need help with empty cells. please provide formulas and explanations. cheers

need help with empty cells. please provide formulas and explanations. cheers

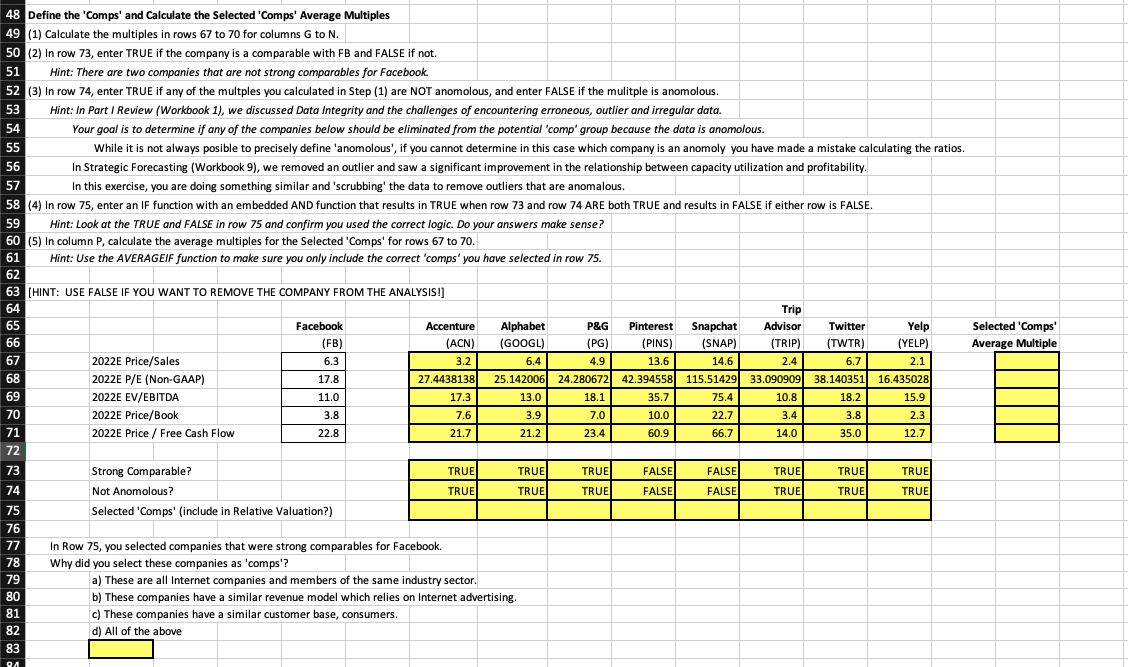

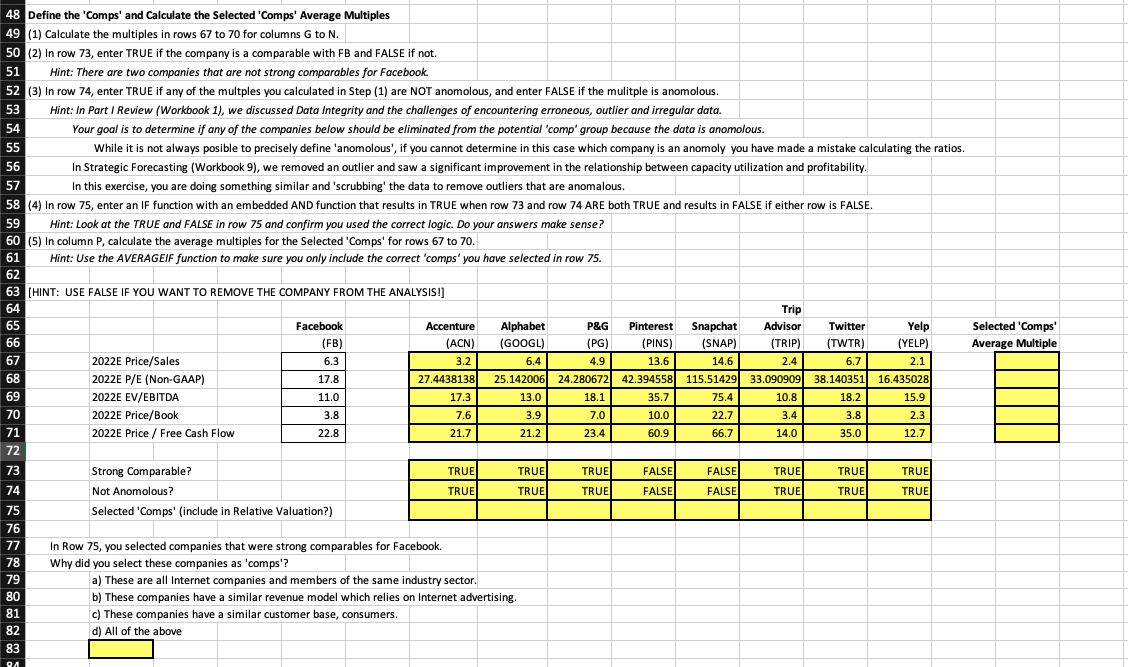

48 Define the 'Comps' and Calculate the Selected 'Comps' Average Multiples 49 (1) Calculate the multiples in rows 67 to 70 for columns G to N. 50 (2) In row 73, enter TRUE if the company is a comparable with FB and FALSE if not. 51 Hint: There are two companies that are not strong comparables for Facebook 52 (3) In row 74, enter TRUE if any of the multples you calculated in Step (1) are NOT anomolous, and enter FALSE if the mulitple is anomolous. 53 Hint: In Part I Review (Workbook 1), we discussed Data Integrity and the challenges of encountering erroneous, outlier and irregular data. 54 Your goal is to determine if any of the companies below should be eliminated from the potential comp' group because the data is anomolous. 55 While it is not always posible to precisely define 'anomolous', if you cannot determine in this case which company is an anomoly you have made a mistake calculating the ratios. 56 In Strategic Forecasting (Workbook 9), we removed an outlier and saw a significant improvement in the relationship between capacity utilization and profitability. 57 In this exercise, you are doing something similar and 'scrubbing' the data to remove outliers that are anomalous. 58 (4) In row 75, enter an IF function with an embedded AND function that results in TRUE when row 73 and row 74 ARE both TRUE and results in FALSE if either row is FALSE. 4, 59 Hint: Look at the TRUE and FALSE in row 75 and confirm you used the correct logic. Do your answers make sense? 60 (5) In column P, calculate the average multiples for the Selected 'Comps' for rows 67 to 70. 61 Hint: Use the AVERAGEIF function to make sure you only include the correct 'comps' you have selected in row 75. 62 63 [HINT: USE FALSE IF YOU WANT TO REMOVE THE COMPANY FROM THE ANALYSIS!) 64 Trip 65 Facebook Accenture Alphabet P&G Pinterest Snapchat Advisor Twitter Yelp Selected 'Comps' 66 (FB) (ACN) (GOOGL) (PG) (PINS) (SNAP) (TRIP) (TWTR) (YELP) Average Multiple 67 2022E Price/Sales 6.3 3.2 6.4 4.9 13.6 14.6 2.4 6.7 2.1 68 2022E P/E (Non-GAAP) 17.8 27.4438138 25.142006 24.280672 42.394558 115.51429 33.090909 38.140351 16.435028 69 2022E EV/EBITDA 11.0 17.3 13.0 18.1 35.7 75.4 10.8 18.2 15.9 70 2022E Price/Book 3.8 7.6 3.9 7.0 10.0 22.7 3.4 3.8 2.3 71 2022E Price / Free Cash Flow 22.8 21.7 21.2 23.4 60.9 66.7 14.0 35.0 12.7 72 73 Strong comparable? TRUE TRUE TRUE FALSE FALSE TRUE TRUE TRUE 74 Not Anomolous ? TRUE TRUE TRUE FALSE FALSE TRUE TRUE TRUE 75 Selected 'Comps' (include in Relative Valuation?) 76 77 In Row 75, you selected companies that were strong comparables for Facebook 78 Why did you select these companies as 'comps'? 79 a) These are all Internet companies and members of the same industry sector. 80 b) These companies have a similar revenue model which relies on Internet advertising. 81 c) These companies have a similar customer base, consumers. 82 d) All of the above d) 83 94 am8www 48 Define the 'Comps' and Calculate the Selected 'Comps' Average Multiples 49 (1) Calculate the multiples in rows 67 to 70 for columns G to N. 50 (2) In row 73, enter TRUE if the company is a comparable with FB and FALSE if not. 51 Hint: There are two companies that are not strong comparables for Facebook 52 (3) In row 74, enter TRUE if any of the multples you calculated in Step (1) are NOT anomolous, and enter FALSE if the mulitple is anomolous. 53 Hint: In Part I Review (Workbook 1), we discussed Data Integrity and the challenges of encountering erroneous, outlier and irregular data. 54 Your goal is to determine if any of the companies below should be eliminated from the potential comp' group because the data is anomolous. 55 While it is not always posible to precisely define 'anomolous', if you cannot determine in this case which company is an anomoly you have made a mistake calculating the ratios. 56 In Strategic Forecasting (Workbook 9), we removed an outlier and saw a significant improvement in the relationship between capacity utilization and profitability. 57 In this exercise, you are doing something similar and 'scrubbing' the data to remove outliers that are anomalous. 58 (4) In row 75, enter an IF function with an embedded AND function that results in TRUE when row 73 and row 74 ARE both TRUE and results in FALSE if either row is FALSE. 4, 59 Hint: Look at the TRUE and FALSE in row 75 and confirm you used the correct logic. Do your answers make sense? 60 (5) In column P, calculate the average multiples for the Selected 'Comps' for rows 67 to 70. 61 Hint: Use the AVERAGEIF function to make sure you only include the correct 'comps' you have selected in row 75. 62 63 [HINT: USE FALSE IF YOU WANT TO REMOVE THE COMPANY FROM THE ANALYSIS!) 64 Trip 65 Facebook Accenture Alphabet P&G Pinterest Snapchat Advisor Twitter Yelp Selected 'Comps' 66 (FB) (ACN) (GOOGL) (PG) (PINS) (SNAP) (TRIP) (TWTR) (YELP) Average Multiple 67 2022E Price/Sales 6.3 3.2 6.4 4.9 13.6 14.6 2.4 6.7 2.1 68 2022E P/E (Non-GAAP) 17.8 27.4438138 25.142006 24.280672 42.394558 115.51429 33.090909 38.140351 16.435028 69 2022E EV/EBITDA 11.0 17.3 13.0 18.1 35.7 75.4 10.8 18.2 15.9 70 2022E Price/Book 3.8 7.6 3.9 7.0 10.0 22.7 3.4 3.8 2.3 71 2022E Price / Free Cash Flow 22.8 21.7 21.2 23.4 60.9 66.7 14.0 35.0 12.7 72 73 Strong comparable? TRUE TRUE TRUE FALSE FALSE TRUE TRUE TRUE 74 Not Anomolous ? TRUE TRUE TRUE FALSE FALSE TRUE TRUE TRUE 75 Selected 'Comps' (include in Relative Valuation?) 76 77 In Row 75, you selected companies that were strong comparables for Facebook 78 Why did you select these companies as 'comps'? 79 a) These are all Internet companies and members of the same industry sector. 80 b) These companies have a similar revenue model which relies on Internet advertising. 81 c) These companies have a similar customer base, consumers. 82 d) All of the above d) 83 94 am8www

need help with empty cells. please provide formulas and explanations. cheers

need help with empty cells. please provide formulas and explanations. cheers