Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help with the following, appreciate if you show your calculations. Thank you! Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of

Need help with the following, appreciate if you show your calculations. Thank you!

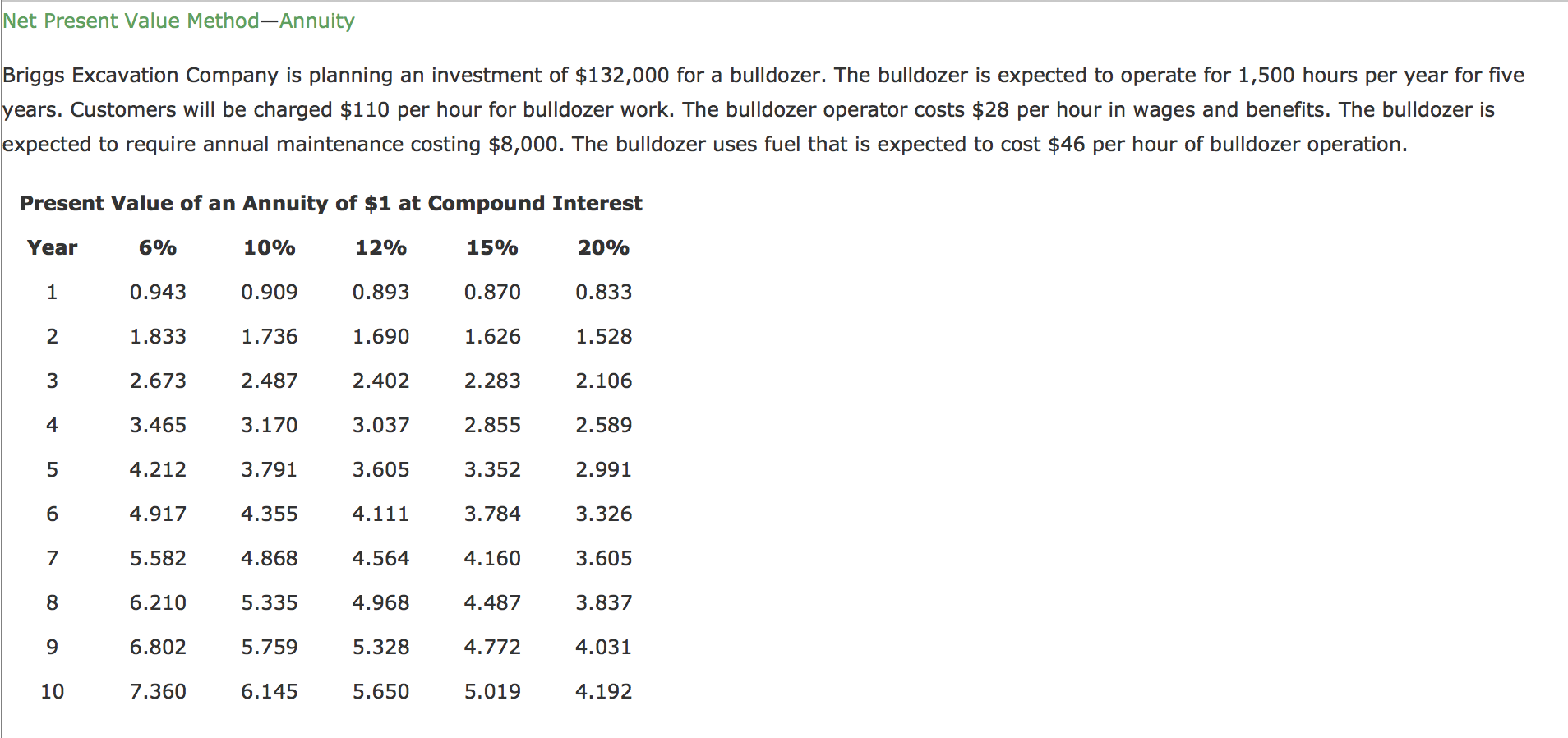

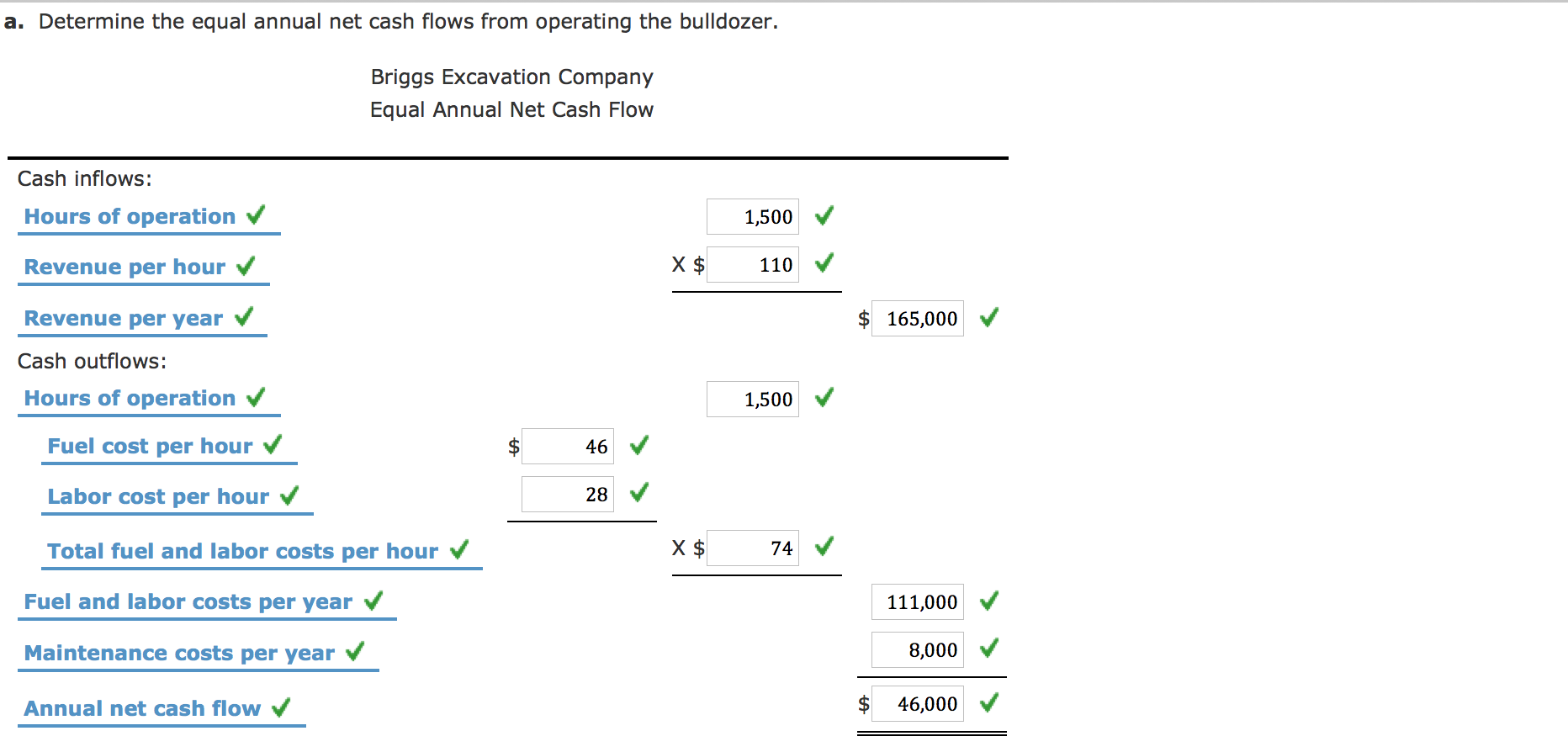

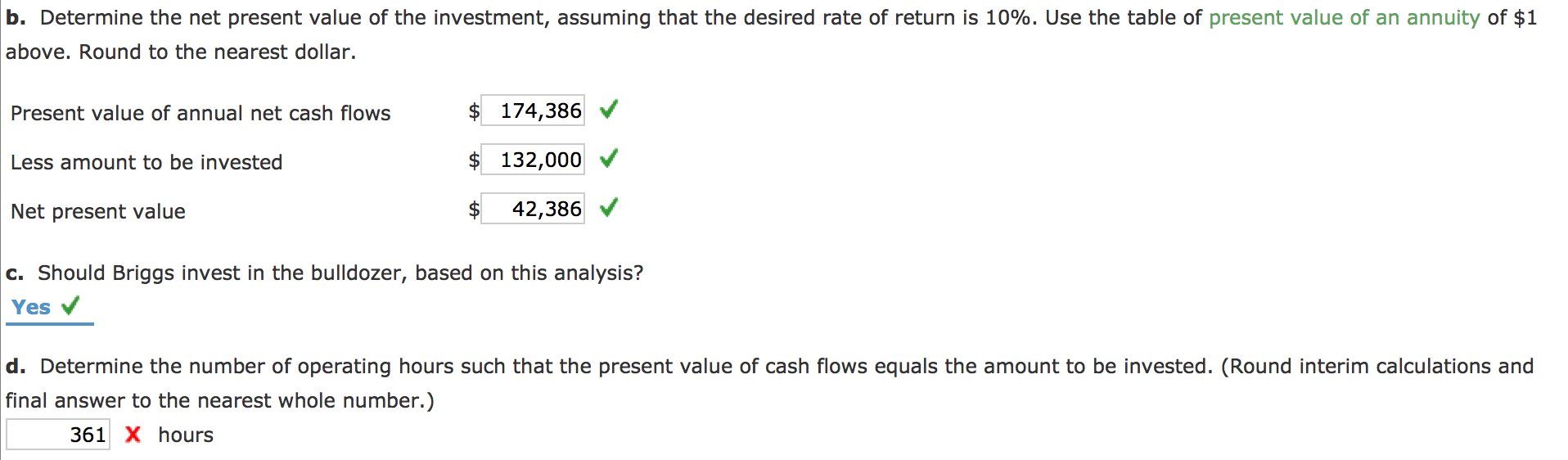

Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of $132,000 for a bulldozer. The bulldozer is expected to operate for 1,500 hours per year for five ears. Customers will be charged $110 per hour for bulldozer work. The bulldozer operator costs $28 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $8,000. The bulldozer uses fuel that is expected to cost $46 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest 6% 0.943 1.833 2.673 3.465 4.212 4.917 5.582 6.210 6.802 7.360 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 12% 0.893 1.690 2.402 3.037 3.605 15% 0.870 1.626 2.283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 2090 0.833 1.528 2.106 2.589 2.991 3.326 3.605 3.837 4.031 4.192 Year 1 2 3 4 6 7 8 4.564 4.968 5.328 5.650 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started