NEED HELP WITH PART B AND C , THANK YOU

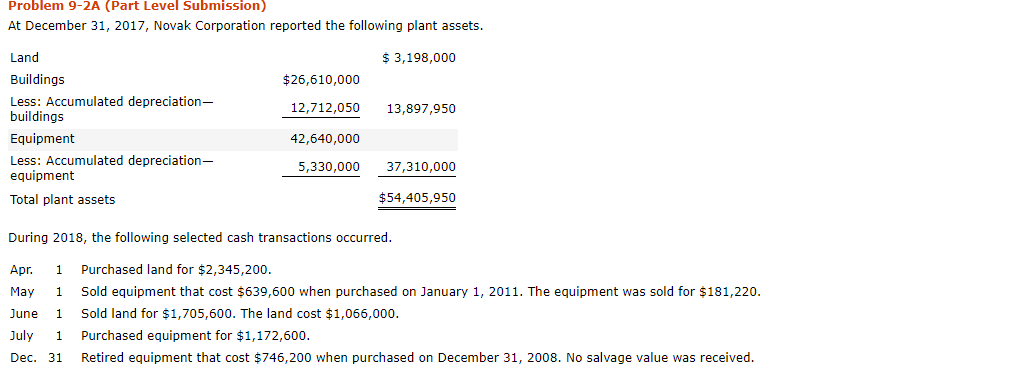

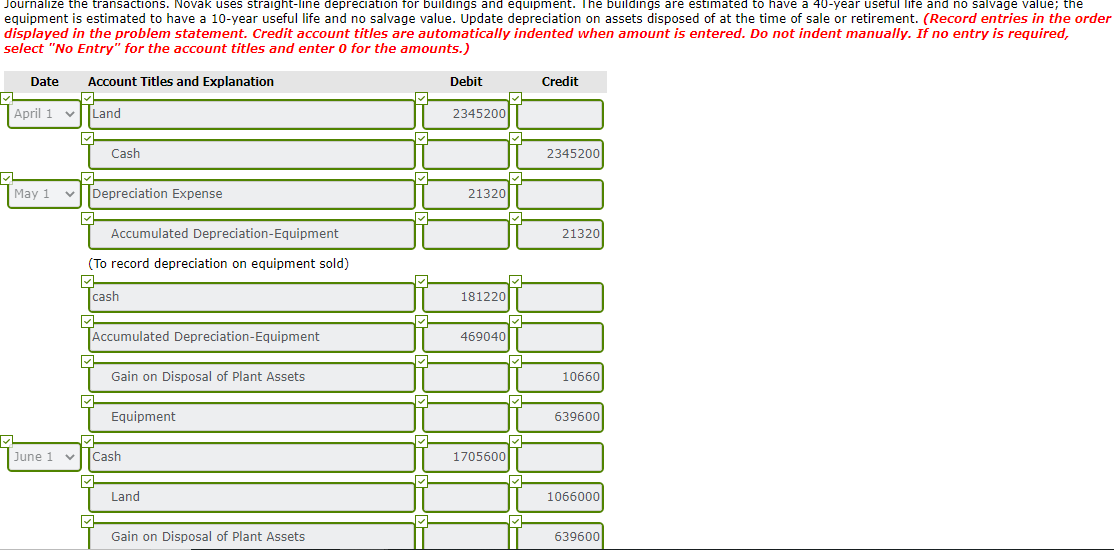

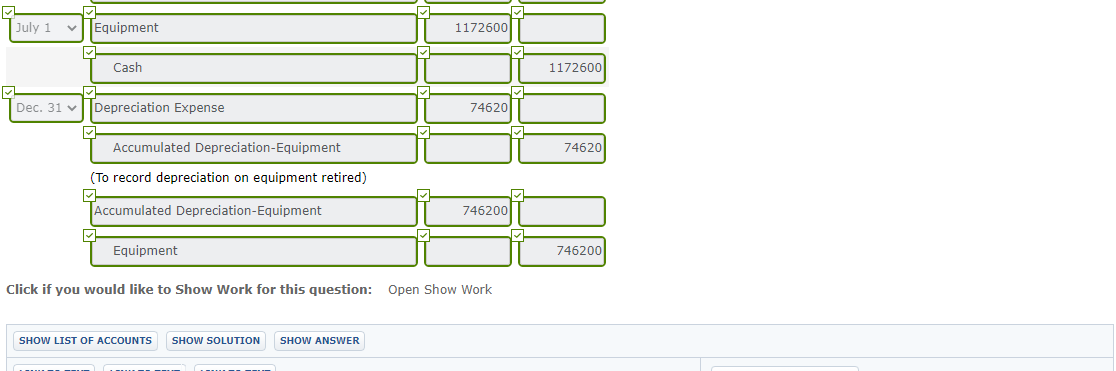

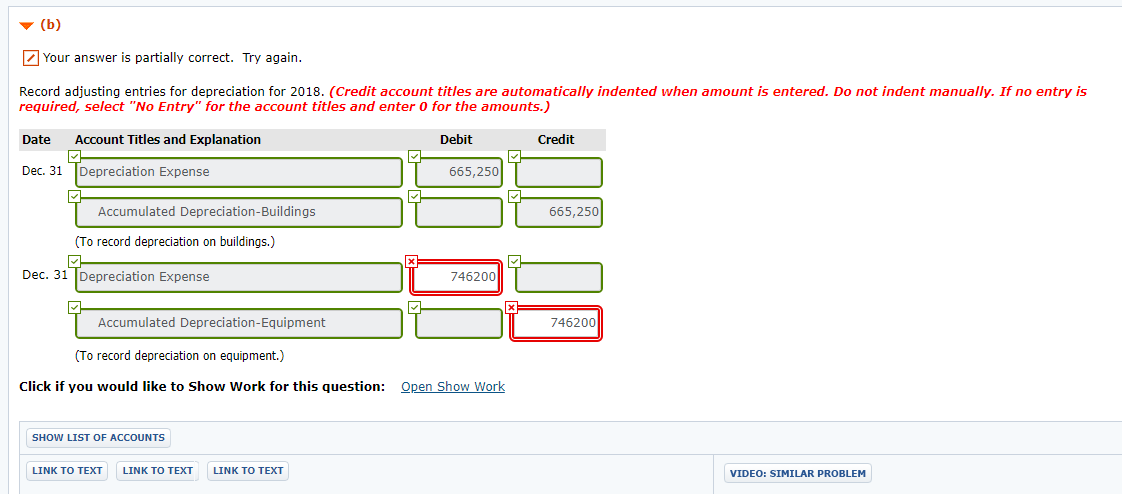

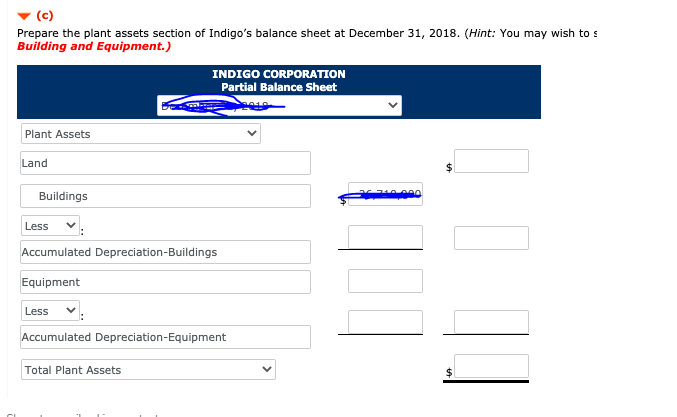

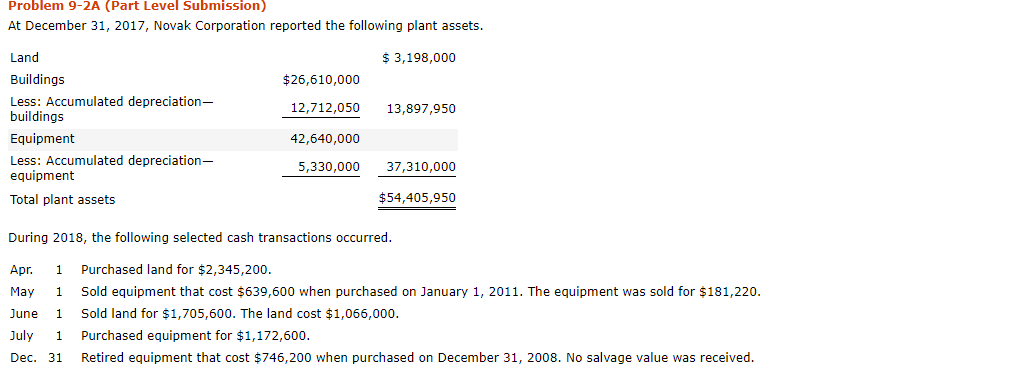

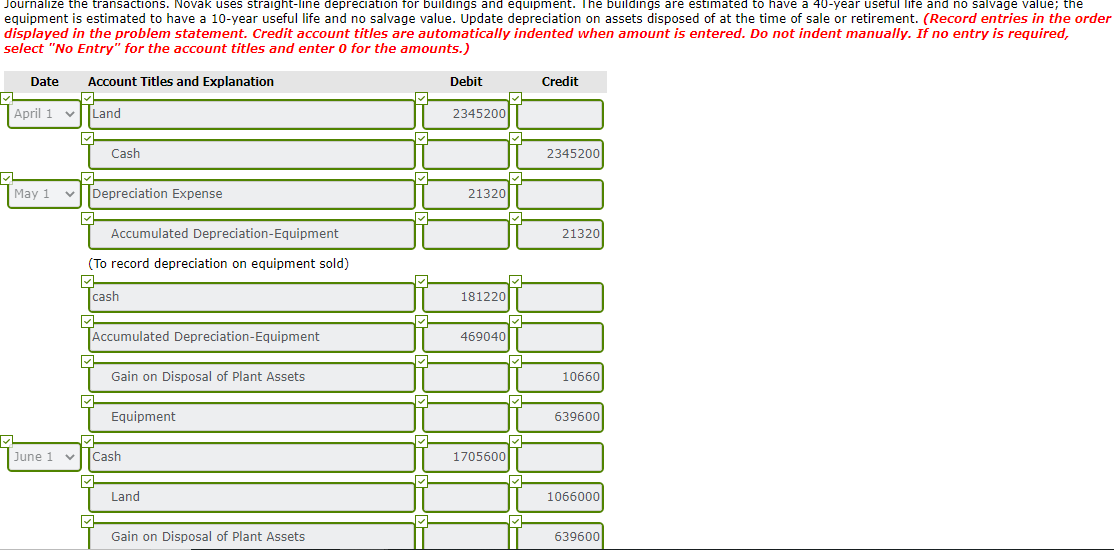

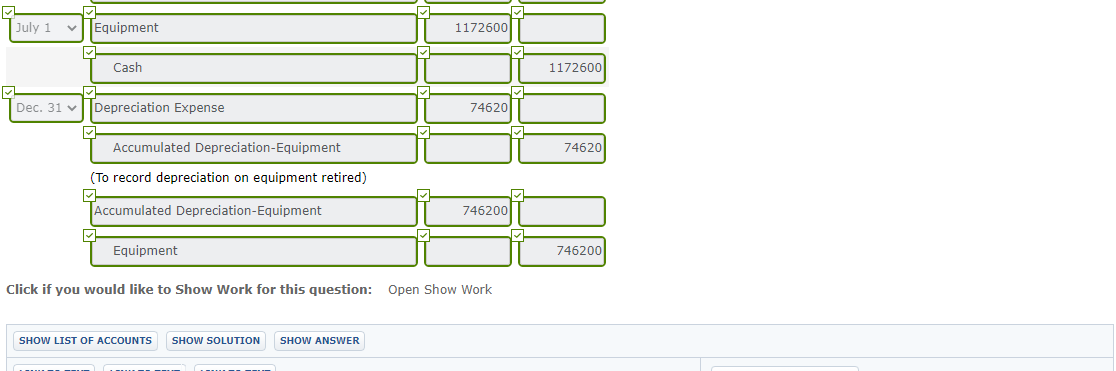

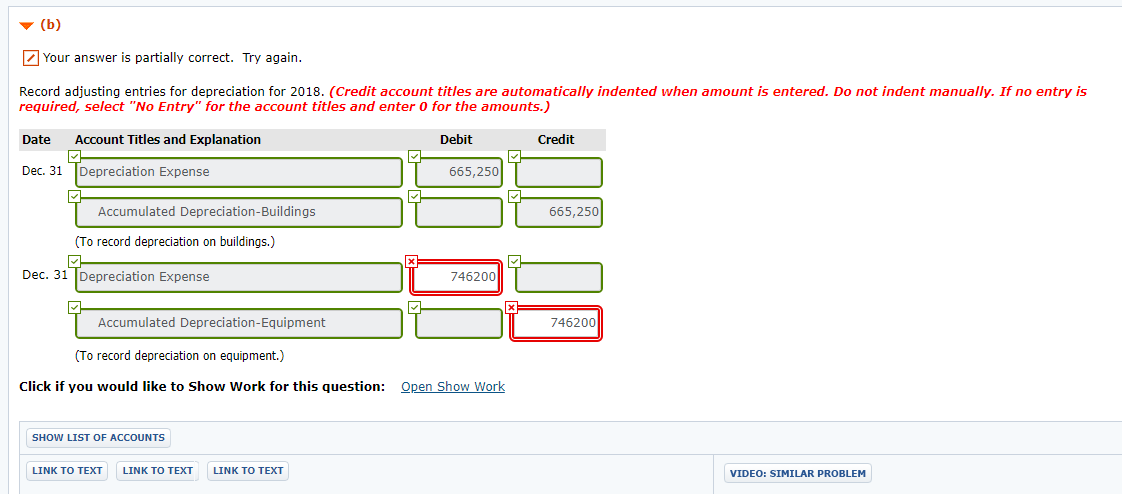

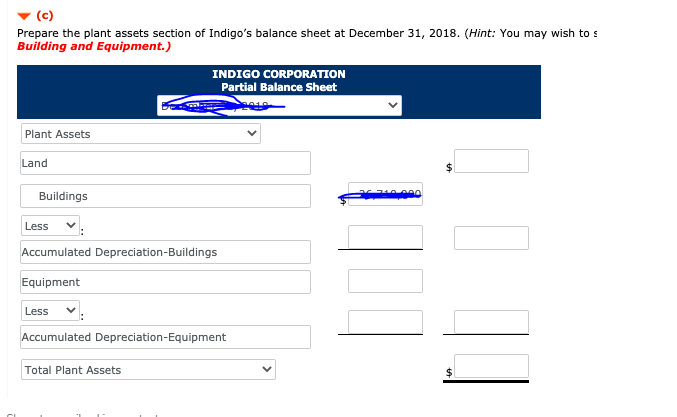

Problem 9-2A (Part Level Submission) At December 31, 2017, Novak Corporation reported the following plant assets. $ 3,198,000 $26,610,000 12,712,050 13,897,950 Land Buildings Less: Accumulated depreciation, buildings Equipment Less: Accumulated depreciation, equipment Total plant assets 42,640,000 5,330,000 37,310,000 $54,405,950 During 2018, the following selected cash transactions occurred. Apr. 1 1 May June July Purchased land for $2,345,200. Sold equipment that cost $639,600 when purchased on January 1, 2011. The equipment was sold for $181,220. Sold land for $1,705,600. The land cost $1,066,000. Purchased equipment for $1,172,600. Retired equipment that cost $746,200 when purchased on December 31, 2008. No salvage value was received. 1 Dec. 31 Journalize the transactions. Novak uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 40-year useful life and no salvage value; the equipment is estimated to have a 10-year useful life and no salvage value. Update depreciation on assets disposed of at the time of sale or retirement. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit April 1 Land 2345200 Cash 2345200 May 1 Depreciation Expense 21320 Accumulated Depreciation-Equipment 21320 (To record depreciation on equipment sold) cash 181220 Accumulated Depreciation-Equipment 469040 Gain on Disposal of Plant Assets 10660 Equipment 639600 June 1 Cash 1705600 Land 1066000 Gain on Disposal of Plant Assets 639600 July 1 v Equipment 1172600 Cash 1172600 Dec. 31 | Depreciation Expense 74620 Accumulated Depreciation-Equipment 74620 (To record depreciation on equipment retired) Accumulated Depreciation Equipment 7462001 Equipment 746200 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS SHOW SOLUTION SHOW ANSWER (b) Your answer is partially correct. Try again. Record adjusting entries for depreciation for 2018. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Depreciation Expense 665,2501 Accumulated Depreciation-Buildings 665,250 (To record depreciation on buildings.) X Dec. 31 Depreciation Expense 746200 X Accumulated Depreciation-Equipment 746200 (To record depreciation on equipment.) Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT LINK TO TEXT VIDEO: SIMILAR PROBLEM Prepare the plant assets section of Indigo's balance sheet at December 31, 2018. (Hint: You may wish to s Building and Equipment.) INDIGO CORPORATION Partial Balance Sheet Plant Assets Land $ Buildings Less Accumulated Depreciation-Buildings Equipment Less Accumulated Depreciation-Equipment Total Plant Assets $