Answered step by step

Verified Expert Solution

Question

1 Approved Answer

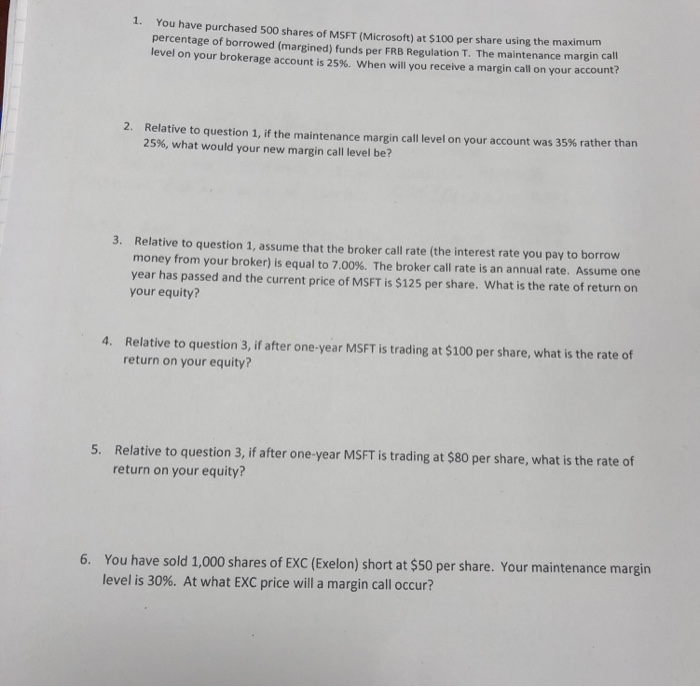

need help with questions 3,4,5,6 please You have purchased 500 shares of MSFT (Microsoft) at $100 per share using the maximum percentage of borrowed (marained)

need help with questions 3,4,5,6 please

You have purchased 500 shares of MSFT (Microsoft) at $100 per share using the maximum percentage of borrowed (marained) funds per FRB Regulation T. The maintenance margin can Tevel on your brokerage account is 25%. When will you receive a margin call on your account 2. Relative to question 1. If the maintenance margin call level on your account was 35% rather than 25%, what would your new margin call level be? 3. Relative to question 1, assume that the broker call rate (the interest rate you pay to borrow money from your broker) is equal to 7.00%. The broker call rate is an annual rate. Assume one year has passed and the current price of MSFT is $125 per share. What is the rate of return on your equity? 4. Relative to question 3, if after one-year MSFT is trading at $100 per share, what is the rate of return on your equity? 5. Relative to question 3, if after one-year MSFT is trading at $80 per share, what is the rate of return on your equity? 6. You have sold 1,000 shares of EXC (Exelon) short at $50 per share. Your maintenance margin level is 30%. At what EXC price will a margin call occur? You have purchased 500 shares of MSFT (Microsoft) at $100 per share using the maximum percentage of borrowed (marained) funds per FRB Regulation T. The maintenance margin can Tevel on your brokerage account is 25%. When will you receive a margin call on your account 2. Relative to question 1. If the maintenance margin call level on your account was 35% rather than 25%, what would your new margin call level be? 3. Relative to question 1, assume that the broker call rate (the interest rate you pay to borrow money from your broker) is equal to 7.00%. The broker call rate is an annual rate. Assume one year has passed and the current price of MSFT is $125 per share. What is the rate of return on your equity? 4. Relative to question 3, if after one-year MSFT is trading at $100 per share, what is the rate of return on your equity? 5. Relative to question 3, if after one-year MSFT is trading at $80 per share, what is the rate of return on your equity? 6. You have sold 1,000 shares of EXC (Exelon) short at $50 per share. Your maintenance margin level is 30%. At what EXC price will a margin call occur

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started