1,800 for employee salaries. 21 Collected $1,700 from customers billed on July 12. 25 Billed customers $1,600 for cleaning services. 31 Paid gasoline for the month on the truck, $300. 31 Declared and paid a $500 cash dividend. Enter the following adjustments on the worksheet, and complete the worksheet. (1) Unbilled fees for services performed at July 31 were $1,500. (2) Depreciation on equipment for the month was $200. (3) One-twelfth of the insurance expired. (4) An inventory count shows $100 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $600. Post the closing entries and complete the closing process. presented above.) Date Credit Explanation Rel JI Debit 17,000 July 1 July 1 JI 2,800 1,644 1,360 1,800 JI JI 1,700 JI 300 No. 101 Balance 17,000 14,200 12,556 11,196 9,396 11,096 10,796 10,296 No. 112 Balance 3,700 2,000 3,600 5,100 No. 126 Balance JI 500 Rel Debit Credit 3,700 1,700 JI 1,600 1,500 Credit Debit 900 July 5 JI July 18 July 20 July 21 JI July 31 July 31 Accounts Receivable Date Explanation July 12 JI July 21 July 25 July 31 Adjusting 12 Supplies Date Explanation Rel July 3 July 31 Adjusting 12 Prepaid Insurance Date Explanation Rel July 5 July 31 Adjusting Equipment Date Explanation Rel July 1 Accumulated Depreciation Equipment Date Explanation Rel July 31 Adjusting Accounts Payable Date Explanation Rel July 1 July 3 July 18 800 Debit Credit JI 1,644 137 900 100 No. 130 Balance 1,644 1,507 No. 157 Balance 11,000 No. 158 Balance 200 No. 201 Balance Debit Credit JI 11,000 Debit Credit 200 Debit Credit J1 8,200 8,200 900 9,100 7,740 1,360 Debit Rel J2 Credit 600 Salaries and Wages Payable Date Explanation July 31 Adjusting Common Stock Date Explanation July 1 Retained Earnings Explanation No. 212 Balance 600 No. 311 Balance 17,000 No. 320 Balance Rel Debit Credit 17,000 Date Rel Debit Credit Closing J3 Closing J3 No. 332 Dividends Date Explanation Rel Debit Credit Balance July 31 JI 500 500 Closing J3 Income Summary Date No, ISO Balance Rel Debit Credit Explanation Closing J3 Closing J3 Closing J3 No. 633 Gasoline Expense Date July 31 Explanation Ret Credit Debit 300 Balance 300 Closing Supplies Expense Date July 31 Rel Debit Credit Explanation Adjusting No. 634 Balance 800 800 Closing Depreciation Expense Date July 31 Ret Debit Credit Explanation Adjusting Closing No. 711 Balance 200 J2 200 Insurance Expense Date July 31 Credit Explanation Adjusting Rel 12 Debit 137 No. 721 Balance 137 Closing Salaries and Wages Expense Date Explanation July 20 July 31 Adjusting Ref Debit Credit No. 726 Balance 1,800 2,400 1,800 12 600 Closing (1) United Toes for services performed By 31 were 51,300 (2) Depreciation on equipment for the month was $200 (3) One-twelfth of the insurance expired. (4) An Inventory count show $100 of cleaning up on hand at (5) Accrued but unpaid employee salaries were on 23 Date Rel Diwed Jy 31 31 we Casing Income D Cosing Going RRR Casing Service Revenue 31 31 July 25 July 31 Aquisiting Cosing 33 Gone Expense Explanation De July 31 300 Date July 3 Explanation Acting Going Depreciation Expense Explanation of Adjusting 2 Cosing 200 Insurance Expense July 3 Austing 137 Desing Sean Wages Expense Jy20 De 1,500 500 Adjusting Casing Comprehensive Problem 4 a-g Kristin Malone opened Kristin's Maids Cleaning Service on July 1, 2019. Durin the following transactions. July 1 Stockholders invested $17,000 cash in the business in exchange for comm 1 Purchased a used truck for $11,000, paying $2,800 cash and the balanced 3 Purchased cleaning supplies for $900 on account. 5 Paid $1,644 on a 1-year insurance policy, effective July 1. 12 Billed customers $3,700 for cleaning services. 18 Paid $1,100 of amount owed on truck, and $260 of amount owed on cleani 20 Paid $1,800 for employee salaries. 21 Collected $1,700 from customers billed on July 12. 25 Billed customers $1,600 for cleaning services. 31 Paid gasoline for the month on the truck, $300. 31 Declared and paid a $500 cash dividend. Enter the following adjustments on the worksheet, and complete the worksheet. (1) Unbilled fees for services performed at July 31 were $1,500. (2) Depreciation on equipment for the month was $200. (3) One-twelfth of the insurance expired. (4) An inventory count shows $100 of cleaning supplies on hand at July 31. (5) Accrued but unpaid employee salaries were $600. Post the closing entries and complete the closing process. presented above.) Date Credit Explanation Rel JI Debit 17,000 July 1 July 1 JI 2,800 1,644 1,360 1,800 JI JI 1,700 JI 300 No. 101 Balance 17,000 14,200 12,556 11,196 9,396 11,096 10,796 10,296 No. 112 Balance 3,700 2,000 3,600 5,100 No. 126 Balance JI 500 Rel Debit Credit 3,700 1,700 JI 1,600 1,500 Credit Debit 900 July 5 JI July 18 July 20 July 21 JI July 31 July 31 Accounts Receivable Date Explanation July 12 JI July 21 July 25 July 31 Adjusting 12 Supplies Date Explanation Rel July 3 July 31 Adjusting 12 Prepaid Insurance Date Explanation Rel July 5 July 31 Adjusting Equipment Date Explanation Rel July 1 Accumulated Depreciation Equipment Date Explanation Rel July 31 Adjusting Accounts Payable Date Explanation Rel July 1 July 3 July 18 800 Debit Credit JI 1,644 137 900 100 No. 130 Balance 1,644 1,507 No. 157 Balance 11,000 No. 158 Balance 200 No. 201 Balance Debit Credit JI 11,000 Debit Credit 200 Debit Credit J1 8,200 8,200 900 9,100 7,740 1,360 Debit Rel J2 Credit 600 Salaries and Wages Payable Date Explanation July 31 Adjusting Common Stock Date Explanation July 1 Retained Earnings Explanation No. 212 Balance 600 No. 311 Balance 17,000 No. 320 Balance Rel Debit Credit 17,000 Date Rel Debit Credit Closing J3 Closing J3 No. 332 Dividends Date Explanation Rel Debit Credit Balance July 31 JI 500 500 Closing J3 Income Summary Date No, ISO Balance Rel Debit Credit Explanation Closing J3 Closing J3 Closing J3 No. 633 Gasoline Expense Date July 31 Explanation Ret Credit Debit 300 Balance 300 Closing Supplies Expense Date July 31 Rel Debit Credit Explanation Adjusting No. 634 Balance 800 800 Closing Depreciation Expense Date July 31 Ret Debit Credit Explanation Adjusting Closing No. 711 Balance 200 J2 200 Insurance Expense Date July 31 Credit Explanation Adjusting Rel 12 Debit 137 No. 721 Balance 137 Closing Salaries and Wages Expense Date Explanation July 20 July 31 Adjusting Ref Debit Credit No. 726 Balance 1,800 2,400 1,800 12 600 Closing