Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help Trying to make a Multi-Step Income statment for this Expecially for the Bullenten point area!!! I am useing excel and have to use

Need Help Trying to make a Multi-Step Income statment for this Expecially for the Bullenten point area!!! I am useing excel and have to use formulas!!

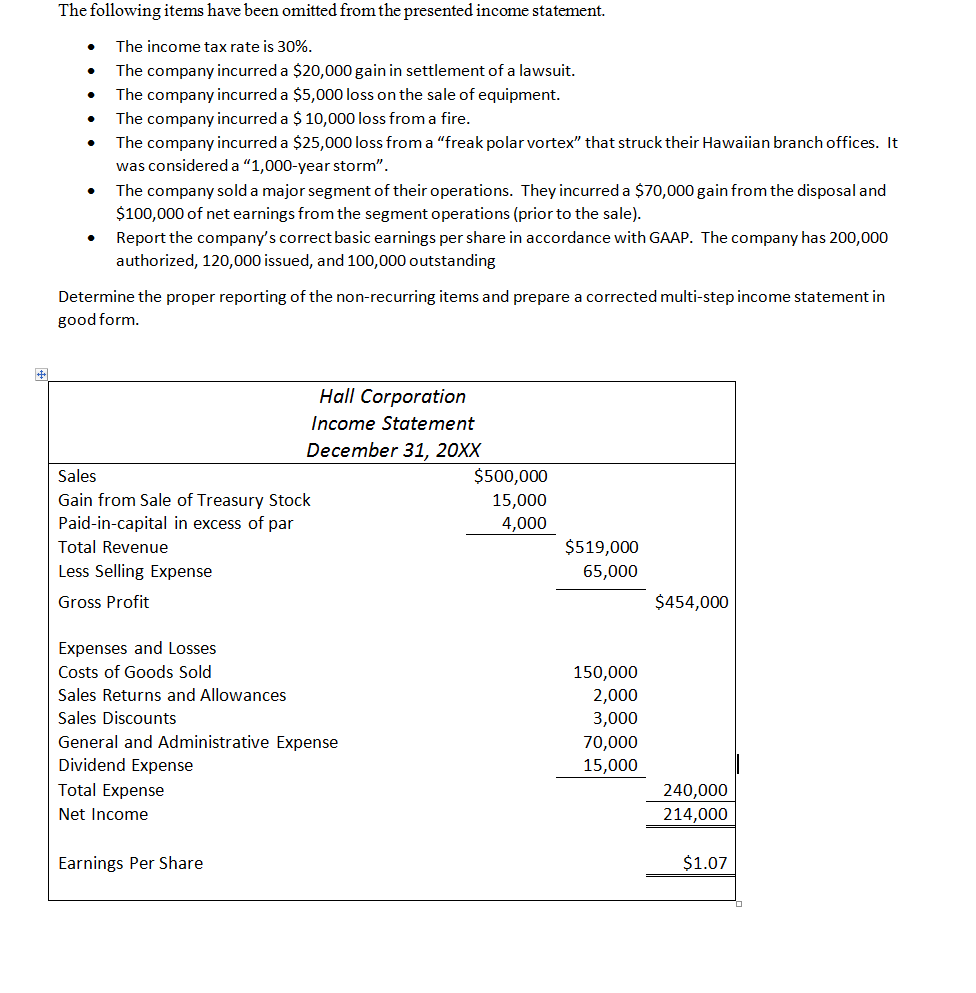

The following items have been omitted from the presented income statement. The income tax rate is 30%. The company incurred a $20,000 gain in settlement of a lawsuit. The company incurred a $5,000 loss on the sale of equipment. The company incurred a 10,000 loss from a fire. The company incurred a $25,000 loss from a "fre polar vortex" that struck their Hawaiian branch offices. It was considered a "1,000-year storm". The company sold a major segment of their operations. They incurred a $70,000 gain from the disposal and $100,000 of net earnings from the segment operations (priorto the sale) Report the company's correct basic earnings per share in accordance with GAAP. The company has 200,000 authorized, 120,000 issued, and 100,000 outstanding Determine the proper reporting ofthe non-recurring items and prepare a corrected multi-step income statement in good form Hall Corporation Income Statement December 31, 20XX $500,000 Sales Gain from Sale of Treasury Stock 15,000 Paid-in-capital in excess of par 4,000 Total Revenue $519,000 65,000 Less Selling Expense $454,000 Gross Profit Expenses and Losses 150,000 Costs of Goods Sold Sales Returns and Allowances 2,000 Sales Discounts 3,000 70,000 General and Administrative Expense 15,000 Dividend Expense Total Expense 240,000 214,000 Net Income $1.07 Earnings Per ShareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started